Refund of erroneously and excessively transferred funds. Letter about the return of money, including those transferred incorrectly Application for the return of incorrectly transferred funds

5/5 (3)

How to draw up a document correctly

You can return money transferred by mistake. To do this, you must follow certain steps. First of all, it is necessary to explain in writing the situation that arose, which resulted in an erroneous transfer of funds.

The letter ends with the details to which you need to transfer money. There are no requirements for writing such a letter. It has a standard form and is drawn up in the usual style. To return funds to firms, organizations or companies, you will need to fill out a special form. A sample form is issued by the organization itself.

An appeal for the return of excessively transferred funds consists of certain points. If any of them are not covered, this may prevent the money from being transferred back.

The main points of the letter for a refund:

- recipient's name: last name, first name, patronymic of the manager, company name (information is written in the upper right corner);

- an address to the addressee, which begins, for example, as follows: “Dear Ivan Ivanovich”;

- the main part of the letter displays the situation that led to the erroneous transfer of funds. The fact is confirmed by the necessary documents: receipts, checks, personal account information, paper proving the procedure for transferring money. The reasons why this overlap occurred are also clarified;

- at the end of the document the date of writing the letter and the signature (with transcript) are indicated;

- in most cases, the person accepting the document indicates his data and the date of receipt of the paper. The head of the organization can endorse the document in order to put an end to the matter and avoid further paperwork.

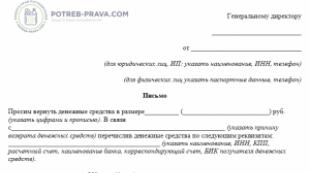

ATTENTION! Look at the completed sample letter for the return of excessively transferred funds:

Attention! Our qualified lawyers will assist you free of charge and around the clock on any issues.

The nuances of writing a letter

Drawing up a letter for a refund has its own characteristics:

- Without a letter expressing a request for a refund, this operation is impossible. It is important for the recipient of the money to confirm that there is a reason for the return;

- the application is made in writing and certified by the payer or his authorized representative. The payer's representative has the right to perform such actions only with a power of attorney;

- a letter for a refund must be confirmed by documents: a copy of the payment order, a check or receipt;

- the request is sent according to the details of the banking organization, as well as the person to whom the money was transferred;

- the fact of receipt of the claim must be confirmed by official confirmation;

- when an erroneous transfer of funds occurred within the framework of an agreement previously concluded by the parties, the refund is also carried out within the framework of this agreement. In some cases, additional actions related to reconciliations and offsets will be required. Such operations are characterized by the preparation and certification of relevant acts;

- when it turns out that the bank or company that transferred the money is not to blame for the current situation, but the money is already in the account, they have the right to refuse the applicant the return procedure.

Such a controversial situation can only be resolved in court.

Watch the video. What to do if money is mistakenly credited to your current account:

Refund deadlines

It is impossible to say exactly when the money should be returned to the applicant. It all depends on the persons involved in the case and the recipient. Moreover, such deadlines are not approved at the legislative level.

When money is transferred to a bank account or card, but the sender realizes in time that he made a mistake, the funds can be returned within 5 business days (although it all depends on the financial institution).

If money is transferred to an individual or legal entity, you must be guided by the law, which states that the optimal period is 7 days from the date of receipt of the letter. If the deadline for repaying the money is delayed, a penalty may be charged for each day of delay.

The procedure for returning excessively transferred funds is simple. The most important thing is to notice the error in time.

Although, it is better to avoid such mistakes and carefully enter the details and contact information of the persons to whom the funds are transferred.

Online magazine for accountants

Attention

3 Compose and send a letter directly to the bank with a request to return the erroneously transferred money, if everything in your payment document is correct, and the amount was transferred to another counterparty as a result of an error by a bank employee.

Refund of erroneously transferred funds with VAT

Upon receipt of your letter, the bank will notify the recipient of the amount mistakenly transferred to his account.

<

< Главная → Бухгалтерские консультации → Платежное поручение Обновление: 11 апреля 2017 г.

The period of such use will begin to count from the moment the recipient learned of the erroneous nature of the payment. If the exact moment cannot be determined, judges will take into account the time when the counterparty should have become aware of such a transaction. A more difficult case occurs when they don’t want to return the money at all. The process of withdrawing funds can then become very protracted. The truth, however, is still on the side of the victim, and the recipient can get into serious trouble in the form of justified claims also for lost profits. If fraud is proven, this is a matter for law enforcement agencies. What conclusions can be drawn from the mistakes made? The return of erroneously transferred funds, as can be seen from the above material, is associated with many problems and measures to solve them.

This amount is indicated in one of the new sections, which is dedicated to “transfer of funds across accounts.” This also applies to the return of erroneous funds, if this process is related to the actions mentioned above. If the recipient of the funds delays returning them, the original owner may demand payment of interest for the use of someone else's resources. Time is counted from the moment the recipient learned that the transfer was erroneous. The same rules apply to situations where transfers are non-cash. The video explains what to do if a payment has gone to the wrong address: Did you notice a mistake? Select it and press Ctrl+Enter to let us know.

