"Night Accountant" The Pension Fund requires accountants to check messages every day. How can an accountant not fall out of the profession?! We prepare the necessary documents

There is very little time left until the end of 2019. To meet the next year fully armed, you need to finish this year's work and prepare for the changes that will take effect on January 1.

The busy season for accountants will begin on January 9th. To make it easier to enter 2019, you can outline a list of important things that you want to complete before the end of December.

1. Submit mandatory reports, pay taxes and fees

Among the most important:

- insurance premiums for pension, social and health insurance for November;

- injury contributions for November;

- SZV-M report on each insured person for November;

- income tax return and pay advance payment for November;

- income tax calculation for November.

2. Reconcile settlements with counterparties and the tax office

It’s worth checking with your counterparties before the end of December. The legislation does not establish which party is the first to draw up a document. The act is drawn up in two copies. It is signed by the head and accountant of the company. If discrepancies are identified, they are reflected in the document. Based on the results of the reconciliation, the receivables or payables of the parties are reflected.

To receive a reconciliation of payments for taxes and insurance premiums, you must send an application (in paper or electronic form) to the Federal Tax Service. The main document that governs the reconciliation procedure is Order of the Federal Tax Service of Russia dated 09.09.2005 No. SAE-3-01/444 @ (note the changes made at the beginning of this year). In this case, the Federal Tax Service presents the applicant with a report in the form of KND 1160070, approved. By Order of the Federal Tax Service dated December 16, 2016 No. ММВ-7-17/685@.

If the company has a debt, it is advisable to pay it off, because penalties are charged for each day of delay, and during long holidays the amount can accrue quite a lot. Let us remind you that from December 28, 2019, clause 5 of Article 1 of Federal Law No. 424-F of November 27, 2018 comes into force, according to which penalties will have to be transferred, including for the day when the arrears are repaid. At the same time, the law limits the size of the penalty: it cannot be greater than the arrears itself.

3. Conduct an inventory of goods and materials and fixed assets

Carrying out an inventory at the end of the year will significantly save time resources during annual reporting and ensure reliability in its preparation. Moreover, there are mandatory requirements in this regard, prescribed in the Law on Accounting and Methodological Recommendations for accounting for inventories and fixed assets. Based on the identified surpluses and shortages, non-operating income and expenses are formed, which are taken into account for income tax and expenses under the simplified tax system.

4. Review accounting policies

From 01/01/2019, public sector employees are required to work according to Order of the Ministry of Finance of Russia dated December 30, 2017 N 274n “On approval of the federal accounting standard for public sector organizations “Accounting policies, estimates and errors”. The new standard is mandatory for state (municipal) budget and autonomous institutions, but commercial structures can also apply its provisions. Taking into account these changes, it is worth adjusting the accounting policy. One of the new requirements that needs to be prepared is the publication of the main provisions of the accounting policy or copies of its documents on the official website of the institution. from January 1.

Let us remind you that the responsibility for developing accounting policies lies with the chief accountant, who is also responsible for maintaining accounting records and timely submission of reports. But it must be approved by the head of the organization. Therefore, all changes must be prepared, agreed upon and approved in December.

5. Clarify on what property you will have to pay tax

A year ago (since January 2019), organizations lost the right to a federal property tax benefit in relation to movable property registered as fixed assets on January 1, 2013. It was assumed that the regions would independently pass laws reinstating the benefit so that taxpayers would not have to pay taxes on such objects (rate up to 1.1%). However, local officials did not accommodate business halfway. In this regard, amendments to Art. 374 Tax Code of the Russian Federation(Federal Law of August 3, 2018 N 302-FZ), which exempt companies from paying tax on any movable property. These changes apply to both Russian and foreign taxpayers.

6. Find out on which real estate you will have to pay tax, taking into account the cadastral value

The transition to paying property tax based on its cadastral value has not yet been completed in all regions. In addition, regional authorities may periodically revise the list of objects whose taxation is carried out taking into account cadastral valuation. For example, the authorities of the Pskov region have already posted a preliminary list of such objects for 2019, and the administration of St. Petersburg stated that work on forming the list is actively underway. Tatarstan has already approved such a list. It is possible that this will be done in Moscow and other regions in the coming days. Therefore, it is important to find out on which real estate the organization will pay tax next year according to the new rules.

