The main directions for increasing the efficiency of a trading enterprise. The efficiency of a retail trade enterprise and ways to improve it. What can hinder efficiency?

graduate work

1.3 Ways to increase the efficiency of commercial activities of a trading enterprise

To obtain the maximum effect from the company’s activities, it is important to constantly work to improve commercial activities. The development of improvement measures should be based on the results of assessing the effectiveness of commercial work in all its areas.

Measures to improve information security should become basic, since the effective implementation of commercial activities is impossible without detailed, reliable and timely information. For this purpose, it is advisable for any organization to keep computer records of goods in the warehouse, contractors, and have information databases (legal, accounting, etc.). It is important to be able to quickly obtain information for making management decisions regarding areas of commercial activity. In this case, it will be effective to create related databases in all areas of commercial activity.

To ensure effective contractual work in an organization, it is necessary to competently draw up contracts with both suppliers and customers, i.e. concluding contracts on the most favorable terms for the company. Favorable terms of the contract may include the following:

Delivery/removal of goods by the other party, i.e. when transport costs are borne by the supplier/buyer;

Beneficial risk distribution in case of force majeure;

It is also necessary to monitor the execution of contracts separately for each counterparty, including monitoring the fulfillment of their contractual obligations. This work will allow us to quickly carry out measures to accelerate the turnover of accounts receivable, reduce accounts payable, and also avoid fines and penalties for overdue obligations. One of these activities is the provision of discounts for prepayment for goods. Thus, the organization frees up its working capital, which makes it possible to repay its obligations to creditors.

In the direction of forming an assortment, it is possible to increase the efficiency of activities by expanding and deepening the assortment. However, first it is necessary to study the demand of buyers, their desire and willingness to purchase these goods. Depending on the specifics of the organization’s activities, it may be advisable to create a narrower but deeper assortment; replacement of obsolete, slow-moving goods with new ones.

To ensure the effectiveness of inventory management activities, it is advisable to apply logistics principles when determining the need for purchased goods, use various inventory control systems (operational management systems, uniform delivery, replenishment of inventory to the maximum level, with a fixed order size with periodic or continuous verification of the actual level stock, etc.).

Effective inventory management involves minimizing the costs of transporting and storing goods. In the case where, according to the contract, the purchasing organization is the customer of transport, it needs to determine what is more profitable: to attract a third party to transport the goods or to use its own transport? When making a decision on this issue, the company must take into account the batch size, frequency of orders, as well as a comparative analysis of the costs of using both options. If a company nevertheless delivers goods using its own transport, it must work to optimize routes in order to save fuel and vehicle time on the road.

Increasing the efficiency of commercial procurement activities will be facilitated by the effective selection of suppliers, cooperation with which provides maximum benefit and minimal risk. For this purpose, the commercial service of a trade organization must compare suppliers according to the most important criteria (they may be different for each organization). It is also necessary to determine whether to purchase goods from the manufacturer or from an intermediary. Naturally, the price from the manufacturer will be lower, then the main criterion will be costs.

Increasing the efficiency of commercial activities in the wholesale sale of goods is ensured by improving the company's pricing policy, as well as the use of advertising and sales promotion tools.

Pricing policy will be more effective when using differentiated prices. This involves providing various types of discounts for customers: discounts for purchasing a certain number of units of goods or for a certain amount, discounts for prepayment, discounts for retail organizations for promoting goods, etc.

The use of discounts has a stimulating effect on buyers. Providing a deferred payment has the same effect, but this is unprofitable for the seller, and is only advisable when the buyer purchases a sufficiently large batch, as well as to attract new and reward regular customers. In any case, the decision to use this payment method can be made only after studying reliable information about the solvency and financial condition of the buyer.

There are also non-price means of attracting buyers and stimulating sales. In wholesale trade, such means include: organizing stands of a trade organization at specialized exhibitions, advertising in specialized print media in the form of small articles with information about the product offered, a new product, the provision of additional services, etc.

The effectiveness of activities for the sale of goods depends not only on the size of the organization’s gross income, but also on its structure: the increase in the amount of gross income should be caused by a higher rate of profit growth compared to the rate of growth of distribution costs. Therefore, a trading organization must constantly work to optimize and reduce the share of costs associated with the sale of goods.

The development and application of certain measures to improve the efficiency of commercial activities is determined by the specific conditions (internal and external) in which the trading organization operates. Just as there are no two identical people in the world, there are no two organizations that could follow the same path, increasing the efficiency of their activities. Studying the theoretical aspects of the commercial activities of a trade organization and assessing its effectiveness only provides specialists in this field with a certain base of concepts, techniques and methods for their practical activities.

Analysis of the profit of a trading enterprise. Reserves and ways to increase the profitability of the enterprise

Financial analysis occupies a special place in the study of enterprise economics. Its goals are to assess the final financial results of the enterprise...

Analysis of the financial and economic activities of the enterprise LLC "Rezontorg"

In modern economic conditions, the activities of each economic entity are the subject of attention of a wide range of participants in market relations (organizations and individuals)...

Analysis of the financial and economic activities of the trading enterprise LLC "Andr"

Accelerating the turnover of working capital is the primary task of enterprises in modern conditions and is achieved in various ways...

The task of the work is to choose the most effective way to distribute and use the resources involved in the production of the finished product, while it is necessary to find answers to the questions...

Analysis of the economic activity of the enterprise

Due to the introduction of innovations, we were able to reduce the mass of the workpiece to (), the mass of the part (), as well as the operational complexity () Table 5...

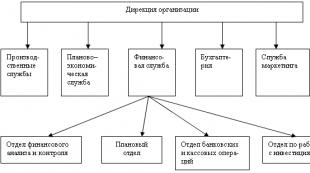

Organization of commercial activities at the enterprise

Commercial work is carried out on the basis of management decisions made by market entities. To make informed management decisions, it is necessary to accumulate and process commercial information...

assessment of the formation and distribution of income of a trading enterprise in modern conditions

Before increasing the profitability of economic activity, it is necessary to identify internal reserves for its growth. The implementation of deep transformations in the economy necessitates the maximum mobilization of internal reserves...

Increasing the economic efficiency of the activities of Myasnaya Dusha LLC, Chelyabinsk by expanding the range of products

All expedient human activity, one way or another, is connected with the problem of efficiency. This concept is based on limited resources, the desire to save time, to obtain as many products as possible from available resources...

Small business development

System of performance indicators for commercial activities in retail trade

In management practice situations arise...

Management analysis in trade using the example of Lotos-Trade LLC

Despite the reduction in the level of distribution costs, it is necessary to maintain the current trend and take the following measures to reduce them: 1. increase the volume of trade turnover; 2...

Formation of a business plan for a trading enterprise using the example of a flower shop

The business plan of the trading enterprise Mnogotsvet LLC is being developed with the aim of presenting it to possible investors to finance the activities of the enterprise in the amount of 300,000 rubles. on the basis of an agreement to provide a loan to an enterprise...

Economic assessment of the activities of ZAO "Sanatorium "Nizhne-Ivkino"

Currently, the service sector is one of the most promising, rapidly developing sectors of the economy, the growing share of the service sector in total GDP...

Efficiency and results of the enterprise’s commercial activities

In modern conditions, trading enterprises are focused not only on structural and organizational development, but also on increasing the efficiency of commercial activities. Performance indicators of a trading enterprise...

INSTITUTE OF ECONOMICS AND TRADE

TAJIK STATE UNIVERSITY OF COMMERCE

Department of Economics and Entrepreneurship

Subject "Economics of trade and public catering"

COURSE WORK

on the topic of:“Increasing the efficiency of a trading enterprise

Completed by: 4th year student

full-time education

Sobirov S

Head: Khomutova L.F.

Introduction

1. The purpose and objectives of financial analysis in modern conditions

1.2 Analysis of the enterprise’s retail turnover indicators

1.3 Analysis of costs and profits of a trading enterprise

2. Analysis and assessment of the financial and economic activities of the trading enterprise "Sitora"

2.1 General characteristics of the trading enterprise “Sitora”, Khujand

2.2. Analysis of retail turnover indicators of the Sitora trading enterprise

2.3 Analysis of costs and profits of the Sitora trading enterprise

2.3.1 Distribution costs of the Sitora trading enterprise

2.3.2 Profit, profitability and efficiency of the Sitora trading enterprise

3. Improving the efficiency of the Sitora trading enterprise

Conclusion

Bibliography

Introduction

The market economy offers the formation and development of enterprises of various organizational and legal forms, based on different types of private property, the emergence of new owners - both individual citizens and labor collectives of enterprises.

A type of economic activity has emerged called entrepreneurship - this is an economic activity, i.e. activities related to the production and sale of products, performance of work, provision of services or sale of goods needed by the consumer. It is of a regular nature and is distinguished, firstly, by freedom in choosing directions and methods of activity, independence in decision-making (of course, within the framework of the law and directed norms), and secondly, by responsibility for the decisions made and their use. Thirdly, this type of activity does not exclude risk, losses and bankruptcy. Finally, entrepreneurship is clearly focused on making a profit, which, in conditions of developed competition, ensures the satisfaction of social needs. This is the most important prerequisite and reason for interest in the results of financial and economic activities. The implementation of this principle in reality depends not only on the independence granted by the enterprise and the need to finance its expenses without government support, but also on the share of profit that remains at the disposal of the enterprise after paying taxes. In addition, it is necessary to create an economic environment in which it is profitable to produce goods, make a profit, and reduce costs.

Therefore, in order to make certain decisions in enterprise management, it is important to conduct various types of economic analysis. The analysis is related to the daily financial and economic activities of the enterprise, their teams, managers, and owners.

So, successful financial management is aimed at:

Survival of the enterprise in a competitive environment;

Avoid bankruptcy and credit financial failures;

Leadership in the fight against competitors;

Acceptable growth rates of the economic potential of the enterprise;

Growth in volumes and sales;

Profit maximization;

Minimizing costs;

Ensuring profitable operation of the enterprise.

This course work on the topic “Improving the efficiency of the Sitora trading enterprise” is relevant because its goal is to study and apply in practice theoretical knowledge, modern methods of researching the financial condition of an enterprise and analyzing the results of financial and economic activities. And also, the use of analysis data to recommend the adoption of practical measures in order to increase the efficiency of the enterprise.