NewsPermalink

Banking error, human factor - these are the main reasons for situations when payments are credited to completely different counterparties or there is an overpayment under contracts. In such situations, it becomes necessary to return the erroneously transferred funds.

Are there legal grounds to demand the return of erroneously transferred funds?

According to Article 1102 of the Civil Code of the Russian Federation, you have every right to demand your money back, since you do not have any contractual or other obligations to the payee. Moreover, Article 1107 of the Civil Code of the Russian Federation states that the recipient of an erroneous transfer is also obliged to compensate interest on the use of your funds. Therefore, you have every reason to return the transferred funds as soon as possible.

How to return an erroneous payment?

There are two ways to get your money back:

- Voluntary. You send a standard application to the recipient with a request to return the erroneously transferred amounts within the agreed period and to the specified details. In this case, you depend on the honesty and integrity of another person.

- Judicial.

Purpose of payment “return of erroneously transferred funds”

This method provides for the return of erroneously transferred funds through a court order.

In a situation where the person who received your money refuses to return the money to your account independently and honestly, there is only one way out - file a claim in court. In such a scenario, especially if large sums are involved, it is worth engaging qualified lawyers who will help you draw up a competent statement of claim and will act on your behalf in court. Choosing a lawyer carefully will guarantee a positive outcome for your case.

How can I return the overpaid funds?

Similar situations may arise if a debt audit has not been previously carried out, and there are also controversial issues in mutual settlements - recalculations according to coefficients, unaccounted returns, discrepancies in the acceptance of services and goods.

What to do and how to properly return the overpayment? For this it is recommended:

- Check mutual settlements.

- A signed mutual settlements audit report is the basis for writing an application to the counterparty to transfer the balance of funds to your account.

The application form is standard, does not have a strictly regulated form, but still contains should be specified:

- your name or full name;

- payment document number;

- the agreement or invoice under which the transfer was made;

- amount to be returned;

- the basis for the return is a reconciliation act approved by both parties.

The return of excessively transferred funds is carried out on the basis of your application in the shortest possible time, since these amounts also fall under Article 1107 of the Civil Code of the Russian Federation. If the counterparty refuses to return the specified amount, you have every reason to go to court.

In order for the return of excessively transferred funds through the court to be successful, it is recommended attract competent lawyers to your side It may be worth contacting a law firm. Lawyers will represent you in court for their fee and will also prepare all the necessary documents.

It is important to return the overpayment if you no longer plan to operate with this counterparty. If you continue to have supplies in the future, then perhaps it’s worth keeping these funds for future operations?

The deadlines for returning the unjustified receipt of someone else's property, in this case erroneously transferred funds, are not directly established by Chapter 60 of the Civil Code. Thus, Article 314 of the Code contains rules according to which funds received without reason must be returned within a reasonable time, unless the obligation establishes a specific deadline for fulfillment and there are no conditions that may allow determining the period for return.

- Full name and contact details of the sender, the same information about the addressee.

Phone number and postal address are required. - Date and place where the letter was written.

- Factual circumstances. For example, you need to write about when and how the funds were transferred.

Or through which credit institution. - The request itself for the return of money. The following are the details for the transfer.

- The sender always puts his personal signature.

- Documents that became attachments and evidence.

Refund of funds transferred by mistake to another Very often a situation arises when errors occur when transferring money from one card to another.

How to return money transferred by mistake?

Bank, depending on the terms of the bank account agreement:

- if it is possible to write off erroneously credited amounts from the company’s bank account without acceptance, writes off the erroneously credited funds without a separate order from the organization;

- If there is no such possibility under the agreement between the bank and the organization, the erroneously transferred funds are written off only upon receipt of the corresponding order.

Purpose of payment in case of erroneous transfer of the amount under the agreement If an erroneous transfer of funds was carried out under the agreement, then the funds are returned due to termination of the agreement. In this case, an agreement to terminate the contract is formed and, in accordance with this agreement, a refund is made.

The purpose of payment indicates the number and date of the agreement to terminate the contract.

Online magazine for accountants

Attention

Compose and send a letter to the counterparty with a request to return the funds if the bank has already transferred money from your current account to the counterparty’s account using this payment document. Please include the details of your organization in the letter. Attach a copy of the payment order.

The counterparty is obliged to return the money within 5 working days. If he refuses to return the illegally received funds, you will have to sue him in court.

3 Compose and send a letter directly to the bank with a request to return the erroneously transferred money, if everything in your payment document is correct, and the amount was transferred to another counterparty as a result of an error by a bank employee. Upon receipt of your letter, the bank will notify the recipient of the amount mistakenly transferred to his account.

After receiving the notification, the counterparty is obliged to transfer this amount to your current account within 3 business days.