7. Find out about the rules for switching to a new VAT rate

Based on Federal Law dated August 3, 2018 N 303-FZ, a new VAT rate of 20% will be introduced in Russia from January 1, 2019. It is important for accountants to understand how to work in the new conditions, so the Tax Service issued Letter No. SD-4-3/20667@ dated October 23, 2019, in which it explained all the intricacies of the transition, including recommending that the return of goods be issued with adjustment invoices. At the same time, in connection with changes in the Tax Code of the Russian Federation, it is planned to clarify other regulations governing the imposition of VAT. In particular, tax authorities are preparing amendments to the sales book, intend to change the form of the VAT declaration, and are going to clarify the formats of the invoice and adjustment invoice.

8. Notify tax authorities about the transition to the simplified tax system or unified agricultural tax.

Those companies and individual entrepreneurs who have decided to switch to a simplified taxation system or to pay the Unified Agricultural Tax must submit applications to the tax office at the place of registration (residence) before December 31 (and in fact, until December 29, because during the five-day period this is the last working day) . We are talking about those taxpayers who already use one of the regimes (or combine both) and newly registered ones. The latter have 30 days from the date of registration to notify the Federal Tax Service of the application of the special regime if the application was not submitted with documents for registration.

Let us remind you that in order to switch to preferential tax regimes, you must meet certain requirements for revenue and number of employees for the previous year.

9. Check the validity periods of contracts with counterparties, suppliers, and EDF operator

If the contract with the TCS supplier or operator ends on December 31, then after the New Year holidays the company, and most importantly its accountant, risks being left without important and useful services that not only save time and nerves, but also allow you to comply with the law. Let us remind you that in Tax Code of the Russian Federation an obligation has been established for taxpayers to submit electronic declarations and submit calculations for insurance premiums if the company employs more than 25 people, and VAT reporting must always be electronic.

10. Pay wages for December, January vacation pay and dividends

If the organization’s charter states that dividends can be paid quarterly, then it is better to distribute profits among participants for 9 months and previous years in December. The founders will benefit from this. Dividend rates will depend on who receives them: a legal entity or an individual, a resident of the Russian Federation or not.

There are more and more pensioners in the work of accountants, personnel officers and simply in the lives of each of us. Unfortunately, such activity does not affect the size of pensions.

Milk rivers with jelly banks

They promise benefits. Honestly, honestly, just refuse...

Would anyone really do this?

Pensioners who have already been assigned an old-age insurance pension can refuse to receive it in order to later receive more with premium coefficients, the Pension Fund suggested.

Now, without the minimum length of service and points, you will not receive an insurance pension. So what should I do?

Help the pension fund do its job

Requirements for insurers are increasing.

The Fund encourages employers to cooperate so that pensions are awarded on time.

This will take the HR officer or accountant no more than 15 minutes, the Pension Fund is confident.

Always wait for messages from the Pension Fund of Russia

An exception is made only for Saturday and Sunday; holidays are not mentioned.

Cool commentary on the news: “We urgently need to introduce a new work unit into the staff: “inspector-caller-responsible.” Responsibilities: daily check of TCS mailings from the Pension Fund of the Russian Federation, the Federal Tax Service, Rosfinmonitoring, the Social Insurance Fund, and statistics.”

And if ten years ago this was a new direction in which there were no clear regulations and legal obligations, today the situation has changed and leading companies are planning a total transition to outsourcing. The head of Sberbank, German Gref, said that in the future the bank will reduce the number of accountants on its staff by three times - to 500 people: “33 thousand accountants worked at Sberbank, today we have 1.5 thousand of them, and 500 people will work "

note

Accounting outsourcing is the most promising and actively developing area in outsourcing.

Accounting has always been one of the stable and profitable areas in the services market. Despite the difficulties in the economy, new business projects are opening every day: online stores, transport companies, small industries, etc. Those who need a good accountant from the first day of work. Large companies and even the state also turn to outsourcing accounting services.