The object of the course work is the trading enterprise “Sitora”. The company is located in the city of Khujand, Sughd region. The main task of the enterprise is the sale of household chemicals, perfumery and cosmetic products and knitted underwear.

1. The purpose and objectives of financial analysis in modern conditions

The main goal of a trading enterprise in modern conditions is to obtain maximum profit, which is impossible without effective capital management. The search for reserves to increase the profitability of the enterprise is the main task of the manager.

It is obvious that the performance of the enterprise as a whole depends entirely on the efficiency of management of financial resources and the enterprise. If things at the enterprise go by themselves, and the management style does not change in new market conditions, then the struggle for survival becomes continuous.

To manage production, you need to have an idea not only of the progress of the plan and the results of economic activity, but also of the trends and nature of the changes taking place in the economy of the enterprise. Comprehension and understanding of information are achieved through economic analysis.

Analysis of the financial and economic activities of an enterprise is one of the most effective management methods, the main element in justifying management decisions. In the conditions of the formation of market relations, it aims to ensure the sustainable development of profitable, competitive production and includes various areas - legal, economic, production, financial, etc.

The content of the analysis of the financial and economic activities of an enterprise involves a comprehensive study of the technical level of production, the quality and competitiveness of products, and the provision of production with material, financial and labor resources. It is based on a systematic approach, comprehensive consideration of various factors, high-quality selection of reliable information and is an important management function.

The main task of financial and economic analysis is to identify opportunities to improve the efficiency of an economic entity through rational financial policy.

The main result of the enterprise's activities are products, costs; the difference between them is profit, which is a source of replenishment of the enterprise’s funds, the final and initial stage of a new round of the production process.

The assessment of the results of the financial and economic activities of an enterprise is carried out within the framework of financial analysis, the main purpose of which is to provide the management of the enterprise with information for making decisions on the management of financial resources.

With the help of financial analysis, you can objectively assess the internal and external relations of the analyzed object: characterize its solvency, efficiency and profitability of the enterprise, development prospects, and then make informed decisions based on its results. Financial analysis is a process based on the study of data on the financial condition of an enterprise and the results of its past activities in order to assess future conditions and results of its activities. Thus, the main task of financial analysis is to reduce the inevitable uncertainty associated with making future-oriented economic decisions.

Financial analysis makes it possible to evaluate:

Property status of the enterprise;

The degree of business risk, in terms of the possibility of repaying obligations to third parties;

Capital adequacy for current activities and long-term investments;

The need for additional sources of financing;

Ability to increase capital;

Rationality of borrowing funds;

The validity of the policy for the distribution and use of profits;

The feasibility of choosing investments, etc.

In a broad sense, financial analysis can be used as a tool for justifying short-term and long-term decisions, the feasibility of investments; as a means of assessing the skill and quality of management; as a way to predict future results.

Retail turnover is a quantitative indicator characterizing sales volume. It expresses economic relations that arise at the final stage of the movement of goods from the sphere of circulation to the sphere of consumption through their exchange for monetary income.

Analysis of retail turnover is carried out with the aim of studying the possibilities of increasing it and maximizing profits.

The main tasks of analyzing retail turnover are as follows:

Checking the implementation of plans (forecasts) for trade turnover, satisfying customer demand for individual goods, determining trends in the socio-economic development of a trading enterprise;

Study, quantitative measurement and generalization of the influence of factors on the implementation of the plan and the dynamics of retail turnover, a comprehensive assessment of the trading activities of the enterprise;

Identification of ways and opportunities for increasing trade turnover, improving the quality of customer service, and the efficient use of economic potential (all types of resources);

The analysis of retail turnover is carried out in actual and comparable prices in the following sequence:

The volume of retail trade turnover is studied in comparison with the plan and in dynamics;

The structure of retail turnover is studied as a whole for a trading enterprise and in the context of individual divisions, by assortment, and sales methods;

Factor analysis is performed;

Reserves for growth in activity volumes are identified in order to improve customer service and maximize profits.

Trade turnover indicators are analyzed in various ways. Considering that we have a small trading enterprise, in this thesis we will consider some of them. Namely:

Analysis of trade turnover by the total volume and rhythm of trading activity;

Analysis of inventory and product turnover of the enterprise;

1.3 Analysis of costs and profits of a trading enterprise

Distribution costs are the costs of bringing goods from production to consumers, expressed in monetary terms. Distribution costs are socially necessary labor costs that ensure that trade fulfills its functions and tasks.

Distribution costs are conventionally divided into pure and additional. Net costs are the costs of organizing the purchase and sale process, maintaining administrative and management personnel, accounting and reporting costs. Additional costs are caused by the continuation of the production process in trade (packaging, packing), the transformation of the production range into a commercial one.

Costs can be explicit or implicit. Explicit (accounting) costs are costs associated with the use of attracted material, financial and labor resources, which are fully reflected in accounting and, according to the law, are included in the cost of product sales. They share:

For material costs (the cost of goods, raw materials, materials used for packaging, storage, ensuring a normal trade and technological process; the amount of wear and tear on low-value and fast-wearing items; the cost of work and services provided by other enterprises to this enterprise, fuel of all types, etc.);

Labor costs;

Contributions for social needs and other deductions;

Depreciation of fixed assets;

Other costs

Implicit costs are the costs associated with the use of resources owned by the enterprise itself. Implicit costs include payments that an enterprise could receive if it used its resources more profitably (costs of lost opportunities), normal profits that keep the entrepreneur in his chosen industry. From the point of view of managing distribution costs, it is important to know their classification into constant and variable (Fig. 1.1). Firstly, this division helps solve the problem of regulating mass and profit growth based on a relative reduction in costs with an increase in sales revenue. Secondly, this classification makes it possible to determine the cost recovery, that is, the margin of financial strength of the enterprise. Thirdly, the allocation of fixed costs makes it possible to use the marginal income method (gross income minus variable costs) to determine the size of the trade markup. Analysis of distribution costs is aimed at identifying opportunities to increase the efficiency of a trading enterprise through a more rational use of labor, material and financial resources in the process of carrying out acts of purchase and sale of goods and organizing trade services to consumers.

The task of a complete analysis of distribution costs is to determine:

Dynamics and degree of implementation of the cost plan by general level and individual expense items;

The size and rate of change of the actual (expected) level

distribution costs compared to their planned level and in dynamics;

The amount of savings or cost overruns (by overall level of costs and individual items);

Changes in the size of the influence of the main factors on the deviation of actual costs from planned ones;

The level of costs for the sale of certain types of goods;

Differences compared to competitors' costs.

fare; interest on short-term loans; expenses for storage, part-time work, sorting and packaging of goods; loss of goods during processing, storage and sales; expenses for operations with containers; payments for property insurance (in terms of cargo insurance and loan repayment risk); expenses for additional wages; accruals (social insurance contributions, employment fund, emergency (Chernobyl) tax) on the variable part of wages; taxes and deductions, the rates of which are calculated as a percentage of turnover |

expenses for the maintenance and rental of buildings, structures, premises, equipment, inventory and passenger transport; wear and tear of dishes, table linen and low-value equipment and the costs of their maintenance; expenses for the permanent part of remuneration; accruals (contributions to social insurance, to the employment fund, Emergency (Chernobyl) tax) on permanent wages; taxes and deductions that do not depend on the size of trade turnover |

Rice. 1.1. Classification of fixed and variable distribution costs

Absolute deviation (savings or overruns) is the difference between the actual and planned costs (or over time).

The change in the level of distribution costs is calculated as the deviation of the actual level from the plan or data of the previous period.

The rate of change in the level of distribution costs is determined by the ratio of the size of the change in their level to the base level, expressed as a percentage.

Relative savings (overspend) are determined by multiplying the size of the change in the level of distribution costs by actual retail turnover and dividing the product by 100.

2. Analysis and assessment of the financial and economic activities of the trading enterprise "Sitora"

2.1 General characteristics of the trading enterprise “Sitora”, Khujand

Individual entrepreneur Zhumabaeva N.A. has three retail facilities in the city of Khujand, Sughd region:

1. Shop “Zvezda” - B. Gafurova 27;

2. Shop "Zebo" - Lenin 4/2;

3. Sitora store - Lermontov 214.

IP Zhumabaeva N.A. operates on the basis of a certificate of individual entrepreneurship dated April 10, 2004, issued by the Administration of the city of Khujand.

Individual Entrepreneur Zhumabaeva carries out retail trade in household chemicals, perfumery and cosmetic products and knitwear.

There is no economic planning and analysis service at the enterprise.

All reporting for inspection authorities, incl. Tax Inspectorate, is maintained by a single accountant, assisted by the head of the enterprise.

The growth in trade turnover over the past year was mainly due to the expansion of the range of underwear and clothing. For household chemicals and perfumes, there was no increase in turnover due to fierce competition (many new stores of this profile were opened in the immediate vicinity) and market saturation with goods of this type

The average length of service of employees at this enterprise is more than 3 years. Wages are increased by increasing trade turnover and, consequently, by increasing labor productivity. New employees were hired in connection with the opening of the children's clothing department, located in an isolated room with a separate exit. groups.

The costs of this store (per month) include:

1. wages to workers,

2. taxes,

3. utility bills,

4. transport costs,

5. rent of land for a store.

Taxation of an enterprise is carried out by paying a single tax on imputed income, which is directly proportional to the area of the store's sales area.

There is no marketing service at the enterprise, but product suppliers provide some services to promote their product groups.

The range of goods is subject to some fluctuations due to the different needs of customers in different periods. These are mainly seasonal fluctuations, for example, in the summer, noticeably more washing powders, eau de toilette and body deodorants are sold. In winter, face and hand skin care products, as well as perfumes, are in greater demand. Each product group has its own “summer” and “winter” products. During the month, fluctuations in the assortment sold are explained by the availability or lack of the necessary amount of funds from the buyer.

The Sitora store is designed for a wide range of consumers, but mainly women, many of whom have children. The choice of new directions in the development of the enterprise is based on this fact.

2.2 Analysis of retail turnover indicators of the Sitora trading enterprise

Rhythm is assessed by periods of time in the organization’s activities (quarters, months, decades, weeks, days), and uniformity is assessed by enterprise or individual trading units. The calculation method is the same. The analysis allows us to determine how rhythmically retail sales are developing and whether customer demand for goods is being evenly satisfied. If there is operational information about changes in retail prices, it can be produced in a comparable form.