Purpose of payment “return of erroneously transferred funds”

In business practice, it sometimes happens that funds go to the wrong address or in larger quantities than intended. In both cases, the company or individual entrepreneur must make efforts to ensure that the erroneously transferred funds are returned.

Important Why is the organization’s money transferred to the wrong address? There may be several reasons for this unpleasant situation:

- Firstly, there may be an error in the details of the counterparty. Such inaccuracies can creep into documents when they are received by fax, which is due to the specifics of this type of communication.

An accountant may also make a mistake when typing a payment order. With electronic document management, such errors are very rare, since the data can be immediately imported into a payment order.

Return of erroneously transferred funds: procedure and features

When paying for “children’s” sick leave, you will have to be more careful. A certificate of incapacity for caring for a sick child under 7 years of age will be issued for the entire period of illness without any time limits. But be careful: the procedure for paying for “children’s” sick leave remains the same!<

So who has the right to work without a cash register until the middle of next year?< Главная → Бухгалтерские консультации → Платежное поручение Обновление: 11 апреля 2017 г.

Refund of erroneously and excessively transferred funds

The period of such use will begin to count from the moment the recipient learned of the erroneous nature of the payment. If the exact moment cannot be determined, judges will take into account the time when the counterparty should have become aware of such a transaction. A more difficult case occurs when they don’t want to return the money at all. The process of withdrawing funds can then become very protracted. The truth, however, is still on the side of the victim, and the recipient can get into serious trouble in the form of justified claims also for lost profits.

Refund of erroneously credited amount

If fraud is proven, this is a matter for law enforcement agencies. What conclusions can be drawn from the mistakes made? The return of erroneously transferred funds, as can be seen from the above material, is associated with many problems and measures to solve them.

Sample letter for return of erroneously transferred funds

The letter must also include bank details for refunding the erroneous payment. Return of erroneously received funds An organization or individual may learn about the erroneous receipt of funds to the account based on information from the bank (message, letter or account statement), as well as having received a message from the payer of funds who made an error when sending funds.

Refund of erroneously transferred amount

Cancellation of an incomplete payment If an erroneous payment was made, but the person realized it in time and, as soon as possible, wrote an application to the bank to cancel the transfer of funds, the bank has the opportunity to cancel the transaction and return the funds to the previous account or send them to the newly specified details. To do this you need to fill out an application:

- The appeal itself is submitted to the general director (or other authorized person) of the bank. And in the header of the application the payer’s details are indicated: full name; - residential address; - passport details; - contact phone number.

- Next, the statement itself is written about the request for a refund or cancellation of the erroneously made payment.

Refund of an erroneously transferred amount payment purpose

This amount is indicated in one of the new sections, which is dedicated to “transfer of funds across accounts.” This also applies to the return of erroneous funds, if this process is related to the actions mentioned above. If the recipient of the funds delays returning them, the original owner may demand payment of interest for the use of someone else's resources. Time is counted from the moment the recipient learned that the transfer was erroneous.

The same rules apply to situations where transfers are non-cash. What to do if a payment has gone to the wrong address is described in the video: Noticed an error? Select it and press Ctrl+Enter to let us know.

Refund of erroneously transferred transaction amount

It is necessary to provide a statement that a person has received a sum of money that was transferred to him by mistake, and that he refuses to return (or ignores) the funds mistakenly transferred to his account or card. After which, the authority’s employees will make a request to the bank to obtain information regarding the owner of the card or account, followed by an investigation and a final court decision.

It’s quite difficult to make a mistake when transferring money to a card or account. The reason lies in the fact that the last digit in the number is randomly generated, but connected according to a special system with the previous numbers.

Following this information, accidentally indicating someone else’s number is quite difficult, but still possible.

NewsPermalink

Within what period of time is the organization required by law to return the erroneously transferred money to the counterparty?

How to correctly return an erroneously transferred payment

Is liability established if the money is not returned immediately?

An organization, upon receiving erroneously transferred funds, is obliged to return these funds, regardless of the reason for their receipt: sums of money or other property were received as a result of his behavior, or because of the mistake of the victim, because of the actions of third parties, or in addition to them will. This procedure is established by Article 1102 of the Civil Code.

The deadlines for returning the unjustified receipt of someone else's property, in this case erroneously transferred funds, are not directly established by Chapter 60 of the Civil Code.

Thus, Article 314 of the Code contains rules according to which funds received without reason must be returned within a reasonable time, unless the obligation establishes a specific deadline for fulfillment and there are no conditions that may allow determining the period for return.

The period during which unjustifiably received funds must be returned begins to be calculated from the moment when the organization that received, in this case, the erroneously transferred funds, learned about the fact of unjust enrichment.

In other words, when it became known that the agreement under which the funds were transferred was terminated, or the money arrived as a result of mistakes, etc. Also, the beginning of a reasonable period is considered the moment when it became known about the receipt of unexplained amounts; in some cases, the beginning of the calculation of a reasonable period is the moment of the beginning of using someone else’s unreasonably received funds.

What is meant in this context by the concept of “reasonable time for fulfilling an obligation”?

