Cash flow quadrant (cash quadrant). Robert Kiyosaki's Cash Flow Quadrant and the Rat Race Rich Dad's Guide to Financial Freedom

Genre: Business literature

Year: 2003

Robert Kiyosaki. Cash Flow Quadrant

Rich Dad's Guide to Financial Freedom

“Man is born free, but finds himself bound in chains. He thinks that he is a master over other people, but he remains a slave even more than they are.”

Jean Jacques Rousseau

My rich dad used to say, “You will never have real freedom without financial independence. Freedom can only be real when a great price has been paid for it.” This book is dedicated to those people who are willing to pay the price.

To our friends:

Thanks to the phenomenal success of Rich Dad Poor Dad, we have made thousands of friends around the world. The words of admiration and support they expressed inspired us to write the book “Cash Flow,” which is a continuation of the previous book.

To all our friends, old and new, for their enthusiasm and support of our wildest dreams, we express our deepest gratitude.

PREFACE

What sector are you in?

Is this sector best suited for you?

Are you financially free? “Cash Flow” was written for you if your life is at a fork in the financial path.

If you want to take control of what you do today to change your financial destiny, then this book will help you chart your next steps. This is what a quadrant looks like.

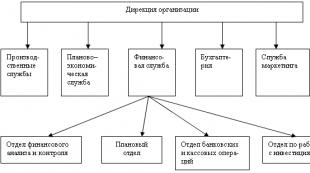

The letters in each sector indicate:

E - employee

S - self-employed

B - business owner

I - investor

Each of us is in at least one of the four cash flow quadrants above. Our place is determined by the source of cash. Many of us rely on checks to pay our salaries and are therefore employees, while others are self-employed. Employees and self-employed people are on the left side of the money quadrant. On the right side of the quadrant are people who receive cash from their own businesses or investments.

The Cash Flow Quadrant depicts the different types of people who make up the world of business, it explains who these people are and what their distinctive characteristics are. This will help you determine which sector you are in and outline your next steps to achieve financial freedom in the future. Since financial freedom can be found in any of the four quadrants, the skills and prowess of Type B and Type I people will help you achieve your financial goals as quickly as possible. Successful "E" people must also become successful in the "I" quadrant.

WHAT DO YOU WANT TO BE WHEN YOU GROW UP?

This book can be called Part II of my book “Rich Dad Poor Dad”. For those who are not familiar with my previous book, I will explain what it says. It talks about the lessons my two fathers taught me about money and life choices. One of them was my real father, the other was my friend's father. One was highly educated and the other had not attended higher education. One was poor and the other was rich. I was once asked, “What do you want to be when you grow up?”

My highly educated father always advised: “Go to school, get good knowledge and then find a well-paid job.” He advised a life path that looked like this:

i.e. employees and highly paid “S”, i.e. a self-employed professional such as a licensed doctor, lawyer or accountant. My poor dad was primarily interested in the security of a paycheck and a secure job with a steady paycheck. Therefore, he was a highly paid government culprit - he headed the Hawaii State Department of Education.

Rich Dad's Advice

My wealthy but uneducated father gave me very different advice. He said: “Go to school, finish it, build your own business and become a successful investor.” He advised choosing a life path that looked like this:

This book is about the mental, psychological, emotional and educational process that took place in me as I followed the advice of my rich father.

WHO IS THIS BOOK FOR?

This book is written for people who are ready to change the sector. This book is especially for those who are still in the “E” and “S” sectors and intend to move to the “B” and “I” sectors. This book is for people who are ready to move on the opposite side of a secure job, who want to win financial freedom. This is not an easy path in life, but the reward you will receive at the end of the path is worth the effort. This is the path to financial independence.

Rich dad told me a simple story when I was just 12 years old, but it led me to great wealth and financial freedom. He thus explained to me the difference between the left side of the "cash flow quadrant", where the "E" and "S" quadrants are, and the right half of the quadrant, which contains the "B" and "I" quadrants. Here's the story:

“Once upon a time, there was an unusual village. It was a wonderful place, if not for a big problem. There was no water in the village, although it rained sometimes. To get rid of this problem once and for all, the elders decided to sign an agreement for the daily supply of water to the village. Two people volunteered to take on this task and the elders signed contracts with each of them. They foresaw that competition between them would reduce the price of the work and ensure the supply of water.