We will analyze the turnover of the Sitora enterprise in terms of the total volume and rhythm of trading activity by month for 2008-2009. For the study, we will build a table based on the data from the cashier-operator’s log [see. Appendix No. 1] at the beginning of each month for 2008-2009. (Table 2.1).

Table 2.1. Trade turnover of the trading enterprise "Sitora" for 2008-2009.

Based on the data in the table, we calculate the gross turnover for the month. To do this, subtract the amount of the previous month of each year from the amount of the next month.

2008 .

January: 548819.60 – 343461.50 = 205358.10

February: 822152 – 548819 = 273332.40

March: 1214163.91 – 822152 = 392011.91

April: 1544614 – 1214163.91 = 330450.09

May: 1922924.20 – 1544614 = 378310.10

June: 2293356.70 – 1922924.20 = 370432.50

July: 2651416 – 2293356.70 = 358059.30

August: 3051780.70 – 2651416 = 400364.70

September: 3372252 – 3051780.70 = 320471.30

October: 3802292.70 – 3372252 = 430040.70

November: 4197712.30 – 3802292.70 = 395419.60

December: 4883824.70 – 4197712.30 = 686112.40

2009 .

January: 5407422.20 – 4883824.70 = 523597.50

February: 5976592.60 – 5407422.20 = 569170.40

March: 6547718.70 – 5976592.60 = 571126.10

April: 7023724.10 – 6247718.70 = 476005.40

May: 7563436.40 – 7023724.10 = 539712.10

June: 8107473.50 – 7563436.40 = 544037.10

July: 8616671.40 – 8107473.50 = 509197.90

August: 9127896.50 – 8616671.40 = 511225.10

September: 9638291.30 – 9127896.50 = 510394.80

October: 10187636.70 – 9638291.30 = 549345.40

November: 10704879.50 – 10187636.70 = 517242.80

December: 11398129.30 – 10704879.50 = 693249.80

From the data obtained, we will construct a graph of changes in trade turnover by month to analyze the rhythm of the enterprise’s trading activities.

From the graph of changes in the turnover of the Sitora enterprise, it is clear that the growth of turnover fluctuates throughout the year by month. As a rule, the maximum turnover occurs in December, as well as in February-March. This is due to the fact that many buyers traditionally purchase perfumes and cosmetics as gifts for the New Year, February 23 and March 8. And declines in sales volume are most noticeable in April and September. The spring drop is a consequence of the creation of a certain inventory among buyers as a result of the gifts they received, and the autumn drop in sales is due to two main factors: “Sitora” (Fig. 2.1).

Rice. 2.1. Graph of changes in turnover of the Sitora enterprise by month

The fall in purchasing power is due to the end of the massive holiday season;

Due to the increased consumer demand for seasonal goods related to the need to prepare children for the start of the school year, as well as to purchase clothes and shoes for the autumn-winter period.

Based on gross monthly turnover, you can calculate the average annual monthly turnover (K sg.v.) for each year. To do this, you need to add up the gross turnover indicators for each month of the analyzed year and divide the amount by the number of months in this year.

205358,10 + 273332,40 + 392011,91 + 330450,09 + 378310,10 + 370432,10 + 358059,30 +

K sg. about. = 12

400364,70 + 320471,30 + 430040,70 + 395419,60 + 686112,40

12= 378363,6

523597,50 + 569170,40 + 571126,10 + 476005,40 + 539712,30 + 544037,10 + 509197,90 +

K sg. about. = 12

511225,10 + 510394,80 + 549345,40 + 517242,80 + 693249,80

12 = 542858,72

Based on the data obtained, we will calculate the average monthly growth in trade turnover (Kr.ob.) in 2008 relative to 2009, taking into account that the inflation rate in 2008 was 15%. To do this we use the formula

average annual monthly turnover for 2008

K r. turnover = average annual monthly turnover for 2008 ∙ 1.15 (2.1)

K r. rev = 378363.6 ∙ 1.15 = 1.25

Based on the results obtained, it is clear that compared to 2008, in 2009 there was a significant increase in trade turnover (25%). This was achieved by expanding the product range.

2.3 Analysis of costs and profits of the Sitora trading enterprise

We will analyze the costs and profits of the Sitora trading enterprise using the example of one month (November) of each year (2008-2009).

2.3.1 Distribution costs of the Sitora trading enterprise

To calculate the amount of costs of our enterprise in the analyzed periods, we will draw up tables in which we will show all the costs of the Sitora enterprise for November 2008-2009.

We will preliminarily calculate the single tax on imputed income (UTII), wages of key workers and depreciation of the vehicle and building.

Since UTII is paid quarterly and in a single amount for all trading enterprises of an individual entrepreneur, we will calculate UTII for the Sitora store for November 2008-2009. according to formulas taken from the UTII tax return for certain types of activities [see. Appendix No. 3].

The basic profitability is 1800, the trading floor area is 56.6 sq. m. m., the correction factors according to the declaration are equal to:

2008 .2009

K1 = 1 K1 = 1.132

K2 = 0.546 K2 = 0.546

K3 = 1.104 K3 = 1

Taking into account the indicators, we will calculate UTII for November 2008.

UTII = 1800 ∙ 56.6 ∙ 1 ∙ 0.546 ∙ 1.104 = 61411.63

Let's calculate UTII for November 2009.

UTII = 1800 ∙ 56.6 ∙ 1.132 ∙ 0.546 ∙ 1 = 62969.18

Now let's calculate the wages of the main workers. It amounts to approximately 0.5% of retail turnover as of November 2008-2009. Retail turnover for November 2008 is 395,419.60, and for November 2009 – 517,242.80.

Salary for November 2008 = 395419.60 ∙ 0.005 = 1977.098

Salary for November 2009 = 517242.80 ∙ 0.005 = 2586.214

Let's calculate the depreciation of a vehicle (VAZ 2111). The average service life of a car in retail trade, according to the recommendations of the car factory, is 3-5 years. During this time, the vehicle wears out by about 70%. Let's calculate the depreciation rate for a vehicle for the year. To do this, divide the cost of the vehicle in each year by its service life.

2008 .

120000: 5 = 24000

2009 .

100000: 5 = 20000

Now let’s calculate the depreciation rate for a car per month of each year. To do this, we divide the depreciation rate for the year by the number of months in the year.

2008 .

24000: 12 = 2000

2009 .

20000: 12 = 1666,7

Now let’s calculate the depreciation of the Sitora store building. According to the lease agreement for the land plot for the Sitora store, it was concluded for 20 years. Based on this, we will calculate depreciation charges for the store building in the analyzed periods (similar to calculating depreciation charges for a vehicle). The depreciation rate for the year is equal to:

2008 .

2000000: 20 = 100000

2009 .

2400000: 20 = 120000

The depreciation rate for a building per month of each year is equal to:

2008 .

100000: 12 = 8333,4

2009 .

120000: 12 = 10000

Let's compile tables of enterprise costs (Tables 2.3, 2.4), using a notebook for accounting for income and expenses [see. Appendix No. 4] and calculated indicators (see next page).

All costs of the Sitora trading enterprise are semi-fixed, except for the wages of the main workers. It is a conditional variable.

From the data in Tables 2.3 and 2.4 it is clear that in 2009 the amount of costs increased. This is due to a significant increase in wages for key workers. A plot of land for the Sitora store was also purchased.

Distribution costs are characterized by amount and level. Their level in retail trade is determined as a percentage of retail turnover. The level of distribution costs is an important qualitative indicator of the trading activity of an enterprise.

Table 2.3 Costs for November 2008

| No. | Name of expense item | ||||

| % of total amount | In somoni from the total amount | ||||

| 1 | For the security of the premises for 11.08 State Institution of the Republic of Tajikistan “OVO at the Department of Internal Affairs of the city of Khujand” | 282 14.11.08 | 4234 | 50% | 2117 |

| 2 | For those Security equipment for 11.08 Branch of the Federal State Unitary Enterprise "Security" of the Ministry of Internal Affairs of Tajikistan TO | 281 14.11.08 | 971 | 50% | 485,50 |

| 3 | For water and wastewater transmission for 11.08 MP “Water supply and sewerage facilities” | 946 28.11.08 | 90 | 100% | 90 |

| 4 | For electricity for 11.08 JSC Khujand Gorelektroset" |

300 29.11.08 | 8274 | 35% | 2758 |

| 5 | For garbage removal for 11.08 MUP and TH "Housing and Public Utilities" | 320 23.12.08 | 973 | 40% | 389,20 |

| 6 | For work on comprehensive maintenance of cash registers for 11.08 FSUE "TPVTI" | 299 29.11.08 | 590 | 25% | 147,50 |

| 7 | For rent of land (Magistralnaya St.) for 11.08 FU MO "city" Khujand" | 289 18.11.08 | 4800 | 100% | 4800 |

| 8 | - | 61411,63 | 35% | 20470,54 | |

| 9 | - | 395419,6 | 0.5% | 1977,09 | |

| 10 | - | 2000 | 100% | 2000 | |

| 11 | - | 8333,4 | 100% | 8333,4 | |

| TOTAL | 487096,63 | 61357,12 | |||

Table 2.4 Costs for November 2009

| No. | Name of expense item | Number and date of payment document | Amount of expenses according to the document, somon. | The share of expenses attributable to this division of the enterprise | |

| % of total amount | In somoni from the total amount | ||||

| 1 | Payment for security of the premises for 11.09 State Institution of the Republic of Tajikistan "Institution of Internal Affairs at the Department of Internal Affairs of the city of Khujand | 343 13.11.09 | 4964 | 50% | 2482 |

| 2 | For telecommunication services for 11.09 Khujand ES TF “Tcell, Babilon” | 350 20.11.09 | 600 | 50% | 300 |

| 3 | Payment for electricity for 11.09 JSC Khujand Gorelektroset" |

372 01.12.09 | 7450 | 35% | 2483,30 |

| 4 | For water and wastewater transmission for 11.09 MP “Water supply and sewerage facilities” | 383 12.12.09 | 141 | 50% | 70,50 |

| 5 | For garbage removal for 11.09 Municipal Unitary Enterprise "Housing and Communal Services" | 302 13.10.09 | 1192 | 50% | 596 |

| 6 | For servicing cash registers for 11.09 FSUE "TPVTI" | 354 22.11.09 | 1333 | 20% | 266,60 |

| 7 | Prepayment for natural gas for 11.06 Gorgaz LLC | 309 19.10.09 | 770 | 100% | 770 |

| 8 | Unified tax on imputed income (UTII) | - | 62969,18 | 35% | 20989,73 |

| 9 | Salaries of main workers | - | 517242,8 | 0,5 | 2586,21 |

| 10 | Depreciation charges on a vehicle | - | 1666,7 | 100% | 1666,7 |

| 11 | Depreciation charges for the Sitora store building | - | 10000 | 100% | 10000 |

| TOTAL | 608434,68 | 65486,97 | |||

Based on the level of costs, one judges, on the one hand, the amount of costs per 1 thousand somons of trade turnover, on the other, the share of trade expenses in the retail price, and on the third, the efficiency of using material, labor and financial resources.