The legislation does not directly define the duration of a reasonable period, since this concept is evaluative.

To apply this concept to the norms of Article 314 of the Civil Code, reasonable, in accordance with the decisions of the Nineteenth Arbitration Court of Appeal No. 19AP-5751/11 dated December 2, 2011, the Thirteenth Arbitration Court of Appeal No. AP-7126/2008 of October 6, 2008, the Eighteenth Arbitration Appeal court No. 18AP-3581/12 dated June 4, 2012, a seven-day period is recognized.

Note. From the moment when the organization became aware, or it should have learned about the fact of unreasonably received funds, interest must be accrued on the entire amount received, in accordance with Article 395 of the Civil Code for the use of other people's funds.

In some cases, the courts determine the moment from which interest begins to accrue, the expiration of a seven-day period, or from the moment when the recipient of the funds learned about this fact and this date is set by the victim.

Ask a Question

(module Article Suggestions)

Incorrectly transferred funds will be refunded if the correct procedure in such cases is followed. To begin with, a letter is drawn up explaining the event of the erroneously transferred funds, at the end of which you can write the details for returning the amount. The letter in question does not have a critical form of execution and is written in a free form. As a rule, the return of erroneously transferred amounts by companies and organizations is carried out when the subjects fill out the appropriate form, a sample of which they provide themselves. This page contains a sample made by FreeDocx.ru specialists and can be downloaded for free via a direct link.

The letter for the return of erroneously transferred amounts contains mandatory points, the absence of which may result in the impossibility of receiving funds:

- Addressee's name: full name of the head, name of the organization in the upper right corner;

- In the middle is a polite address by name and patronymic of the manager, starting with the word “Dear”;

- The content of the letter tells about what happened, provides evidence of the event (checks, receipts, personal account data, papers confirming the financial transaction) and indicates the reasons for what happened;

- At the very bottom, the author puts his own signature, transcript and date;

- Here there is a note from the office about the date and full name of the employee who accepted the document, as well as a visa from the management to satisfy the request in order to exclude further correspondence.

The return of erroneously transferred payments is not an ordinary event, and in each specific case, the message regarding funds will be checked to the smallest detail. You need to be prepared for the fact that the organization, and especially the bank, will not transfer the erroneously transferred funds just like that.

How to return overpaid funds?

A letter confirming the return of erroneously transferred funds may not be enough. It is likely that serious reasons and written confirmation will be required.

Legal work to restore the violated rights of citizens is based exclusively on obtaining material evidence. A person’s usual attention, order in paperwork and storage of all material traces of events in life will allow one to avoid unpleasant situations and restore balance much faster than without them. An example sample letter for the return of erroneously transferred payments, offered by the resource, will slightly simplify the task of receiving funds back. Enjoy your use.

Date: 2015-08-25

Sample letter for return of erroneously transferred funds

That is, the longer the money is not returned, the greater the interest the buyer will have to pay. Return of funds transferred by mistake to another person Most often, an error when transferring funds from one person to another occurs when making transfers from one bank card to another. If there is no banking error and the payment was made using the actually specified (albeit in principle erroneous) details, the bank, as a rule, will not take any action to return the funds. All this will have to be dealt with personally by the injured party. The bank can only cancel a funds transfer if the funds have not yet been credited to the new account.

How to return money transferred by mistake?

Attention

An organization, upon receiving erroneously transferred funds, is obliged to return these funds, regardless of the reason for their receipt: sums of money or other property were received as a result of his behavior, or because of the mistake of the victim, because of the actions of third parties, or in addition to them will. This procedure is established by Article 1102 of the Civil Code.

Return of erroneously transferred funds: advice from an accountant

In business practice, it sometimes happens that funds go to the wrong address or in larger quantities than intended. In both cases, the company or individual entrepreneur must make efforts to ensure that the erroneously transferred funds are returned.

- Firstly, there may be an error in the details of the counterparty. Such inaccuracies can creep into documents when they are received by fax, which is due to the specifics of this type of communication.

An accountant may also make a mistake when typing a payment order. With electronic document management, such errors are very rare, since the data can be immediately imported into a payment order. - Secondly, there may be a mistake by the banking institution.

How to return erroneously transferred money?

Everything will be OK, you'll see! Prime 01/04/2010, 00:05 Last year, my assistant sent money to the wrong company. The names are the same, she got them mixed up. We wrote and called to no avail, we don’t know anything, go through the forest.

We contacted lawyers, filed a claim, and filed a lawsuit. On the eve of the meeting, when our lawyer was already in Moscow, because...

The company is Moscow, they showed up themselves, offered a settlement and reimbursed all expenses absolutely voluntarily.