Professional outsourcing companies have built a quality system for accounting. Therefore, the risk of errors is minimized. Entrepreneurs are not immune to the fact that a full-time accountant can quit at any time without finishing the job. And by concluding an agreement with an outsourcing company, the entrepreneur shifts these risks to the outsourcer. In case of termination of the contract, there is a clear procedure for completing the work and transferring cases.

This approach allows you to avoid spending money on recruiting and motivating employees and organizing workplaces. Outsourcing provides an opportunity to save on taxes by reducing the tax base. At the same time, thanks to outsourcing, a business can receive the services of truly qualified specialists at a relatively low cost.

note

In the USA, which is the world's first economy, there are only one million accountants. At the same time, 92% of accounting services are outsourced. Our country will develop along the same path. According to experts, by 2035 Russia will need another 400 thousand outsourced positions for accountants.

The obvious conclusion is that effective outsourcing is possible for any company.

Experienced accountants and businessmen see this as excellent prospects for creating their own business and uniting groups of accountants to provide comprehensive services to large and medium-sized businesses. Of course, everything is not so simple and without knowledge of the specifics of the industry and work experience, it is almost impossible to do it alone. But you can always enlist the support of an experienced partner, for example, with the help of a franchise.

The oldest company providing outsourced accounting services is Global Finance. The company has been operating since 2001, and therefore its specialists know first-hand about all the intricacies of this business and possible pitfalls. In 2015, Global Finance began to scale and opened a franchising direction. By 2018, the company's partner network consists of 85 branches and this is only a small part of what the market already requires. At the moment, 70% of Global Finance partners are accountants.

note

Accountants who want to open their own business outsourcing accounting services often have problems with clients. Being accounting specialists, they face difficulties in attracting clients.

Global Finance provides partners with a branded website and customized advertising campaigns, teaches how to properly attract clients, helps with their search and provides support after training. In addition, the company has many federal clients, which are transferred to regional partners. Attracting such clients would be impossible for a young company or a novice accountant because they prefer to work exclusively with large suppliers.

You can become a Global Finance partner and start your own business with a small investment of 150,000 to 500,000 rubles, which will pay off in 2-4 months of work.

At the mere mention of an accountant, most immediately see the image of a woman slightly over 50, poorly versed in modern technology and software, and always dissatisfied with something. But if you think about it like that, it’s difficult to imagine and accurately outline the entire range of responsibilities of this specialist. It is even more difficult to understand what an accountant should know in order to be useful to the enterprise and increase income.

Who is an accountant?

By and large, an accountant imagines this financial analyst, which:

- Accurately understands all cash flows.

- Able to understand whether the next undertaking brings profit or loss.

- Can detect any forgery and changes in reporting documentation.

- With proper “sleight of hand” it will easily “save” the enterprise a couple of extra millions.

It is extremely difficult to objectively evaluate your own business; you always want to underestimate losses somewhere and overestimate performance indicators somewhere. As a result, a picture is formed in the imagination that does not reflect the real state of affairs. But a specially trained professional can record everything on paper and demonstrate real level of income and expenses.

What does an accountant do?

What does an accountant actually do? At any enterprise he:

- Generates reporting in the format established by the state.

- Passes all financial flows through its forms and forms.

- Regulates the spending of every ruble on every little thing.

- Distributes funds among employees, this also applies to payroll.

- Submits tax returns.

- Prepares tax payment documents on time.

It may seem that anyone can handle all this in just a couple of working days, the rest of the time peacefully drinking coffee. Something similar actually happens at some enterprises; for some reason they keep a whole department of employees when only one professional can handle the job. In the same week.

But sometimes connections and nepotism play a decisive role, rather than optimizing the workflow. On the other hand, in a crisis It is these organizations that suffer the most. They, in turn, begin reforms with such “bloated” departments.

This does not mean that accountants are not needed or that there are too many of them. There are only a few truly high-quality specialists, their services are always at a premium. In the end, any director should value his accountant . After all, if anything happens, they will have to sit or hastily migrate to warmer climes together.

What is the job of an accountant?