The book “The Cash Flow Quadrant” by Robert Kiyosaki and Sharon Lecter is less like a textbook and more like a self-instruction manual. It will allow you to dig into the very essence of the structure of modern society, which is divided into four main parts according to the field of activity and the type of thinking. Namely, thinking contributes to success, achievements or failures. The book will give you strength and confidence, and instill a desire to change on the path to a happy and free life. The author will help the reader determine his own belonging to a certain type and tell him how to move to another if desired.

Most people run in circles in the so-called financial trap. They belong to the working class. Once you start working for someone else, it’s too hard to stop. It's scary to take risks. But, if you judge correctly, then this particular work is risky. After all, tomorrow it may not exist. Unfortunately, those who work harder and longer will never become rich and successful. There are others who work for themselves, but their income also depends on their personal participation in the work.

The author of the book believes that by becoming financially literate, people can become financially free. There is much less risk in starting a business than it seems at first glance. This is a well-coordinated system that can work properly and generate income even in the absence of the owner. You need to gather your courage, gain courage and leave the oppressive circle. Everyone’s success depends only on themselves, and the book will help you understand what you need to do to achieve this success and become independent.

The work belongs to the genre of Economics. Business. Right. It was published in 2011 by Potpourri. The book is part of the Rich Dad series. On our website you can download the book "Cash Flow Quadrant" in fb2, rtf, epub, pdf, txt format or read online. The book's rating is 4.3 out of 5. Here, before reading, you can also turn to reviews from readers who are already familiar with the book and find out their opinion. In our partner’s online store you can buy and read the book in paper version.

Why do some people work constantly and live poorly, while others spend minimal time working and have the status of rich people? To answer this question, it is necessary to assess your own capabilities and prospects in order to determine the further direction of your own development and conduct of activities.

To do this, it is recommended to use a simple analysis tool created by a famous millionaire and author of books on finance.

Financial flow

The cash flow quadrant reflects the reality, possibilities and prospects of human activity. It also provides guidance for actions aimed at creating an enabling environment for development to move across sectors. Using the tool, you can transform into a person who independently generates cash flow.

What is the Cash Flow Quadrant by Robert Kiyosaki Robert Kiyosaki presented his concept of financial flows in his book.

It reflects four ways in which people make money. Each of them has its own concepts, thinking, interests and values.

Quadrant sectors

To understand the basic principles of money, you need to compare your worldview, desires and work results with each quadrant of the system. According to its author, all people are divided into four types, two of which have active income, for which a person works for money. The remaining two ways of earning money are identified as passive, in which you do not need to make any effort to receive money.

- Active income can be obtained by working for hire or through one of the self-employment schemes that involve putting in effort and spending time to earn money.

- To receive passive income, you need to have your own business or invest in a profitable project. The profit obtained in this way is not proportional to the time and effort expended. According to the author’s concept, there are four ways to earn money:

- employment;

- entrepreneurship;

business;

The wage labor sector is located in the upper left part of the quadrant. It includes people who work for an employer and receive a regular salary. Its size depends on the time a person spends at work and on the tasks he performs. In fact, employees trade their time for money. They have a stable salary, the size of which can be so large that the employee allows himself to improve his quality of life.

The disadvantage of hired labor is the lack of free time. If a person does not work, then the flow of funds immediately stops. Kiyosaki associates this sector with the rat race, since a person works to eat and eats to work.

Small business

Values of each sector

Small businesses are located at the bottom, left side of the quadrant. This category includes entrepreneurs, self-employed individuals and freelancers. Small business participants independently organize the work process and strive to complete the work efficiently, since this factor determines whether the customer will cooperate with them in the future.

They are also competent to independently promote and sell the results of their work.

The financial flow for entrepreneurs is distributed more favorably than for employees. However, the “running in circles” pattern is also present in small businesses.

Big business Big business in the quadrant is interpreted in the upper sector on the right side.

It includes representatives of large businesses who provide work not only for themselves, but also create jobs for people from sectors located on the left side of the quadrant. Read also:

Where can I get a million dollars? Business executives earn more money than employees and small entrepreneurs. At the same time, by competently delegating their responsibilities, they can devote minimal time to business.

However, they cannot leave everything to chance, since the activities of hired workers require control. There is still an element of walking in circles, although cash flows for such people are distributed more efficiently.

Investment The investment sector is located in the lower right corner. Their difference from representatives of other sectors lies in the possibility of receiving passive income after making certain efforts that require the expenditure of energy, time and financial resources. The category of investors includes persons who, in order to receive income without time and energy costs, invest their funds in profitable projects.

Left and right side of the quadrant

The quadrant is divided not only into four sectors that interpret ways of earning money, but also into two parts that identify the state of a person who receives income in a certain way.