So, really contact a lawyer if the company does not return the money voluntarily. And most likely he will return it, why do they need problems? Svetka 01/05/2010, 22:53 sorry for the flood, I’m following the thread, a sore spot I myself have observed such *oops, and more than once

Respect to my legal theorists!!! how is it ffso correctly seen from the heights of the codes

How to return an erroneous payment to the account of a shell company

Instruction 1 Regardless of the status of the sender, be it a legal entity or an individual, try to begin correcting the mistake as soon as possible, without postponing the matter. Until the traces of the transferred funds turn out to be confusing, and the money itself has not yet been withdrawn from the recipient’s account.

2 First, find the error in your payment details. Since further actions will depend specifically on the identification of the owner of the account to which the funds were transferred.

Now, in order. First of all, check the digits of the current account number, since this is where errors often occur. If the problem is in the account, then you can be sure that the bank will not miss such a payment and will return your money. That is, this is an option when all the details were filled out correctly, except for the current account.

How to return money mistakenly paid to a legal entity?

It is necessary to provide a statement that a person has received a sum of money that was transferred to him by mistake, and that he refuses to return (or ignores) the funds mistakenly transferred to his account or card. After which, the authority’s employees will make a request to the bank to obtain information regarding the owner of the card or account, followed by an investigation and a final court decision.

It’s quite difficult to make a mistake when transferring money to a card or account. The reason lies in the fact that the last digit in the number is randomly generated, but connected according to a special system with the previous numbers. Following this information, accidentally indicating someone else’s number is quite difficult, but still possible.

Online magazine for accountants

Littleone 2009-2012 Family matters Work and education Erroneous payment between legal entities. What actions? PDA View full version: Erroneous payment between legal entities. What actions? BOMBA 12/29/2009, 20:51 Dear forum users, please tell me! If an accountant (runs several companies) accidentally sent our payment to another company, is it possible to request the money back through the bank? And, in general, what should our actions be? Thanks in advance for your answers 🙂 @KET@ 12/29/2009, 21:01 Write a letter Please return the erroneous payment paid..

Purpose of payment when returning funds to the buyer

in the amount.. to the details.. The bank does not have the right to return the payment, it happens that the bank returns the payment by letter or call, but only if the payment is sent to the bank within several hours, provided that it has not yet been processed by the bank. unfailing 12/29/2009, 21:02 yes, the company must return what it received by mistake.

How to return the money transferred by mistake?

Dark Lady 01/10/2010, 14:27 If the invoice contained all the essential conditions (price, list of equipment, payment period and delivery time), write a letter stating that the equipment is in your warehouse and you are ready to transfer it. See what they answer you. Although it is difficult to say anything unambiguously without seeing the documents, there is a chance to fight for the fulfillment of obligations in kind.

kumiko 01/10/2010, 16:57 +1 Dark lady. Murio 01/10/2010, 17:34 sorry for the flood, I’m following the thread, it’s a sore spot I myself have observed such *oops, and more than once my respect to the legal theorists!!! how is it ffso correctly seen from the heights of the codes

The following measures should be recommended:

- Carefully check the details of the counterparty, including using the services of the Federal Tax Service. If a payment order is filled out by an inexperienced accountant, the head of the department should also check the document.

- Try to accept details only by email to avoid inaccuracies in the reflection of data when transmitting documents by fax.

- Immediately enter all partner details into the database, even if the transactions were one-time in nature.

- Transfer money in stages within one transaction only after reconciling the calculations for the previous stage.

The tips are simple, but they will help you avoid these troubles.

No one is safe from sending money to the wrong recipient by mistake. As a rule, the reason for this is incorrect details or a simple sender error. Many people believe that there is no way to get this money back. However, the Civil Code of the Russian Federation defines the receipt of such a transfer as enrichment received without justification. Thus, the law obliges any recipient of such a transfer to return the funds to their rightful owner.

Quite often, a person notices that he has sent money to the wrong place immediately after sending it. If this is done through a bank, you should immediately contact the support service of the financial institution. Typically, bank transfers are processed within three business days. If your money has not yet transferred to the recipient’s account, it will be frozen by the bank until the full investigation.

Quite often, a person notices that he has sent money to the wrong place immediately after sending it. If this is done through a bank, you should immediately contact the support service of the financial institution. Typically, bank transfers are processed within three business days. If your money has not yet transferred to the recipient’s account, it will be frozen by the bank until the full investigation.

If the money has already been deposited into the account of the wrong recipient, the bank will not be able to return it to you, since it cannot withdraw money from customer accounts. Here it is recommended to ask bank representatives who exactly the transfer was made to. And after that try to contact the person who received your money.

(Video: “Money was mistakenly credited to the current account”)

The refund procedure may seem quite complicated and lengthy. However, if you transfer a large amount, you still have to go through it. In most cases, it is not possible to avoid legal proceedings. Practice shows that in such situations the court takes the side of the plaintiff. After considering all the data in this case, the court obliges the person or organization that erroneously received the money to return the funds in full. In addition, the defendant will have to pay all legal costs and interest associated with the transfers.

You must remember that before going to court, you must contact the recipient and invite him to voluntarily return the funds. The court accepts the claim only after you prove that you tried to solve the problem peacefully. First, send a letter to the erroneous recipient with an offer to voluntarily return the money.