Each accountant comes to his workplace for the opening of the organization, after which the following events often occur step by step:

- He makes coffee and tells his colleagues how last night went.

- He is trying to clear away the stack of documents he brought yesterday before closing.

- He remembers the unfinished business and goes to the archive, where he disappears for another hour.

- Trying to reason with the tax service over the phone. As usual, they mixed up something and announced some non-existent fines and delays.

- Once again he repeats to Petrov that pay will be on the 20th, not a week earlier.

- Melancholy, he enters data from paper documents into the system. At the same time, you may think about whether it is possible to somehow mechanize the process and exclude the accountant from this scheme. Preferably with retention of position and salary.

In fact, the responsibilities of each employee must be specified in the contract. At some enterprises, the accounting department has an additional burden of analyzing the financial situation and making forecasts. But usually they pay extra well for this.

Beginner accountant: where to start?

To become a good specialist you should start from education. Self-taught people are rarely held in high esteem, so it’s better to go to college or a higher educational institution.

If you already have a diploma and even a job in your hands, you should move on to the following stages of establishing yourself as a high-class accountant:

- It would be useful to familiarize yourself with the peculiarities of taxation at an enterprise.

- You should familiarize yourself with all reporting financial documents that are circulated in the organization.

- It's worth doing some extra work with the software. Courses won't hurt, even if they're paid. In a couple of weeks, you can learn enough useful “tricks” that will save hours of work.

- It is always necessary to be interested in the specifics of legislation; ultimately, responsibility will have to be borne by the state. So in the next few years, a novice accountant will only be interested in how the next law will be rewritten and whether it will be adopted in the third reading.

- You should never stop in your development. The legislative framework is changing, documents are being updated, and software is being improved.

But the most important thing is to never forget that often accountant deals with money, sometimes with colossal sums. And if something happens, the burden of responsibility will have to be borne at least alone. Maximum - with higher authorities.

How to save money on bookkeeping?

Today, some enterprises refuse to maintain an entire department or even one specialist, resorting to the help of third-party organizations.

|

Own accountant |

Freelancer |

|

He works full time and demands a decent salary for the region. |

He performs only the assigned task and only takes money for this. |

|

Sick leave, maternity leave, vacation are paid, and full social insurance is provided. |

Does not require anything other than the amount specified in the contract. |

|

Can work a couple of weeks a month, the rest of the time - imitate vigorous activity. |

There is no point in imitation, because only the amount of work performed is paid, and not every working day. |

|

He is more interested in the success of the enterprise. |

The incoming and outgoing accountant always has only his own interests. |

It’s stupid to deny the obvious savings, but there are always some nuances. Sometimes your specialists may have very interesting connections, and in some issues they may be more accommodating.

Minimum knowledge required for an accountant

To perform his duties, an accountant must:

- Know the specifics of tax legislation.

- Understand the documentation that is prepared at the enterprise.

- Have an analytical mind and understand the basics of mathematical analysis.

- Have an idea of all expenses. Understand what the company does in general.

- Keep up with the times and understand modern software.

- Understand that he is dealing with finances, that in the event of any unforeseen situation, the responsibility will fall on him.

At first, this knowledge turns out to be quite enough. And then it all depends on your desire to develop your own skills.

It seems that only accounting enthusiasts themselves know what an accountant should know. But they are hiding this secret from everyone else somewhere, most likely right behind the electric kettle.

Video about the responsibilities and knowledge of an accountant

In this video, accountant Elena Kovaleva will tell you what her job is. How does an accountant's day go, what should he know and be able to do:

Are you applying for a new job as a chief accountant? Of course, it’s scary, because this is a responsible and difficult position. But, as Carlson said, “calm, only calm!” And, of course, attentiveness.

Let's try to paint a picture of behavior at the final interview and a plan of action in the first days of work.

At the interview

When the future employer has already made a positive decision on your candidacy, ask him a few questions:

- what is expected of you in this job as a chief accountant;

- what problems exist in the accounting department;

- what goals the company sets for itself for the current year and for the next 2-3 years;

- How does the manager evaluate the work of the accounting department now?