Kiyosaki's concept provides for the division of the ideological structure into left and right parts. People of one of them feel security, and the other - freedom. Employees and small entrepreneurs receive a small, but regular and guaranteed income, so they are considered to be in a zone of financial security, in which there are no risks and opportunities for growth. Large businessmen and investors count only on the return on the resources invested in the business, the actions taken, as well as on monitoring the activities of employees and performers. Their work is fraught with risks, so it is impossible to judge financial security from this perspective. However, all this is compensated by large incomes and minimal time expenditure, which determine the formation of a sense of freedom.

Dependence of behavior on location in the sector

Characteristics of people from each sector of the quadrant

The way of thinking shapes certain actions of a person, which influences his attitude towards one of the sectors of the quadrant.

By changing it you can transform into another sector.

An employee is engaged in carrying out the tasks assigned to him by management. For his activities, he receives a stable salary and a likely opportunity for career growth. A distinctive feature of people in this sector is insufficient income and a complete lack of free time. The main clients of banks in the field of lending are people from the wage sector. They go into debt to solve problems that arise to meet their needs. It is worth noting that this category of people does not have savings.

The more they earn, the higher their demands, and the more they spend.

Business entities have advantages over hired workers, but they are relevant only in the case of conducting permanent activities. Business representatives can plan their time, volume of work and wages, but cessation of activity will result in lack of money. Without work there will be no income.

Despite the large amount of earnings, representatives of this segment cannot accumulate savings that would allow them not to carry out activities.

Having organized the work of others to achieve his goals, the entrepreneur automatically moves to the neighboring sector.

The activities of businessmen are focused exclusively on selling the results of the labor of hired workers. The responsibility of a representative of a large business is only to organize and control their work. His work involvement is minimized because he does not have to perform specific tasks every day for which he is paid.

Robert Kiyosaki, Sharon Lechter

Rich Dad's Guide to Financial Freedom

“Man is born free, but finds himself bound in chains. He thinks that he is a master over other people, but he remains a slave even more than they are.”

Jean Jacques Rousseau

My rich dad used to say, “You will never have real freedom without financial independence. Freedom can only be real when a great price has been paid for it.” This book is dedicated to those people who are willing to pay the price.

To our friends:

Thanks to the phenomenal success of Rich Dad Poor Dad, we have made thousands of friends around the world. The words of admiration and support they expressed inspired us to write the book “Cash Flow,” which is a continuation of the previous book.

To all our friends, old and new, for their enthusiasm and support of our wildest dreams, we express our deepest gratitude.

PREFACE

What sector are you in?

Cash Flow Quadrant Are you financially free?"Cash flow"

If you want to take control of what you do today to change your financial destiny, then this book will help you chart your next steps. This is what a quadrant looks like.

The letters in each sector indicate:

written for you if your life is at a fork in the financial path.

E – employee

S – self-employed

B – business owner

Each of us is in at least one of the four cash flow quadrants above. Our place is determined by the source of cash. Many of us rely on checks to pay our salaries and are therefore employees, while others are self-employed. Employees and self-employed people are on the left side of the money quadrant. On the right side of the quadrant are people who receive cash from their own businesses or investments.

I – investor"Cash Flow Quadrant"

WHAT DO YOU WANT TO BE WHEN YOU GROW UP?

depicts the different types of people that make up the world of business, it explains who these people are and what their distinctive characteristics are. This will help you determine which sector you are in and outline your next steps to achieve financial freedom in the future. Since financial freedom can be found in any of the four quadrants, the skills and prowess of Type B and Type I people will help you achieve your financial goals as quickly as possible. Successful "E" people must also become successful in the "I" quadrant.

My highly educated father always advised: “Go to school, get good knowledge and then find a well-paid job.” He advised a life path that looked like this:

This book can be called Part II of my book “Rich Dad Poor Dad”. For those who are not familiar with my previous book, I will explain what it says. It talks about the lessons my two fathers taught me about money and life choices. One of them was my real father, the other was my friend's father. One was highly educated and the other had not attended higher education. One was poor and the other was rich. I was once asked, “What do you want to be when you grow up?”

Poor dad recommended that I choose between the highly paid "E", i.e. employees and highly paid "S", i.e. a self-employed professional such as a licensed doctor, lawyer or accountant. My poor dad was primarily interested in the security of a paycheck and a secure job with a steady paycheck. That's why he was a highly paid government official, heading the Hawaii State Department of Education.