The main purpose of the letter is to ask the recipient to return your money. It is sent personally to the recipient if it is a private person. When an erroneous transfer ends up in the account of a company, a letter is sent to the chief accountant or director. After this, the recipient of other people's funds must transfer them back. In this case, it is assumed that bank interest, which is charged for the transfer between accounts, will be deducted from the amount.

The main purpose of the letter is to ask the recipient to return your money. It is sent personally to the recipient if it is a private person. When an erroneous transfer ends up in the account of a company, a letter is sent to the chief accountant or director. After this, the recipient of other people's funds must transfer them back. In this case, it is assumed that bank interest, which is charged for the transfer between accounts, will be deducted from the amount.

A correctly drafted letter about the return of erroneously transferred funds will convince the recipient that it is better to do without legal proceedings. The main criteria that must be indicated in the letter:

- The name of the organization through which the transfer was made;

- Data of the person to whom the demands are made;

- A check or other document confirming the transfer;

- Sender's signature and details.

How to format a letter?

- At the top of the letter the full name of the head of the company or individual is indicated.

- In the main text, it is necessary to describe in detail, but briefly, the situation in which the money ended up in the wrong account.

- So that the recipient knows where to make the return, the sender's bank details are indicated.

The claim letter must also include documents that confirm that the transfer was actually transferred to this account. Receipts or checks are suitable for this. The letter will need to clarify which documents are attached to it.

- Full name of the sender or director of the company. If the company transferred funds, its name should be indicated.

- Politely contact the recipient or company representative who received the erroneous transfer. Offer to voluntarily return the funds. Also warn that if the letter is refused or ignored, you will have to go to court.

- Try to explain briefly, but clearly, how exactly the funds were transferred to the wrong account. Please inform that you are enclosing a check or other payment document with the letter to confirm such a transfer. The amount of the erroneous transfer will also be indicated here.

- Although the recipient must return the money to the account from which the transfer was made, it is still recommended to indicate the details where the funds should be transferred.

- At the end of the letter the date of completion and the signature of the sender are indicated.

Naturally, before you write a letter, you have to find out exactly where the money was transferred. This way you will not only know who to send the letter to, but also get acquainted with other information about the recipient. After all, the integrity of the recipient or the head of the company determines how quickly you will receive the money back.

Reply to letter about refund

You can send your request to the recipient in any way:

- courier service;

- by mail;

- personally in hands.

Essentially, a request letter is a formal document, so the recipient must provide a written response.

Once a claim has been received in writing, the recipient should review recent transactions in their account. In this way, he will be able to verify that the specified amount was actually transferred to him.

After checking their accounts, the recipient must provide a written response as to whether they intend to voluntarily make a reverse transfer. If the recipient does not intend to do this, he is obliged to notify the sender about this. The reason for your refusal is indicated here. Such actions by the recipient indicate that he does not consider this translation to be erroneous, and is ready to prove this in court.

If the recipient is ready to return the money, he will indicate exactly when he can make the transfer. Although practice shows that if a person returns money, he does not write a response letter, but immediately transfers the funds to the sender.

(Video: “What to do if the payment went to the wrong address?”)

Terms for returning erroneously transferred funds

In such situations, the law does not oblige the recipient to return the money after a certain time. However, reasonable deadlines must still be observed. When it comes to litigation, a week is considered reasonable. Although this is influenced by certain factors:

In such situations, the law does not oblige the recipient to return the money after a certain time. However, reasonable deadlines must still be observed. When it comes to litigation, a week is considered reasonable. Although this is influenced by certain factors:

- How much time has passed since the erroneous translation;

- Whether the money was used by the recipient;

- Is it technically possible to transfer funds quickly;

- How exactly the defendant can transfer funds.

It is worth noting that time is not in the defendant’s favor here. If he starts using “other people’s” money, the sender has the opportunity to demand interest or monetary compensation. Thus, the longer the transfer of money by the recipient takes place, the greater the interest he will have to pay to the injured party.

If the company made a translation by mistake, it draws up the letter on its own letterhead. All information about the organization is indicated here. Its responsible employee addresses the head of the recipient company. The document is certified by the signatures of the director and chief accountant. Also attached to the request are documents that confirm that the transfer was actually made.

If the company made a translation by mistake, it draws up the letter on its own letterhead. All information about the organization is indicated here. Its responsible employee addresses the head of the recipient company. The document is certified by the signatures of the director and chief accountant. Also attached to the request are documents that confirm that the transfer was actually made.

If the recipient refuses this request, the sending company is recommended to file a claim in court. It would be a good idea to seek help from a lawyer. This is especially true for erroneous transfers of large amounts. With the help of a lawyer, you will correctly draw up a claim and collect significant evidence.

If you mistakenly sent money to someone else's account, it is also recommended to write a letter to the recipient. Such a pre-trial warning will notify the recipient of the fact of an erroneous transfer. As practice shows, individuals rarely respond to requests to voluntarily return funds. Often, recipients simply ignore the sender's requests. In this case, you should also go to court.