EXPERIENCE EXCHANGE

Leading expert of JSC "MSAI FDP-Aval"

“ First of all, talk to the manager about the company’s activities. After all, high-quality accounting in an organization without understanding its activities is impossible. In particular, the classification of income and expenses in accordance with clause 4 of PBU 9/99 largely depends on the specifics of the activity. For example, rental for most organizations is other income, but for “professional” landlords it is the main activity. Therefore, before you start managing the accounting department, ask the manager:

1) what is the main activity of the company. If the company is a trading company, check whether there are export operations in order to immediately understand whether you will have to keep separate VAT records clause 10 art. 165 Tax Code of the Russian Federation. If the company is a manufacturing company, then find out in more detail about the specifics of the production process, stages of production, periods. After all, this will have to be taken into account when determining the cost of production;

2) whether tax audits have been carried out previously. If yes, then in what quantity and with what result for the company. Unpleasant situations are possible when an audit has already been scheduled and the previous chief accountant quit precisely due to this circumstance. In such a situation, a new accountant should understand whether he needs the hassle due to possible mistakes of others;

3) whether a mandatory or voluntary audit is carried out. The auditor's report can shed light on many of the company's accounting circumstances. It is advisable to familiarize yourself with the reports for several years in order to understand the trends in accounting and identify the main mistakes made by the previous accountant. By the way, you should evaluate the auditor himself - what kind of company was audited, what is its reputation in the market, what kind of clients does it have, how much its services cost. After all, it is obvious that in Moscow for 30,000-50,000 rubles. it is impossible to purchase the services of a high-quality auditor, which means that the audit was carried out only to obtain a formal positive conclusion and it is not worth relying on the data of such an audit.”

So, you have a certain picture of your future work and future responsibilities, you are satisfied with everything and you have agreed to go to work. During the interview you should also find out:

- what is the structure of the accounting department, because you need to understand how many subordinates you will have and how the distribution of responsibilities between them is currently organized;

- whether the previous chief accountant continues to work or has he already quit. In the latter case, it is important to understand which employee will be responsible for transferring matters to you. If this is a person who is far from accounting, the most he can do is give you the keys to the office where the papers are kept. And no one can answer your questions about why records were kept this way and not otherwise.

If your predecessor hasn't left yet, try meeting him in a non-work environment.

EXPERIENCE EXCHANGE

“ Chat with your predecessor, invite him to an informal meeting. This way you can learn more about the company’s activities and the accounting procedures that were used for certain transactions. More importantly, during the communication process, you can assess the competence of the previous accountant, guided by your professional experience.

After all, you should understand that the tax authorities can also check the periods for which your predecessor was responsible. clause 4 art. 89 Tax Code of the Russian Federation. Therefore, if during the conversation it becomes obvious that he is not very competent, then you should worry about either checking these periods yourself or involving a tax auditor. If, on the contrary, it is clear that the previous accountant is a highly qualified specialist, then such communication is a good reason to learn more, for example, about the features of communication with your new tax inspectorate.”

What difficulties can you expect even before you begin to directly perform the functions of the head of the counting kingdom? If the former chief accountant is still working, then the question of applying for the position will arise. After all, it may turn out that for some time the company will have two chief accountants. Although this situation does not contradict labor legislation, Rostrud still does not advise employing two chief accountants at the same time.

FROM AUTHENTIC SOURCES

Deputy Head of the Federal Service for Labor and Employment

Read about the specifics of the employment contract concluded with the chief accountant:“ Having two chief accountants on staff at the same time, even for a short time, is an almost unrealistic situation. And it's better to avoid it.

The solution could be like this. The outgoing chief accountant transfers the affairs to an existing employee (for example, an accountant, senior accountant), from whom the new employee will take them over. And after the dismissal of the previous chief accountant, he will be appointed to the position of chief and will calmly continue to receive cases from the accounting employee.”

So check with your manager what position you will be assigned to immediately upon starting work. Here are the possible options:

- <если> your predecessor agrees to move to a lower position before your dismissal, then they will immediately draw up an employment contract with you as the chief accountant;

- <если> the former chief accountant does not agree to go down, You can first register as a deputy chief accountant (accountant, senior accountant). And from the day following the last day of work of the former chief accountant, an employment contract will be signed with you as the chief accountant.