The optimal level of costs corresponds to the best way to use limited resources to achieve the goal of ensuring competitiveness.

Let's calculate the level of costs (U From) for November 2008-2009. It represents the ratio of the amount of costs from the total amount for the month of the analyzed year to the turnover for the month of this year. The formula looks like:

∑ monthly costs

UI = Monthly turnover (2.9)

Using this formula, we get:

2008 .

UIZ = 395419.60 = 0.16

2009 .

UIZ = 517242.80 = 0.13

Comparing the results obtained, we see that the level of costs in 2009 decreased compared to 2008 (from 0.16 to 0.13). This tells us that the efficiency of the enterprise has increased.

2.3.2 Profit, profitability and efficiency of the Sitora trading enterprise

As already indicated in paragraph 2.3., we can calculate profit only using indirect indicators, based on the fact that the entire profit of the enterprise in 2008-2009. went to increase working capital. Since the dates of store audits in the analyzed period do not coincide, to calculate profits we will take the average monthly figure for the 4th quarter.

To begin with, let's calculate the amount of increase in working capital (∑ o.s. ") for the 4th quarter of 2008-2009, using the data in Table 2.2.

2008 .

∑ o.s. " = (841706 – 619903) : 3 = 73934.4

2009 .

∑ o.s. " = (1799127 – 1351078) : 3 = 149349.7

Let's adjust the obtained indicators for the amount of inflation, and also take into account the level of the trade markup.

2008 .

∑ o.s.

2009 .

" = 73934.4: 1.3 = 56872.7

The increase in the amount of working capital in 2009 compared to 2008 was 56.3%. This indicator tells us that profit at our enterprise has increased.

2008 .

Wed. TO = (4883824.7 – 3372253) : 3 = 503857.6

2009 .

Wed. TO = (11398129.3 – 9638291.3) : 3 = 586612.7

Now we can calculate the profitability indicator for the 4th quarter of 2008-2009 using formula 1.6.

2008 .

R = 503857, 6 = 0.11

2009 .

R = 586612, 7 = 0.15

Comparing the obtained indicators, we see that the profitability of the Sitora enterprise has increased (from 0.11 to 0.15).

Having considered profit and profitability indicators, we must calculate how efficiently our enterprise operates. To do this, we should analyze invoices for the purchase of goods for November 2008-2009. for two suppliers, consider and calculate several important indicators and evaluate the structure of turnover of the Sitora trading enterprise.

The Sitora store uses the services of various suppliers. But the main suppliers include:

1. Badri Munir LLC, Khujand.

2. Komron-freight LLC, Gafurov.

Let's look at the invoices for these suppliers for the purchase of goods for November 2008-2009. [cm. Appendix No. 5] and draw up tables based on the data of these invoices (Tables 2.5, 2.6) (see next page).

Table 2.5 Purchase of goods for November 2008

| No. | Name of product | Quantity, pcs. | Average price, somon./pcs. | Amount, somon. |