If you made a transfer to a bank card and immediately noticed an error, you should immediately contact the employees of the financial institution. The transfer may not have been completed yet. In this case, the funds are frozen. In this case, clarification of the situation may last for a month. The bank may require a statement from the sender confirming that he wishes to cancel the money transfer.

Every citizen may encounter the fact that funds will be transferred to some account by mistake. This usually happens when concluding an agreement or conducting a transaction. Funds can also be transferred using the correct details, but in excess.

Dear readers! The article talks about typical ways to resolve legal issues, but each case is individual. If you want to know how solve exactly your problem- contact a consultant:

APPLICATIONS AND CALLS ARE ACCEPTED 24/7 and 7 days a week.

It's fast and FOR FREE!

In this case, you will need to return the erroneously transferred money. Since this is not always easy to do, you will need to go through a special return procedure.

There is a specific procedure for drawing up an application, according to which the funds will be transferred back to the owner. It is important to reflect in it the main points according to which you can understand the details of the translation.

Important points

If the payment was made incorrectly, then steps must be taken to return it. Such an event is not considered ordinary. In each case, you need to check the message carefully, having studied all the details.

It is worth remembering that the transfer of money back by the organization and the bank is carried out in rare cases just like that. To return funds that were transferred for other purposes, you must follow the procedure established in 2020.

The basis for this is a letter that reflects all the circumstances of the incident. It is necessary to provide the details where the return should be made. The letter does not have a set form. Therefore, it can be compiled arbitrarily.

Sometimes, even with a letter, it is not possible to get the money back. After all, a citizen must provide reasons for carrying out the procedure, expressed in writing.

The work of a legal nature to restore a citizen’s rights consists of searching for material evidence. Particular attention is paid to material sources.

Reasons for drawing up

It is necessary to draw up a document on the basis of which funds transferred by mistake will be returned in several cases. Technical errors are considered frequent among them.

When concluding a transaction, funds may be randomly debited from a citizen’s personal account. This can happen due to incorrect operation of the translation system.

In the second case, we are talking about a mistake by the owner of the funds. A person may make a mistake in the details by indicating one of the account numbers incorrectly.

Errors also occur when the transfer amount is entered incorrectly. As a result, the organization may receive more funds than required.

In whose favor are they usually mistaken?

Often, funds transferred by mistake are found in different accounts. Moreover, not only a citizen or an organization can receive them.

The transfer can be sent to:

- to various payment systems (electronic wallets);

- to credit organizations;

- to terminals that allow you to pay for services remotely;

- to telephone and Internet operators;

- to various contractors providing intermediary services;

- to the Federal Tax Service;

- to extra-budgetary funds.

In addition, there are often situations where the recipient of funds is an individual.

Most problems stem from companies retaining previously used payment forms. As a result, no forms are required to be filled out. One click is enough for funds to be transferred to an individual, institution or bank.

What to do after discovery

If a person discovers that he transferred funds by mistake, then he must follow the instructions below:

- At the initial stage, a written application for the return of funds is drawn up. It must be signed by the originator. The document is also certified by a notary office.

- The letter is sent to the organization that mistakenly became the recipient of the funds.

- Notice can be sent in several ways. It is possible to submit it in person by visiting the institution’s office. The document is also sent by mail or using delivery provided by a courier service.

- After the organization receives the letter, it must check all monetary transactions that were made on the accounts. This is necessary to detect an error. It is important to evaluate the correctness of income, expenses and account balance.

- If an error is identified, a written response is drawn up. It contains the terms of return, the amount that the applicant must receive. Otherwise, a document containing justification for the impossibility of reverse translation is also transmitted.

Letter writing example

When drafting, you need to focus on the sample letter for the return of erroneously transferred funds, presented below:

to CEO

LLC "Stroyplast"

Kozlovtsev Gennady Pavlovich

statement.

Promsbyttorg LLC, Moscow, requests the transfer of erroneously transferred funds within the framework of payment order No. 454 dated March 24, 2020 in the amount of 5 thousand 658 rubles 00 kopecks to the current account using the following details:

account number 5845588765236975622365888 at Promstroybank in Moscow

c/s 6998206876698666977413369, BIC 59436886.

General Director _____________________ Onishchenko Yu.M.

Chief accountant _____________________ Minakova O.Yu.

Document structure

Before you write a letter about the return of erroneously transferred funds, you need to find out its structure.

Despite the fact that the law does not provide for a prescribed form of the document, some requirements are imposed on the content:

- The addressee's details are required. These include the full name of the management and the name of the organization. Data is entered in the upper right corner.

- In the central part of the document, you can politely address the manager by name and patronymic. The best option would be to start with the words “Dear.”

- The main part of the letter describes the circumstances of the incident. Checks, receipts, and statements of personal accounts are also provided here. All these financial documents help confirm the fact of the transfer. This section also describes the reasons for what happened.