First days at a new job

What to take on, what to grab onto? Here's what our expert advises.

EXPERIENCE EXCHANGE

“ A new person who takes on the position of chief accountant will have to solve many problems. Therefore, it is advisable to divide them into three groups.

Urgent tasks - those that need to be completed “here and now” - postponing them can have negative consequences. Such tasks include the preparation of primary documents for current banking operations, settlements with counterparties under the terms of contracts, payment of wages, fulfillment of tax authorities’ requirements for the submission of documents, preparation of accounting and tax reporting on time, etc.

Second-stage tasks are those that need to be solved, but failure to complete them “right now” will not lead to negative consequences. In particular, this may include correcting errors in primary documents or checking the work of the previous accountant. It should be borne in mind that second-order tasks tend to turn into urgent ones if they are not solved for a long time.

Third priority tasks are those that can be postponed. For example, developing your own forms of primary documents can wait. In the meantime, the organization will use unified forms.

Leading expert of JSC "MSAI FDP-Aval"

That is, you will probably have to not only quickly resolve current issues (conduct current initial work, pay urgent bills, etc.), but also get up to speed at the same time. It would be good if the former chief accountant showed you where the documents are located and what accounting features the organization has.

WE TELL THE MANAGER

Even if the deadline for accepting and transferring cases upon dismissal of the chief accountant registered in his employment contract, job description or other local act of the company, upon dismissal of one’s own free will the chief accountant has the right to stop working, when 2 weeks have passed since the application was submitted Articles 9, 80 of the Labor Code of the Russian Federation.

In particular, ensure that by your predecessor's last day of employment:

- all accounting entries for the past period have been completed, all primary documents that are the basis for each posting are filed in place, and accounting and tax reporting forms are also filled out, if, suppose, the deadline for its submission is approaching;

- books and magazines formed registration of securities, powers of attorney, readings of summing cash and control counters of cash register equipment, bank check books, accounting of invoices received and issued, purchases and sales, cash book.

Although remember that the chief accountant leaving the company is generally not obliged to hand over the files and, after his dismissal, to respond to your requests or the director’s requests for the acceptance and transfer of cases.

And if your predecessor has already quit and hasn’t handed over anything to anyone, then you will even have to carry out the entire process of familiarizing yourself with the new accounting department on your own and as quickly as possible.

There are no regulatory rules for the acceptance and transfer of cases by the chief accountant from the chief accountant. Everyone organizes this differently. This is what an experienced accountant advises us.

EXPERIENCE EXCHANGE

Chief accountant of MM Industry LLC

“ Over the past 7 years, I have already changed my job five times and always moved to the position of chief accountant. And each time the cases were received differently, depending on the circumstances. For example, in some places I was not able to find the former chief accountant. And sometimes, even if he was still working, he was not eager to transfer cases and talk about all the pitfalls in accounting for “his” period. In both cases, I had to independently master the “good” I had received.

The best way to accept cases is prescribed in industry Instruction No. 25-12/38, approved. Ministry of Health of the USSR 05.28.79. It outlines the main accounting parameters that it is advisable to check when accepting cases. In particular, the organization of the accounting department, the general condition of accounting, cash and cash accounting, settlement transactions and fixed assets. This, of course, is an ideal model; in practice you don’t have time to check everything. But I try to stick to this pattern.

First of all, I get acquainted with the accounting policy (if there is one), see how the accounting department works, how areas are distributed between accountants, who is responsible for what. I conduct a superficial audit of accounting and tax accounting. I personally get to know each employee who will subsequently work under my leadership.

You can, of course, make an interim balance sheet and an act stating that the previous chief accountant transfers account balances in exactly this form, but in practice this is not the case. I know that I am not responsible for the offense committed by my predecessor. And the tax period for which I have to report, in any case, will need to be brought into compliance with the legislation.”

So, what is the best way for you to proceed when accepting cases?

Explore accounting policies and document flow procedures in the organization. All this may have some industry-specific characteristics. Therefore, it is also worth looking at the relevant regulations.