| 1 | Tide 450 g. | 143 | 22,9 | 3274,7 |

| 2 | Tide 900 g. | 50 | 44,7 | 2235 |

| 3 | Tide 2400 g. | 7 | 120,81 | 845,7 |

| 4 | Myth 400 g. | 145 | 15,87 | 2301,2 |

| 5 | Myth 400 g. automatic | 19 | 17,43 | 1655,8 |

| 6 | Myth 900 | 95 | 35,10 | 667 |

| 7 | Tix 400 g. | 96 | 11,66 | 1119,4 |

| 8 | Tix 1300 g. | 20 | 33,65 | 673 |

| 9 | Lenore 500 ml. | 55 | 19,41 | 1067,5 |

| 10 | Lenore 1 l. | 49 | 32,97 | 1615,5 |

| 11 | Fairy 500 ml. | 68 | 30,82 | 2095,8 |

| 12 | Mr. Proper 400 g. | 11 | 18,36 | 202 |

| 13 | Pampers Midi | 13 | 367,76 | 4781 |

| 14 | Pampers Junior | 10 | 491,72 | 4917,2 |

| 15 | Pampers Slip & Play | 23 | 271,47 | 6243,8 |

| 16 | Shamtu 200 ml. | 38 | 33 | 1254 |

| 17 | Shamtu 380 ml. | 37 | 44 | 1628 |

| 18 | Clairol 200 ml. | 16 | 54 | 864 |

| 19 | Bl.-a-Med 50 ml. | 125 | 16 | 2000 |

| 20 | Dez. Secret '45 | 21 | 50 | 1050 |

| 21 | Pampers Maxi | 15 | 492 | 7380 |

| 22 | Ariel 450 g. | 27 | 31 | 837 |

| 23 | Ariel 2400 | 4 | 35 | 140 |

| 24 | Tide 150 g. | 56 | 11 | 616 |

| 25 | AC 200 ml. | 20 | 15 | 300 |

| 26 | AC 1l. | 20 | 27 | 540 |

| 27 | Comet flash 600 ml. | 5 | 31 | 155 |

| 28 | Pantin 200ml. | 9 | 66 | 594 |

| 29 | Safeguard 100 g. | 27 | 13 | 351 |

| 30 | Ariel 150 g. | 12 | 12,3 | 147,6 |

| 31 | Comet flash 450 g. | 51 | 19 | 969 |

| 32 | Naturella 10 pcs. | 60 | 20 | 1200 |

| 33 | Naturella 20 pcs. | 24 | 36 | 864 |

| 34 | Allways Ultra | 72 | 32 | 2304 |

| 35 | Head 200 ml. | 36 | 68 | 2448 |

| 36 | Bl.-a-Med 100 g. | 81 | 36 | 2916 |

| 37 | Soap 90 g. | 82 | 3,8 | 311,6 |

| 38 | Household soap 250 g. | 96 | 4 | 384 |

| 39 | Otb. Bos 250 g. | 85 | 11,8 | 1003 |

| 40 | Otb. Whiteness 1 l. | 212 | 6 | 1272 |

| 41 | Biolan 400 g. | 48 | 11,4 | 547,2 |

| 42 | Biolan-active 400g. | 96 | 9,5 | 912 |

| 43 | Biolan 900 g. | 20 | 20,3 | 406 |

| 44 | Scamvon 250 g. | 10 | 33 | 330 |

| 45 | Sorti 900 g. | 40 | 21 | 840 |

| 46 | Laska 180 ml. | 36 | 16,4 | 590,4 |

| 47 | Sorti Color 400 g. | 21 | 15 | 315 |

| 48 | Ek/kor sorts | 7 | 9,36 | 65,5 |

| 49 | Zifa 550 g. | 160 | 13,10 | 2096 |

| 50 | Natalie Maxey | 130 | 9,36 | 1216,8 |

| 51 | Natalie Po 10 | 80 | 8,37 | 669,6 |

| 52 | Natalie S 10 | 120 | 11,30 | 1356 |

| 53 | Natalie Ezh deo | 96 | 10,35 | 1084,8 |

| 54 | T/b Kyiv | 576 | 4,01 | 2309,8 |

| 55 | T/b Sissy | 280 | 3,51 | 982,8 |

| 56 | T/b Voronezh | 700 | 2,25 | 1573 |

| 57 | T/b Clean | 420 | 2,48 | 1041,6 |

| 58 | T/b Family | 168 | 4,10 | 688,8 |

| 59 | T/b Soft sign | 216 | 4,37 | 944 |

| 60 | Salt Forest | 12 | 18,77 | 225,2 |

| 61 | Salf. ow. Aquael 20 | 104 | 10,31 | 1072,2 |

| 62 | 5+ w/c 750 ml. | 18 | 23,40 | 421,2 |

| 63 | 5+ w/c 500 ml. | 43 | 15,48 | 665,6 |

| 64 | Effect d/v ml. | 20 | 17,28 | 345,6 |

| 65 | Penoxol 350 g. | 80 | 6,44 | 515,2 |

| 66 | Purely 500 g. | 10 | 6,30 | 63 |

| 67 | Chistin 400 g. | 30 | 7,70 | 231 |

| 68 | Selena 600 ml. | 36 | 12,69 | 456,8 |

| 69 | Mole 1.2 | 10 | 17,87 | 179 |

| 70 | Soda calcium. 700 g | 60 | 7,16 | 429 |

| 71 | Pemos-super 500 | 100 | 9,90 | 990 |

| 72 | Monika 500 ml. | 12 | 17,33 | 208 |

| 73 | Sanox 750 ml. | 60 | 17,19 | 1029 |

| 74 | Sanox-gel 750 ml. | 60 | 18,72 | 1123,2 |

| 75 | Sanfor-gel 750 ml. | 45 | 21,11 | 950 |

| 76 | Sanitary duckling | 36 | 10,31 | 371,1 |

| 77 | B-m Exclusive | 24 | 35,19 | 844,6 |

| 78 | Otb. Lily | 100 | 4,68 | 468 |

| 79 | Wed. Floor E 1l. | 16 | 31,64 | 506,24 |

| 80 | Zifa 450 g. | 72 | 11,34 | 816,48 |

| 81 | Daxy 800 g. | 10 | 12,87 | 128,7 |

| 82 | Lily of the valley 500 g. | 12 | 14,40 | 172,8 |

| 83 | Sorti Color 2400 g. | 4 | 80,87 | 323,5 |

| 84 | E 400 g. | 44 | 18 | 792 |

| 85 | Natalie the hedgehog software | 148 | 10,35 | 1531,8 |

| 86 | Natalie Comfort | 126 | 18,99 | 2392,8 |

| 87 | Cinderella 500 ml. | 16 | 10,22 | 163,5 |

| 88 | Sanfor-plus 500 ml. | 36 | 14,40 | 518,4 |

| 89 | Sanita-gel 500 ml. | 20 | 18,09 | 361,8 |

| 90 | Sanit-antirzha 500 ml. | 20 | 14,85 | 297 |

| 91 | Effect d/sant. | 10 | 15,44 | 154,4 |

| 92 | Santex-chlorine 750 ml. | 12 | 19,31 | 231,7 |

| 93 | 5+ Gel 500 ml. | 7 | 15,48 | 108,4 |

| 94 | Shower gel Rozhkov | 26 | 15,35 | 400 |

| 95 | Gel for soul Forest fairy tale | 8 | 12,60 | 100,8 |

| 96 | Soap Your Sunshine | 36 | 4,28 | 154,08 |

| 97 | Floral gel for face | 4 | 19,40 | 77,6 |

| 98 | Foam Courage 1 l. | 24 | 23,72 | 569,28 |

| 99 | Calgon 500 g. | 20 | 64,80 | 1296 |

| 100 | Bingon 500 g. | 24 | 32,18 | 772,3 |

| 101 | Crumb paste 500 g. | 24 | 18,54 | 445 |

| 102 | Lily of the valley paste 500 g. | 24 | 14,40 | 345,6 |

| 103 | 5+ w/ jeans. | 2 | 49,50 | 99 |

| 104 | 5+ w/children | 2 | 50,36 | 101 |

| 105 | 5+ w/ delicate. | 3 | 28,58 | 85,7 |

| 106 | Stork Cashmere | 10 | 22,14 | 221,4 |

| 107 | Weasel for black 1 l. | 3 | 76,82 | 230,4 |

| 108 | T/b Lilac | 164 | 2,61 | 428 |

| 109 | Blue Forget-Me-Not | 60 | 4,50 | 270 |

| 110 | Ins. Dohlox | 30 | 20,70 | 621 |

| 111 | Selena for kitchen | 4 | 24,26 | 97 |

| 112 | Mole 0.78 | 20 | 13,19 | 263,8 |

| 113 | Mole 0.4 | 72 | 7,97 | 573,8 |

| 114 | Selena for slabs | 12 | 13,01 | 156,12 |

| 115 | Selena d/ steel | 12 | 11,03 | 132,4 |

| 116 | Cinderella is polishing. | 36 | 8,91 | 321 |

| 117 | Solita 340 ml. | 198 | 6,89 | 1364,2 |

| 118 | Solita 680 ml. | 100 | 10,71 | 1071 |

| 119 | Sanfor-gel 500 ml. | 28 | 18,36 | 514 |

| 120 | Foam for bathtubs Special | 18 | 17,82 | 321 |

| 121 | Special face cream | 48 | 11 | 528 |

| 122 | Shampoo Rus. herbs | 12 | 10,58 | 127 |

| 123 | Floral gel/intim | 6 | 20,88 | 125,3 |

| 124 | Shampoo Borros | 20 | 10,76 | 215,2 |

| 125 | Tide 450 automatic | 45 | 27,72 | 1247 |

| 126 | Tix 2400 automatic | 4 | 76,36 | 305,4 |

| 127 | Oldaze disc. 20*18 | 35 | 22,54 | 789 |

| 128 | Tampax compak 8 | 6 | 38,96 | 233,8 |

| 129 | Head 400 ml. | 9 | 107,80 | 970,2 |

| 130 | Pantin 400 ml. | 10 | 104,81 | 1048,1 |

| 131 | Soap Kamei | 28 | 11,62 | 325,4 |

| 132 | Dez. Old Spice | 15 | 49,15 | 737,2 |

| 133 | Des.-roll. Old Spice | 8 | 40,84 | 326,7 |

| 134 | Des.-roll. Secret | 9 | 37 | 333 |

| 135 | Myth 2400 automatic | 1 | 95,62 | 95,62 |

| 136 | Tix 1500 automatic | 2 | 49,23 | 98,5 |

| 137 | Mr. Proper 500 ml. | 6 | 29,19 | 175,1 |

| 138 | Persol reb. 200 g. | 80 | 5,94 | 475,2 |

| 139 | Biolan color 450 g. | 24 | 14,31 | 343,4 |

| 140 | E 2in1 3 kg. | 3 | 118,31 | 355 |

| 141 | T/b Euro 2 pcs. | 28 | 9,14 | 256 |

| 142 | T/b Euro 4 pcs. | 14 | 15,48 | 216,7 |

| 143 | Shampoo Rozhkov | 16 | 15,30 | 244,8 |

| 144 | Tix 400 g automatic | 18 | 14,10 | 253,8 |

| 145 | Lenore 2 l. | 12 | 59,33 | 712 |

| 146 | Ariel 450 automatic | 5 | 34,57 | 172,8 |

| 147 | Des.-aer. Secret | 11 | 44,31 | 487,4 |

| TOTAL | 124590,14 | |||

Table 2.6 Purchase of goods for November 2009

| No. | Name of product | Quantity, pcs. | Average price, somon./pcs. | Amount, somon. |