- After drawing up the document, the citizen’s signature is placed. Its decoding and the date of execution of the document are indicated here.

- At the bottom of the office there is a mark with the data of the employee who accepted the document and the date of registration of the paper. The manager signs the paper if he agrees to satisfy the applicant’s request.

How to avoid mistakes

When drawing up a document, there are several important features to consider:

- You must have proof that payment has been made.

- The information is presented on sheet A4.

- The letter contains the company details. This is necessary to ensure that the business partner transfers funds to the correct account.

- You must contact the head of the recipient organization.

- It is important to accurately indicate the amount to be refunded.

- The document must reflect the “Appendix” item. It lists the papers that are attached to the application.

What should the recipient respond?

After drawing up and submitting an application for the return of erroneously transferred funds, the citizen needs to wait for a response. In response to the letter, the organization must draw up a return document within the time limits established by law.

The document notes the decision made by the company regarding the return of funds. It can be positive or negative. In the latter case, the refusal must be motivated.

The response must be submitted on the official letterhead of the organization. It is sent to the address indicated in the applicant's contact information. If the recipient does not agree with this decision, he can appeal to higher authorities to appeal it.

For example, if a regional credit institution refuses a refund, then you need to contact its management. It is also possible to visit the central office of the bank.

It is also possible to appeal the decision to a judicial authority. For this purpose, a statement of claim is drawn up. The defendant is the company that refused to return the money.

When to expect a refund

The exact terms for the return of funds are not prescribed by law. Therefore, the period is determined by the organization that erroneously received them.

When money is credited to a bank card or account, the refund is made within five days. If the recipient is a private person, individual entrepreneur or organization, they themselves have the right to decide when to return the funds to them.

Typically the return period does not exceed seven days. The countdown begins from the moment the letter is sent and becomes familiar with it.

If the process is delayed, the return will not be free for the recipient. You will have to pay a penalty for each day of delay.

What to do if money is not returned

If all of the above methods do not help you get your money back, then you need to send an application to the arbitration court. Evidence of translation must be attached to the application. These include documents confirming the error. There must also be a letter that was sent to the bank.

A refund letter is a formal request in writing for the return of overpaid money as part of a previously completed transaction or due to a technical fault.

This request-demand essentially refers to official documents to which a response must be sent. And despite the fact that the statement can be drawn up in any form, it still should not contradict the legislation of the Russian Federation.

Where can money be transferred by mistake?

There are several authorities where funds can be transferred erroneously:

- Bank.

- Any of the payment systems.

- Remote payment terminal.

- Internet operator.

- Counterparty.

- Tax office, Pension Fund and other institutions.

- Final recipient (any individual).

Initially, it is necessary to write a written notice to the organization or person to whose details the money was mistakenly sent.

The drawn up demand must be signed and, if circumstances so require, certified.

You can send a notification in the following ways:

- Personally in hands.

- Using courier services.

- By mail notification.

Whatever method of transmission of the letter is chosen, The recipient's signature is required that he has been notified of the erroneous transfer of funds. Further, regardless of whether it is a legal entity or an individual, the defendant needs to check all monetary transactions that were made on his account. Organizations also need to reconcile all documents regarding the receipt and expenditure of money and the final balance.

After all internal checks, the defendant must send a response notice within the established calendar period, indicating whether a refund will be issued or not.

If the answer is negative, the reason for non-return is indicated. The demand is signed and sent to the “affected party”. If the fact of an erroneous transfer of funds is proven, they are returned to the sender’s account from where they were sent.

How to write a document correctly?

After finding out to whose details the money was sent, it is necessary to correctly draw up a notice of its return. To do this you need:

- Collect all documents who will be able to confirm the payment. For legal entities this is, for individuals - checks or receipts.

- Write the letter itself. The company does this on the organization’s letterhead indicating all the details; an ordinary citizen writes on an A4 sheet indicating passport data, actual address of residence, and contact information.

- As with all official letters, this requirement must be addressed to the manager (director, boss, manager, etc.).

- Next comes the part where the request for a refund is indicated. It is imperative to indicate the exact amount that needs to be returned and the basis for the return.

- Attach the collected documents, confirming the fact of the operation. The letter contains a note “Attachment”, which lists what exactly is attached to the notification.

- Sign the notice. The legal entity affixes the seal and signatures of the manager and accountant.

Return deadlines

Russian legislation does not define the exact terms for the return of erroneously transferred money. Everything will depend on where these funds ended up:

- If the payment was made to a bank account or card and the payer caught it in time, then the money can be returned within 5 working days(again, the period is determined by the banks).

- In the event of an incorrect transfer to a private or legal entity, the law establishes a reasonable time frame for return. In practice this is usually 7 working days from the moment the letter was written. If the process is delayed, the authorities have the right to impose interest on the defendant for each day of delay.

Of course, the money back system itself is not so complicated if you realize it in time and start acting. But it is better to be careful and check the details and contact information of the person to whom the transfer is being made several times.