Check availability accounting and tax reporting, accounting registers:

- <если>there has not yet been an on-site tax audit, then for a period of at least 3 calendar years preceding your arrival at the company;

- <если>there was an on-site tax audit, then for the period from the date of drawing up the certificate of such an audit to the day of your arrival at the organization clause 8 art. 89 Tax Code of the Russian Federation. In this case, you also need to look at the act and decision based on the results of the audit, as well as payment slips confirming the fulfillment of the requirement to pay taxes, fines, and penalties.

Check the latest reporting data with the data from the registers or balance sheet. It makes sense to print out the balance sheet for the date you start work and have it certified by the director. This way you will record what amounts were reflected in the accounting program on a certain date.

Check operations:

- <или> selectively. For example, look in the balance sheet for the current date for all large amounts, right down to primary documents;

- <или> in a continuous manner within a short period of time. For example, select the period of the highest turnover for accounts lasting a quarter and check the reflection in the accounting of all transactions in this quarter.

When checking, pay attention in particular to:

- for the correct completion of reporting forms, the presence of a mark on its acceptance by the inspection, the deadline for its submission and the presence of all necessary signatures;

- for the coincidence of the data in the turnover sheets with the data in accounting and tax reporting;

- for the correctness of the initial registration (for example, check the presence of signatures of authorized persons and the presence of documents confirming their authority - powers of attorney, orders).

Already based on these parameters, you will be able to assess how competently your predecessor kept records, and, having identified shortcomings or serious errors, describe to the director the possible consequences of these errors. Let him make a decision: leave everything as it was or entrust you with correcting the mistakes.

See if there are “unclosed” tax control documents- requirements for the submission of documents, requirements for the provision of explanations for any reporting, requirements for the payment of arrears, etc. That is, study the correspondence with tax authorities and funds. As a rule, there are short deadlines for the execution of these documents, and in order to avoid fines, it is better to deal with them first.

Take inventory if the previous chief accountant was a financially responsible person (for example, he combined the positions of chief accountant and cashier). It will be necessary to check all the property for which he was responsible. clause 27 of the Regulations, approved. By Order of the Ministry of Finance dated July 29, 1998 No. 34n; Part 3 Art. 11 of the Law of December 6, 2011 No. 402-FZ.

If it is planned that you will also be the financially responsible person for this property, then you need to join the inventory commission.

WE TELL THE MANAGER

Regardless of whether the former chief accountant was a financially responsible person or not, it is advisable to assign an inventory of funds- both at the cash desk and on current accounts.

And in general, look at how long ago an inventory was carried out in the organization (and whether it was carried out), how competently everything was done (or, perhaps, formally - on paper). This will also help you assess the real financial position of the company.

Organize a reconciliation tax settlements with the inspectorate and contributions to funds. You may not have time to conduct a full reconciliation, so follow the abbreviated scenario:

- <если> the company is connected to telecommunication channels (TCS), you will receive an extract of transactions for settlements with the budget in electronic form appendices 1, 7 to the Order of the Federal Tax Service dated June 22, 2011 No. ММВ-7-6/381@;

- <если> the company is not connected to TCS, then make a written request for a certificate about the status of settlements with the budget Appendix 8 to Order of the Ministry of Finance dated July 2, 2012 No. 99n.

From these documents it will be clear whether the accruals of the company and the inspection (funds) coincide. Remember, the faster you find the arrears and pay them off, the smaller the penalties will be.

EXPERIENCE EXCHANGE

“ Reconciliation with the tax authority allows us to identify not only arrears, but also overpayments of taxes. The previous accountant may not have known about the existence of an overpayment for previous periods, and the Tax Code of the Russian Federation allows only 3 years for its return or offset against future payments. clause 7 art. 78 Tax Code of the Russian Federation. If a new accountant returns the overpaid tax, then he will probably earn the respect of the manager, and possibly a bonus.”

Leading expert of JSC "MSAI FDP-Aval"

Document the acceptance of cases in writing, if the former chief accountant or another employee wants to give you some documents or items (keys to a safe, a carrier with a key to the Client-Bank system, a bank checkbook, a seal). You can draw up an act about this in any form.