| 1 | Otb. Whiteness 1 l. | 240 | 6,21 | 1490,4 |

| 2 | Eona liquid 500 ml. | 24 | 32,54 | 780,96 |

| 3 | Soap 200 g. | 50 | 7,43 | 371,5 |

| 4 | Scented soap | 90 | 7,92 | 712,8 |

| 5 | Fragrant soap Ass 90 | 120 | 3,74 | 448,8 |

| 6 | Soap 190 g. used | 108 | 7,07 | 763,56 |

| 7 | Soap Fin. 90 | 96 | 3,78 | 362,88 |

| 8 | Otb. Persol 2-u 200 g. | 80 | 6,98 | 558,4 |

| 9 | Otb. Persol lime 200 g. | 80 | 7,07 | 565,6 |

| 10 | Otb. Persol econ 200g | 160 | 6,21 | 993,6 |

| 11 | Nab. Small Fairy 5 Ave. | 12 | 179,64 | 2155,68 |

| 12 | Paul Snowdrop | 10 | 7,38 | 73,8 |

| 13 | Lily of the valley paste 400 g. | 24 | 13,14 | 315,36 |

| 14 | Lily of the valley paste 500 g. | 36 | 15,53 | 559,08 |

| 15 | Gloss d/ black 1 l. | 18 | 32,31 | 581,58 |

| 16 | Scamvon 250 g. | 40 | 31,19 | 1247,6 |

| 17 | Calgon 500 g. | 40 | 64,80 | 2592 |

| 18 | Stork cashmere 750 g. | 35 | 24,48 | 856,8 |

| 19 | E Color/aut. 1.5 kg. | 7 | 66,29 | 464,03 |

| 20 | E Color/aut. 2in1 2.4 kg. | 7 | 100,44 | 703,08 |

| 21 | Zifa 550 g. | 80 | 14 | 1120 |

| 22 | Sticks I am the most 300 st. | 12 | 21,60 | 259,2 |

| 23 | Sticks I am the most 100 st. | 24 | 9,72 | 233,28 |

| 24 | Toothpick bol. | 2 | 63 | 126 |

| 25 | T/b Kyiv used bushings | 384 | 4,61 | 1770,24 |

| 26 | T/b Family used bushings | 240 | 4,32 | 1036,8 |

| 27 | T/b Voronezh used bushings | 250 | 2,30 | 590 |

| 28 | Salt Bezhin meadow 500 g. | 15 | 5,99 | 89,85 |

| 29 | Luck 500 g. | 40 | 8,10 | 324 |

| 30 | Penoxol 350 g. | 64 | 6,80 | 435,2 |

| 31 | Sanit liquid. 330 g. | 72 | 8,06 | 580,32 |

| 32 | Solita liquid 340 g | 72 | 7,70 | 554,4 |

| 33 | Solita liquid 680 g | 80 | 11,97 | 957,6 |

| 34 | Sanox 750 ml. | 15 | 18,09 | 271,35 |

| 35 | Sanfor-gel 750 ml. | 30 | 22,64 | 679,2 |

| 36 | Pemosuper liquid. 500 ml | 10 | 12,06 | 120,6 |

| 37 | Antiscale liquid. | 36 | 7,34 | 264,24 |

| 38 | Tab. unit. Fresh 1 | 14 | 12,51 | 175,14 |

| 39 | Ariel 450 g. | 17 | 31,74 | 539,58 |

| 40 | Ariel 3 kg. machine | 7 | 197,83 | 1384,81 |

| 41 | Tide 150 g. | 24 | 10,53 | 252,72 |

| 42 | Tide 400 g. | 71 | 20,65 | 1466,15 |

| 43 | Tide 900 g. | 3 | 45,34 | 136,02 |

| 44 | Tide 450 automatic | 61 | 28,12 | 1715,32 |

| 45 | Tide 3 kg. machine | 26 | 153,14 | 3981,64 |

| 46 | Myth 400 g. | 95 | 15,63 | 1484,85 |

| 47 | Myth 400 g. automatic | 116 | 18,30 | 2122,8 |

| 48 | Myth 400 ed. With air conditioner | 16 | 21,05 | 336,8 |

| 49 | Myth 2 kg. machine | 18 | 82,53 | 1485,54 |

| 50 | Myth 2 kg. auto with air conditioner | 4 | 94,90 | 379,6 |

| 51 | Myth 4 kg. machine | 6 | 152,78 | 916,68 |

| 52 | Tix 400 g automatic | 16 | 14,37 | 229,92 |

| 53 | AC 200 g. Bio+acid. from. | 17 | 14,75 | 250,75 |

| 54 | AC 1 l. liquid otb. | 16 | 24 | 384 |

| 55 | Mr. Proper 500 ml. | 14 | 29,61 | 414,54 |

| 56 | Lenore 500 ml. | 11 | 20,08 | 220,88 |

| 57 | Lenore conc. 500 ml. | 10 | 34,55 | 345,5 |

| 58 | Lenore 2 l. | 7 | 61,36 | 429,52 |

| 59 | Comet liquid h/s 450 ml. | 8 | 46,61 | 372,88 |

| 60 | Fairy 500 ml. | 42 | 31,57 | 1325,94 |

| 61 | Pampers Slip & Play 44*2, 52*2 | 27 | 481,10 | 12989,7 |

| 62 | Pampers det. salf. 72 | 2 | 101,7 | 202,34 |

| 63 | Naturella hedgehog. 60 pcs. | 3 | 55,97 | 167,91 |

| 64 | Olweiz Ultra normal | 3 | 57,82 | 173,46 |

| 65 | Olweiz Ultra fresh 9 | 10 | 29,76 | 297,6 |

| 66 | Oldeyes discrit 20*18 | 9 | 22,19 | 199,71 |

| 67 | Londial 250 ml. | 17 | 36,71 | 624,07 |

| 68 | Shamtu 380 ml. | 29 | 45,14 | 1309,06 |

| 69 | Pantin 150 ml. cream | 2 | 67,59 | 189,60 |

| 70 | Pantin 200 ml. | 17 | 67,59 | 114903 |

| 71 | Camey foam for baths 500 | 2 | 94,80 | 189,60 |

| 72 | Bl.-a-Med 50 ml. | 17 | 23,08 | 392,36 |

| 73 | Bl.-a-Med 50 ml. | 21 | 11,97 | 251,37 |

| 74 | Bl.-a-Med 100 ml. | 41 | 37,53 | 1538,73 |

| 75 | Bl.-a-Med Pro-min. 100 | 6 | 26,26 | 157,56 |

| 76 | Dez. The secret of nature. 45 g | 8 | 49,89 | 399,12 |

| 77 | OLAY DC clean they say | 1 | 101,75 | 101,75 |

| 78 | OLAY DC peeling | 1 | 116,28 | 116,28 |

| 79 | OLAY night cream | 2 | 178,05 | 356,1 |

| 80 | OLAY for leather around ch. | 1 | 170,77 | 170,77 |

| 81 | OLAY set | 2 | 207,11 | 414,22 |

| 82 | Ariel 150 g. | 20 | 12,10 | 242 |

| 83 | Ariel 450 automatic | 11 | 36,02 | 396,22 |

| 84 | Ariel 1.5 kg. machine | 13 | 102,02 | 1326,26 |

| 85 | Tide 1.5 kg. machine | 6 | 79,66 | 477,96 |

| 86 | Myth 900 | 15 | 34,55 | 518,25 |

| 87 | Tix 370 g. | 28 | 9,74 | 272,72 |

| 88 | AC 500 ml. | 6 | 35,26 | 211,56 |

| 89 | Mr. Proper 400 g. | 9 | 18,97 | 113,82 |

| 90 | Mr. Proper 750 g. | 4 | 41,32 | 165,28 |

| 91 | Comet flash gel 500 | 9 | 31,15 | 280,35 |

| 92 | Comet flash por. 400 g. | 19 | 18,65 | 354,35 |

| 93 | Pameprs Maxi | 14 | 484,13 | 6777,82 |

| 94 | Pampers Newborn | 10 | 161,57 | 1615,7 |

| 95 | Pampers Junior+ | 6 | 484,12 | 2904,72 |

| 96 | Naturella ult. maxi | 24 | 22,09 | 530,16 |

| 97 | Allways classic 10*16 | 34 | 23,08 | 784,72 |

| 98 | Olweiz ultra 40 pcs. | 5 | 93,77 | 468,85 |

| 99 | Allways ult. Light, night | 23 | 31,25 | 718,75 |

| 100 | Head 200 ml. | 7 | 69,53 | 486,71 |

| 101 | Head 400ml. | 2 | 113,45 | 226,9 |

| 102 | Head 5 ml. | 60 | 3,46 | 207,6 |

| 103 | Pantin 5 ml. | 60 | 3,29 | 197,4 |

| 104 | Pantin set 2*200 | 4 | 91,90 | 367,6 |

| 105 | Clairol 200 ml. | 18 | 56,60 | 1018,8 |

| 106 | Kamei soap 100 g. | 22 | 12 | 264 |

| 107 | Dez. Old Spice | 14 | 50,46 | 706,44 |

| 108 | Air. The style is classy. 245 | 40 | 24,30 | 972 |

| 109 | Air. Lac Nov. Shine | 12 | 27 | 324 |

| 110 | Dez. Owk sport | 6 | 18 | 108 |

| 111 | Gall Cosmetic bag 5 pcs. | 6 | 33,30 | 199,8 |

| 112 | Household soap 70% | 48 | 4,60 | 220,8 |

| 113 | Household soap 65% | 48 | 4,01 | 192,48 |

| 114 | Cream p/b Tube 82 g. | 64 | 16,74 | 1071,36 |

| 115 | Foam Courage 1 l. | 12 | 97,76 | 1173,12 |

| 116 | Pol E 0.5 l. | 12 | 17,42 | 209,04 |

| 117 | Paul E 1 l. | 16 | 31,05 | 496,8 |

| 118 | Paul Cinderella 750 ml. | 24 | 12,42 | 298,08 |

| 119 | Bingola 450 g. | 12 | 31,28 | 375,36 |

| 120 | Bingon 500 g. | 36 | 35,10 | 1263,6 |

| 121 | Eona-super 300 g. | 32 | 27,59 | 882,88 |

| 122 | Glitter color 1 l. | 3 | 33,12 | 99,36 |

| 123 | Natalie the hedgehog | 96 | 10,90 | 1046,4 |

| 124 | T/b Clean used bushings | 240 | 2,79 | 669,6 |

| 125 | T/b Bel lotus/sleeves | 288 | 3,24 | 933,12 |

| 126 | Salf. ow. Aquael/det. | 12 | 26,24 | 314,88 |

| 127 | Natalie from the wings. drive | 48 | 13,37 | 641,76 |

| 128 | Natalie effect drive | 63 | 16,79 | 1057,77 |

| 129 | Natalie is an anatomist. 20 pcs. | 60 | 15,71 | 942,6 |

| 130 | Natalie comfort drive | 63 | 19,08 | 1202,04 |

| 131 | Natalie deo | 30 | 8,60 | 258 |

| 132 | Natalie antom 10 pcs. | 30 | 8,28 | 248,4 |

| 133 | Natalie hedgehog bikini | 64 | 13,28 | 849,92 |

| 134 | Natalie maxi | 30 | 9,32 | 279,6 |

| 135 | 5+ gel for toilet. 750 ml. | 30 | 27 | 810 |

| 136 | Sanox-gel 750 ml. | 15 | 20,21 | 303,15 |

| 137 | Tsomonomoy 1 l. | 6 | 26,42 | 158,52 |

| 138 | Cinderella d/carpet. 300 ml | 10 | 8,73 | 87,3 |

| 139 | Cinderella d/carpet. 250 ml | 10 | 11,07 | 110,7 |

| 140 | Carpet 250 ml. | 15 | 33,08 | 496,2 |

| 141 | Sanita-antirzha 500 ml | 10 | 16,74 | 167,4 |

| 142 | Sanita-gel 500 ml. | 20 | 20,97 | 419,4 |

| 143 | 5+ gel for kitchen 500 ml. | 20 | 24,53 | 490,6 |

| 144 | Spare wheel for unit. | 72 | 4,37 | 314,64 |

| 145 | Tab/unit Fresh 2 | 28 | 23,22 | 650,16 |

| 146 | Soda calcium. 700 g | 60 | 7,43 | 445,8 |

| 147 | Sanit 1 l. | 30 | 18,72 | 561,6 |

| 148 | Mole 0.4 | 54 | 8,60 | 464,4 |

| 149 | Pemosuper por. 400 g. | 20 | 11,57 | 231,4 |

| 150 | Ideal 540 ml. | 20 | 9,18 | 183,6 |

| 151 | Cinderella d/pos. 500 ml. | 36 | 9,86 | 354,96 |

| 152 | Shampoo April 1 l. | 24 | 14,67 | 352,08 |

| 153 | Champ. Fruit flower 1 l. | 30 | 15,17 | 455,1 |

| 154 | Tooth. n. Dental 125 ml. | 20 | 16,38 | 327,6 |

| 155 | Soap Fax 1sh * 75 | 40 | 4,73 | 189,2 |

| 156 | Soap 7 sky 70 | 40 | 3,96 | 158,4 |

| 157 | Cream d/b Tube 75 g. | 20 | 12,69 | 253,8 |

| 158 | Pure lin. gel for hair | 24 | 22,19 | 532,56 |

| 159 | Jew. d/sl.varnish Laska | 35 | 7,79 | 272,65 |

| 160 | Zifa 450 g. | 20 | 11,97 | 239,4 |

| 161 | Natalie ultra cr. | 42 | 17,24 | 724,08 |

| 162 | Sanfor-plus 750 ml. | 25 | 18,99 | 474,75 |

| 163 | Gloss d/pos. | 15 | 11,12 | 166,8 |

| 164 | Milk d/person Special | 6 | 20,03 | 120,18 |

| 165 | Tix 2.4 kg. machine | 3 | 77,80 | 233,4 |

| 166 | Naturella is ok. 20 pcs. | 24 | 36,68 | 880,32 |

| 167 | Naturella hedgehog. 40 pcs. | 5 | 40,32 | 201,6 |

| 168 | Tampax 16 | 10 | 59,28 | 592,8 |

| 169 | Oldeyes 60*15 | 2 | 55,48 | 110,96 |

| 170 | OLAY day cream | 2 | 127,17 | 254,34 |

| 171 | Camey shower gel 250 | 10 | 57,17 | 571,7 |

| 172 | Safeguard soap | 26 | 12,53 | 325,78 |

| 173 | Des.-roll. Secret 50 g. | 12 | 37,61 | 451,32 |

| TOTAL | 120424,73 | |||

From the resulting tables we see that in November 2008, 147 items of goods were ordered for a total amount of 124,590.14 somons, and in November 2009, 173 items of goods were ordered for a total amount of 120,424.73 somons. This suggests that the store ordered more items of goods in November 2009, but at a low cost. Suppliers also reduced the purchase price for some items of goods.

Next, we will compile tables on sales of the same product for November 2008-2009. (Table 2.7, 2.8). The trade markup on the purchase price in 2008 was equal to 35% for Badri Munir goods, and 25% for Komron-freight goods. In 2009, the trade markup was reduced and amounted to 30% for Badri Munir goods, and 20% for Comron Freight goods.

Table 2.7 Sales of goods for November 2008

| No. | Name of product | Quantity, pcs. | Average price, somon./pcs. | Amount, somon. |

| 1 | Tide 450 g. | 143 | 28,7 | 4104 |

| 2 | Tide 900 g. | 50 | 55,8 | 2790 |

| 3 | Tide 2400 g. | 7 | 151 | 1057 |

| 4 | Myth 400 g. | 145 | 19,8 | 2871 |

| 5 | Myth 400 g. automatic | 19 | 43,8 | 832,2 |

| 6 | Myth 900 | 95 | 21,7 | 2061,5 |

| 7 | Tix 400 g. | 96 | 14,6 | 1401,6 |

| 8 | Tix 1300 g. | 20 | 42,1 | 842 |

| 9 | Lenore 500 ml. | 55 | 24,2 | 1331 |

| 10 | Lenore 1 l. | 49 | 42,2 | 2067,8 |

| 11 | Fairy 500 ml. | 68 | 38,8 | 2638,4 |

| 12 | Mr. Proper 400 g. | 11 | 22,9 | 251,9 |

| 13 | Pampers Midi | 13 | 459,7 | 5976,1 |

| 14 | Pampers Junior | 10 | 614,6 | 6146 |

| 15 | Pampers Slip & Play | 23 | 339,4 | 7806,2 |

| 16 | Shamtu 200 ml. | 38 | 41,3 | 1569,4 |

| 17 | Shamtu 380 ml. | 37 | 55 | 2035 |

| 18 | Clairol 200 ml. | 16 | 67,5 | 1080 |

| 19 | Bl.-a-Med 50 ml. | 125 | 20 | 2500 |

| 20 | Dez. Secret '45 | 21 | 62,5 | 1312,5 |

| 21 | Pampers Maxi | 15 | 615 | 9225 |

| 22 | Ariel 450 g. | 27 | 38,8 | 1047,6 |

| 23 | Ariel 2400 | 4 | 43,8 | 175,2 |

| 24 | Tide 150 g. | 56 | 13,8 | 772,8 |

| 25 | AC 200 ml. | 20 | 18,8 | 376 |

| 26 | AC 1l. | 20 | 33,8 | 676 |

| 27 | Comet flash 600 ml. | 5 | 38,8 | 194 |

| 28 | Pantin 200ml. | 9 | 82,5 | 742,5 |

| 29 | Safeguard 100 g. | 27 | 16,3 | 440,1 |

| 30 | Ariel 150 g. | 12 | 15,4 | 184,8 |

| 31 | Comet flash 450 g. | 51 | 23,8 | 1213,8 |

| 32 | Naturella 10 pcs. | 60 | 25 | 1500 |

| 33 | Naturella 20 pcs. | 24 | 45 | 1080 |

| 34 | Allways Ultra | 72 | 90 | 6480 |

| 35 | Head 200 ml. | 36 | 85 | 3060 |

| 36 | Bl.-a-Med 100 g. | 81 | 45 | 3645 |

| 37 | Soap 90 g. | 82 | 5,13 | 420,7 |

| 38 | Household soap 250 g. | 96 | 5,4 | 518,4 |

| 39 | Otb. Bos 250 g. | 85 | 16 | 1360 |

| 40 | Otb. Whiteness 1 l. | 212 | 8,1 | 1717,2 |

| 41 | Biolan 400 g. | 48 | 15,4 | 739,4 |

| 42 | Biolan-active 400g. | 96 | 12,8 | 1228,8 |

| 43 | Biolan 900 g. | 20 | 27,5 | 550 |

| 44 | Scamvon 250 g. | 10 | 44,6 | 446 |

| 45 | Sorti 900 g. | 40 | 28,3 | 1132 |

| 46 | Laska 180 ml. | 36 | 22,1 | 795,6 |

| 47 | Sorti Color 400 g. | 21 | 20,2 | 424,2 |

| 48 | Ek/kor sorts | 7 | 12,7 | 88,9 |

| 49 | Zifa 550 g. | 160 | 17,7 | 2832 |

| 50 | Natalie Maxey | 130 | 12,7 | 1651 |

| 51 | Natalie Po 10 | 80 | 11,3 | 904 |

| 52 | Natalie S 10 | 120 | 15,3 | 1836 |

| 53 | Natalie Ezh deo | 96 | 14 | 1344 |

| 54 | T/b Kyiv | 576 | 5,4 | 3110,4 |

| 55 | T/b Sissy | 280 | 4,7 | 1316 |

| 56 | T/b Voronezh | 700 | 3,03 | 2121 |

| 57 | T/b Clean | 420 | 3,4 | 1428 |

| 58 | T/b Family | 168 | 5,5 | 924 |

| 59 | T/b Soft sign | 216 | 5,9 | 1274,4 |

| 60 | Salt Forest | 12 | 25,3 | 303,6 |

| 61 | Salf. ow. Aquael 20 | 104 | 14 | 1456 |

| 62 | 5+ w/c 750 ml. | 18 | 31,6 | 568,8 |

| 63 | 5+ w/c 500 ml. | 43 | 20,8 | 894,4 |

| 64 | Effect d/v ml. | 20 | 23,3 | 446 |

| 65 | Penoxol 350 g. | 80 | 8,7 | 696 |

| 66 | Purely 500 g. | 10 | 8,5 | 85 |

| 67 | Chistin 400 g. | 30 | 10,3 | 309 |

| 68 | Selena 600 ml. | 36 | 17,1 | 615,6 |

| 69 | Mole 1.2 | 10 | 24,1 | 241 |

| 70 | Soda calcium. 700 g | 60 | 9,7 | 582 |

| 71 | Pemos-super 500 | 100 | 14,3 | 1430 |

| 72 | Monika 500 ml. | 12 | 23,4 | 280,8 |

| 73 | Sanox 750 ml. | 60 | 23,2 | 1392 |

| 74 | Sanox-gel 750 ml. | 60 | 25,2 | 1512 |

| 75 | Sanfor-gel 750 ml. | 45 | 28,5 | 1282,5 |

| 76 | Sanitary duckling | 36 | 14 | 604 |

| 77 | B-m Exclusive | 24 | 47,51 | 1140,24 |

| 78 | Otb. Lily | 100 | 6,3 | 630 |

| 79 | Wed. Floor E 1l. | 16 | 42,7 | 683,2 |

| 80 | Zifa 450 g. | 72 | 15,3 | 1101,6 |

| 81 | Daxy 800 g. | 10 | 17,4 | 174 |

| 82 | Lily of the valley 500 g. | 12 | 19,4 | 232,8 |

| 83 | Sorti Color 2400 g. | 4 | 109,1 | 436,4 |

| 84 | E 400 g. | 44 | 24,3 | 1069,2 |

| 85 | Natalie the hedgehog software | 148 | 14 | 2072 |

| 86 | Natalie Comfort | 126 | 25,6 | 3225,6 |

| 87 | Cinderella 500 ml. | 16 | 13,8 | 220,8 |

| 88 | Sanfor-plus 500 ml. | 36 | 19,4 | 698,4 |

| 89 | Sanita-gel 500 ml. | 20 | 24,4 | 488 |

| 90 | Sanit-antirzha 500 ml. | 20 | 20 | 400 |

| 91 | Effect d/sant. | 10 | 20,8 | 208 |

| 92 | Santex-chlorine 750 ml. | 12 | 26 | 312 |

| 93 | 5+ Gel 500 ml. | 7 | 20,9 | 146,3 |

| 94 | Shower gel Rozhkov | 26 | 20,7 | 538,2 |

| 95 | Gel for shower Forest Fairy Tale | 8 | 17 | 136 |

| 96 | Soap Your Sunshine | 36 | 5,7 | 205,2 |

| 97 | Floral gel for face | 4 | 26,2 | 104,8 |

| 98 | Foam Courage 1 l. | 24 | 32 | 768 |

| 99 | Calgon 500 g. | 20 | 87,5 | 1750 |

| 100 | Bingon 500 g. | 24 | 43,4 | 1041,6 |

| 101 | Crumb paste 500 g. | 24 | 25 | 600 |

| 102 | Lily of the valley paste 500 g. | 24 | 19,4 | 465,6 |

| 103 | 5+ w/ jeans. | 2 | 66,8 | 133,6 |

| 104 | 5+ w/children | 2 | 68 | 136 |

| 105 | 5+ w/ delicate. | 3 | 38,5 | 115,5 |

| 106 | Stork Cashmere | 10 | 30 | 300 |

| 107 | Weasel for black 1 l. | 3 | 103,7 | 311,1 |

| 108 | T/b Lilac | 164 | 3,5 | 574 |

| 109 | Blue Forget-Me-Not | 60 | 6 | 360 |

| 110 | Ins. Dohlox | 30 | 28 | 840 |

| 111 | Selena for kitchen | 4 | 32,7 | 130,8 |

| 112 | Mole 0.78 | 20 | 17,8 | 356 |

| 113 | Mole 0.4 | 72 | 10,7 | 770,4 |

| 114 | Selena for slabs | 12 | 17,6 | 211,2 |

| 115 | Selena d/ steel | 12 | 14,9 | 178,8 |

| 116 | Cinderella is polishing. | 36 | 12 | 432 |

| 117 | Solita 340 ml. | 198 | 9,3 | 1841,4 |

| 118 | Solita 680 ml. | 100 | 14,5 | 1450 |

| 119 | Sanfor-gel 500 ml. | 28 | 24,7 | 691,6 |

| 120 | Foam for bathtubs Special | 18 | 24 | 432 |

| 121 | Special face cream | 48 | 14,8 | 710,4 |

| 122 | Shampoo Rus. herbs | 12 | 116,3 | 1395,6 |

| 123 | Floral gel/intim | 6 | 28,1 | 168,6 |

| 124 | Shampoo Borros | 20 | 14,5 | 290 |

| 125 | Tide 450 automatic | 45 | 34,6 | 1557 |

| 126 | Tix 2400 automatic | 4 | 95,4 | 381,6 |

| 127 | Oldaze disc. 20*18 | 35 | 28,1 | 983,5 |

| 128 | Tampax compak 8 | 6 | 48,7 | 292,2 |

| 129 | Head 400 ml. | 9 | 145,5 | 1309,5 |

| 130 | Pantin 400 ml. | 10 | 131 | 1310 |

| 131 | Soap Kamei | 28 | 14,5 | 406 |

| 132 | Dez. Old Spice | 15 | 61,4 | 921 |

| 133 | Des.-roll. Old Spice | 8 | 51 | 408 |

| 134 | Des.-roll. Secret | 9 | 46,2 | 415,8 |

| 135 | Myth 2400 automatic | 1 | 119,5 | 119,5 |

| 136 | Tix 1500 automatic | 2 | 61,5 | 123 |

| 137 | Mr. Proper 500 ml. | 6 | 36,5 | 219 |

| 138 | Persol reb. 200 g. | 80 | 8 | 640 |

| 139 | Biolan color 450 g. | 24 | 19,3 | 463,2 |

| 140 | E 2in1 3 kg. | 3 | 159,7 | 479,1 |

| 141 | T/b Euro 2 pcs. | 28 | 12,3 | 344,4 |

| 142 | T/b Euro 4 pcs. | 14 | 20,8 | 291,2 |

| 143 | Shampoo Rozhkov | 16 | 20,6 | 329,6 |

| 144 | Tix 400 g automatic | 18 | 17,6 | 316,8 |

| 145 | Lenore 2 l. | 12 | 74,2 | 890,4 |

| 146 | Ariel 450 automatic | 5 | 43,2 | 216 |

| 147 | Des.-aer. Secret | 11 | 55,4 | 609,4 |

| TOTAL | 164796 | |||

Table 2.8 Sales of goods for November 2009

| No. | Name of product | Quantity, pcs. | Average price, somon./pcs. | Amount, somon. |

| 1 | Otb. Whiteness 1 l. | 240 | 8,07 | 1936,8 |

| 2 | Eona liquid 500 ml. | 24 | 42,3 | 1015,2 |

| 3 | Soap 200 g. | 50 | 9,66 | 483 |

| 4 | Scented soap | 90 | 10,3 | 927 |

| 5 | Fragrant soap Ass 90 | 120 | 4,86 | 583,20 |

| 6 | Soap 190 g. used | 108 | 9,19 | 992,52 |

| 7 | Soap Fin. 90 | 96 | 4,91 | 471,36 |

| 8 | Otb. Persol 2-u 200 g. | 80 | 9,07 | 725,6 |

| 9 | Otb. Persol lime 200 g. | 80 | 9,19 | 735,2 |

| 10 | Otb. Persol econ 200g | 160 | 8,07 | 1291,2 |

| 11 | Nab. Small Fairy 5 Ave. | 12 | 233,53 | 2802,36 |

| 12 | Paul Snowdrop | 10 | 9,59 | 95,9 |

| 13 | Lily of the valley paste 400 g. | 24 | 17,08 | 409,92 |

| 14 | Lily of the valley paste 500 g. | 36 | 20,19 | 726,84 |

| 15 | Gloss d/ black 1 l. | 18 | 42 | 756 |

| 16 | Scamvon 250 g. | 40 | 40,55 | 1622 |

| 17 | Calgon 500 g. | 40 | 84,24 | 3369,6 |

| 18 | Stork cashmere 750 g. | 35 | 31,82 | 1113,7 |

| 19 | E Color/aut. 1.5 kg. | 7 | 86,18 | 603,26 |

| 20 | E Color/aut. 2in1 2.4 kg. | 7 | 130,57 | 913,99 |

| 21 | Zifa 550 g. | 80 | 18,2 | 1456 |

| 22 | Sticks I am the most 300 st. | 12 | 28,08 | 336,96 |

| 23 | Sticks I am the most 100 st. |

Any organization sooner or later faces the problem of increasing production efficiency. And we are not always talking about the economic component.

What methods to prefer when organizing such work is decided by the management of the enterprise. Based on knowledge of the internal and external environment, the characteristics of production processes, it is possible to develop a plan that will lead to the achievement of the intended goal.