We are writing a report

If you discover any significant mistakes made by your predecessor, it makes sense to report this to your manager in writing. In the memorandum you can indicate How do you rate state of accounting in the company, what actions you made in the process of receiving and transferring cases to identify errors in accounting, what risks are there the company because of them and how their negative consequences can be eliminated.

In general, I consider the state of accounting in the organization to be satisfactory. There are no discrepancies in the registers of synthetic and analytical accounting. But when checking the availability of accounting and tax reporting for the period from 2010 to 2013. It was revealed that the VAT return for the first quarter of 2013 was not submitted to the Federal Tax Service and VAT in the amount of 100,000 rubles was not paid. for the same period.

The company may be fined RUB 20,000 for failure to pay VAT and late submission of VAT reports. and 5000 rub. (clause 1 of article 122, clause 1 of article 119 of the Tax Code of the Russian Federation).

I submitted a VAT return to the Federal Tax Service for the first quarter of 2013; VAT in the amount of RUB 100,000 was paid. and penalties on the date of tax payment in the amount of 1960 rubles.

The memorandum can be drawn up in two copies, one - given to the head of the organization, the second - kept for yourself. clause 6 of the Regulations on Chief Accountants, approved. Resolution of the Council of Ministers of the USSR dated January 24, 1980 No. 59; Art. 19 of the Law of November 21, 1996 No. 129-FZ.

Remember, you cannot be punished for mistakes made by your predecessor. Part 1 Art. 1.5 Code of Administrative Offenses of the Russian Federation. This was confirmed to us by Rostrud.

FROM AUTHENTIC SOURCES

“ Even if serious problems are revealed during the transfer of affairs, this will not prevent the dismissal of the previous chief accountant. And the new chief accountant, taking over the affairs of a new organization, is not responsible for “any shortcomings” that arose in accounting before his arrival.”

Rostrud

That is why, if subsequently the tax authorities conduct an audit of the period in which you have not yet worked as the chief accountant in this company, draw the attention of the inspectors to who was the chief accountant and during what period, submit an order on your appointment to the position. And make sure that when drawing up the audit report, the tax authorities indicate the f. And. O. the person who led the accounting department in the audited period.

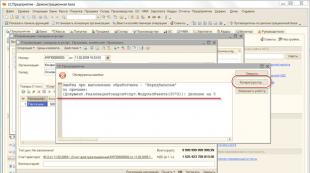

We prepare the necessary documents

Bank card with sample signatures

If you have the right to sign payment documents, re-issue a card with sample signatures at the bank in form No. 0401026 according to OKUD and receive a new digital signature (if you use the Client-Bank remote banking system) clause 7.6 of the Central Bank Instruction No. 28-I dated September 14, 2006.

To do this, take your passport, a copy of the order on your appointment to the position and, together with the director, go to the bank pp. 7.13, 7.14 Central Bank Instructions dated September 14, 2006 No. 28-I. By the way, it won’t hurt to call the bank before visiting the bank and find out what other documents they will want to look at from you. For example, sometimes they ask for a copy of the dismissal order of your predecessor, an extract from the Unified State Register of Legal Entities confirming information about who your director is and what the company’s legal address is.

Power of attorney to represent interests in the tax office

You need this document to submit documents to the Federal Tax Service and receive them from the tax office. It is better that the power of attorney issued to you contains the wording: “to represent the interests of the organization before the tax authorities.” With such paper, you can not only submit documents to the inspection, but also, if necessary, for example, make corrections to the declaration directly at the inspection.

There is no need to inform the inspectorate or funds about the appearance of a new chief accountant in the company. But you can write a letter about this in any form. Attach a copy of the order of your appointment and your passport to the application and hand it all over to the tax office. This way, tax authorities will know who to contact if accounting and tax questions arise for your company. But if you don't do this, there will be no negative consequences for you or the company.

Also, if your reporting is submitted electronically and the electronic signature was made in the name of the previous chief accountant, do not forget to contact your certification center so that they can issue an electronic signature verification key certificate for you.