What is meant by operational efficiency?

Enterprise efficiency is an economic category. This concept refers to the company’s performance, which can be expressed in:

- growth in production rates;

- reducing costs and tax burden;

- reducing the amount of emissions into the environment;

- increasing labor productivity, etc.

There are also scientific works that define organizational effectiveness as the effectiveness of an operation or project in which the resulting product or new action brings in more money than was spent. Or these manipulations save a certain amount of resources, which also exceeds the costs of work associated with their implementation.

Effectiveness conditions

In most cases, in an effort to improve the efficiency of an organization, management expects to obtain a certain financial result. But this does not always reflect the strategic future of production. Therefore, it is believed that it is more correct to achieve growth rates. We can say that we have achieved economic efficiency in production if:

- the financial result obtained is higher than that of competitors;

- the organization allocates sufficient resources to carry out production or management changes;

- the growth rate of financial indicators will be higher in the near future than that of competitors.

This approach constantly motivates the search for solutions that increase the competitiveness of production. This is important in order to carry out work aimed at strategic development.

It is also important that each structural unit of the organization is concerned with finding ways to increase its economic efficiency. After all, if one of them works poorly, the organization will not be able to improve its performance as a whole.

Tools for increasing efficiency

The ways to improve the efficiency of an enterprise are very diverse. The main ways to increase the profit of an organization are as follows:

- cost reduction, which can be achieved by reducing price conditions for purchases, optimizing production, reducing personnel or wage levels;

- modernization of processes or entire production, which makes it possible to achieve increased labor productivity, reduce the volume of processed raw materials, waste, and automate most operations;

- changes in the organizational system that may affect the management structure, principles of customer service, communications, etc.;

- strengthening marketing communications when the goal is to maximize sales volumes of goods, change attitudes towards the organization, and find new opportunities for production.

Each of these areas can be detailed and has its own methods of work. The entire management system in the company must be configured so that at any level employees take initiatives that lead to increased economic efficiency.

Often, a set of measures that should improve work efficiency affects all blocks of activity at once. This systematic approach allows for a synergistic effect.

Factors influencing efficiency

If enterprise management is interested in achieving improved results, it must analyze information about the state of the external and internal environment. Then it will be clear which of the existing factors need to be used for the benefit of future strategic development. These include:

- Minimal use of resources. The less technology, equipment, and personnel are used while maintaining production volumes, the more efficient the organization.

- Increasing personnel efficiency by optimizing the structure, improving qualifications and training, finding more competent personnel, and changing the motivational system.

- Increasing the efficiency of personnel by improving their health and improving working conditions. Measures aimed at solving these problems lead to a reduction in the number of sick days (saving money for the employer), increasing productivity and employee loyalty.

- Strengthening socio-psychological factors. The use of decentralization tools in management can be a good impetus for development.

- Application of the results of scientific and technological progress. Ignoring modern technologies or making excuses from their implementation due to the need for investment leads to a decrease in competitiveness and possible liquidation later. Fearing an unfavorable economic situation in the current period, companies often close the way for future development.

- Using diversification, cooperation and other strategies to apply existing resources to different projects.

- Attracting investment capital and other third-party financing mechanisms. Even privatization can open up ways to improve the efficiency of an enterprise.

All these factors lead not only to an increase in economic but also managerial efficiency. To monitor the effectiveness of the work being carried out, control periods and indicators that will be checked should be outlined.

Let us separately focus on the factor of employee health, for the reason that few employers yet pay due attention to this. Meanwhile, caring for the team directly affects the company’s profits. For example, according to a study conducted as part of the HR Lab. – HR Innovation Laboratory”, a smoking employee spends 330 working (!) hours a year on smoke breaks. If his salary is 50,000 rubles per month, then it turns out that over the course of a year the company loses up to 100,000 rubles in labor costs, plus about 40,000 rubles in taxes and social contributions; plus the cost of sick leave, which smokers, according to statistics, take more often. And if the employee’s salary is higher, then the expenses are even higher. What if there are dozens or hundreds of such employees in the company?

In order to eliminate this unnecessary expense item and increase the efficiency of smoking employees, we can advise companies. (Follow the link to find a calculator that will help you calculate how much your company will save if employees quit smoking.)

Where should you start?

To understand what work needs to be done to improve production efficiency, a thorough analysis should be carried out. The head of the company must have a justification for future management decisions, therefore the following is required:

- collect statistics for previous years on product output, sales, number of employees, wage fund, profitability, etc.;

- find out industry averages or competitors’ indicators;

- compare the economic performance of the enterprise and other market participants;

- depending on which indicator lags more, analyze the factors that led to this result;

- identify those responsible for developing activities that should change the situation, and the deadlines for achieving new indicators.

It is possible that management will have to make many decisions regarding themselves. For example, transform the functions and style of management, distribution of responsibilities, the amount of delegated authority, methods of working with personnel and transferring information within the company.

What might be preventing you from improving your efficiency?

Even if management sees sense in changes that should lead to increased company efficiency, the results may not be forthcoming. Oddly enough, the problems lie in the psychological perception of management changes, as well as in their legal support.

For example, the introduction of new technologies and installation of equipment almost always leads to a reduction in personnel. Naturally, the company's employees will not want to be left without work. Their task is to delay such changes as much as possible. They may also resort to economic arguments, saying that reinstalling equipment will require stopping work for some time.

From a legal point of view, the process of dismissing employees is strictly regulated. If procedures are violated, the enterprise is doomed to incur additional costs, which reduces economic performance.

In order to overcome all these resistances, you need to think through a system for notifying employees about changes, demonstrating the positive aspects of implementing changes.

Additional difficulties may arise from:

- with a lack of funding or inability to access investment sources;

- with a lack of competencies among the company’s employees, which does not allow the implementation of planned plans;

- with the lack of a strategic planning system in the organization and analytics for previous years of work.

To achieve economic efficiency, systematic and large-scale work will be required. We cannot exclude the need to involve third-party specialists who can save time on implementing changes.

In general, with a competent approach and the use of reasonable measures, it is possible to increase the efficiency of each enterprise, regardless of the situation and stage of its development it is in.