Rich Dad's Advice

My wealthy but uneducated father gave me very different advice. He said: “Go to school, finish it, build your own business and become a successful investor.” He advised choosing a life path that looked like this:

This book is about the mental, psychological, emotional and educational process that took place in me as I followed the advice of my rich father.

WHO IS THIS BOOK FOR?

This book is written for people who are ready to change the sector. This book is especially for those who are still in the “E” and “S” sectors and intend to move to the “B” and “I” sectors. This book is for people who are ready to move on the opposite side of a secure job, who want to win financial freedom. This is not an easy path in life, but the reward you will receive at the end of the path is worth the effort. This is the path to financial independence.

Rich dad told me a simple story when I was just 12 years old, but it led me to great wealth and financial freedom. He thus explained to me the difference between the left side of the "cash flow quadrant", where the "E" and "S" quadrants are, and the right half of the quadrant, which contains the "B" and "I" quadrants. Here's the story:

“Once upon a time, there was an unusual village. It was a wonderful place, if not for a big problem. There was no water in the village, although it rained sometimes. To get rid of this problem once and for all, the elders decided to sign an agreement for the daily supply of water to the village. Two people volunteered to take on this task and the elders signed contracts with each of them. They foresaw that competition between them would reduce the price of the work and ensure the supply of water.

The first of the two to receive the contract, Ed, immediately got to work. I bought two identical buckets and began carrying water, running along the path to the lake, which was located a mile from the village. He immediately began earning money, working from morning to night, filling huge tanks with water, which he carried from the lake in his two buckets. Every morning he had to get up before everyone else to make sure there was an adequate supply of water for the needs of the villagers. It was hard work, but the man felt happy because he was earning money and had one of two exclusive contracts for his business.

Translation from English completed O. G. Belosheev Published by: RICH DAD’S Cashflow quadrant (Guide to Financial Freedom) by Robert T. Kiyosaki, 2011.

© 2011 by CASHFLOW Technologies, Inc. This edition published by arrangement with Rich Dad Operating Company, LLC

© Translation. Edition in Russian. Decor. Potpourri LLC, 2012

My rich dad used to say, “You can never be truly free without financial freedom.”

And he also said: “But freedom also has its price.”

This book is dedicated to those who are willing to pay this price.

Editor's note

Times change

Since the first edition of Rich Dad Poor Dad was published in 1997, there have been many changes in the economy, and investing in particular. Fourteen years ago, Robert Kiyosaki's words “your home is not your asset” challenged conventional wisdom. His unconventional views on money and investing sparked a wave of skepticism, criticism, and outrage.

In 2002, Robert's book, Rich Dad's Prophecy, warned us to prepare for an imminent financial market crash. In 2006, deep concern about the deteriorating plight of America's middle class led Robert Kiyosaki to co-author with Donald Trump the book Why We Want You to Be Rich.

Robert is known around the world as a passionate advocate for financial education. Today, as we face the fallout from the collapse of the subprime mortgage system, record levels of foreclosures, and a global economic crisis that still rages, Kiyosaki's prophetic statements appear to be coming true. Many skeptics turn into believers.

When Robert was preparing his book “The Cash Flow Quadrant” for a new edition in 2011, he realized two important things: his ideas and concepts have stood the test of time, and the investment environment and conditions for investors have changed significantly. These changes, which have and will continue to have a major impact on people in the I quadrant (investors), prompted Robert to update and revise an important section of this book, the chapter “The Five Levels of Investors.”

Acknowledgments

Thanks to the phenomenal success of Rich Dad Poor Dad, we have made thousands of new friends all over the world. Their kind words and friendship—and their amazing stories of persistence, passion, and success in applying rich dad principles to their lives—inspired us to write The Cashflow Quadrant: Rich Dad's Guide to Financial Freedom. We therefore thank our friends, both old and new, for their enthusiastic support, which has exceeded all our expectations.

Preface

What is your life's purpose?

“What do you want to be when you grow up?” - This question has been asked to most of us at one time or another.

As a child, I had many hobbies, so it was easy to choose. If something seemed interesting and prestigious, I wanted to do it. I dreamed of becoming a marine biologist, astronaut, Marine, merchant seaman, pilot, and professional football player.

I managed to achieve three goals from this list - to become a marine officer, a sailor and a pilot.

I knew for sure that I didn’t want to be a teacher, a writer, or an accountant. Pedagogical work did not attract me because I did not like school. I also had no desire to become a writer, because I failed the English exam twice. I didn’t spend two years getting an MBA for the simple reason that I hated accounting, which was a required subject in the program.

Now, ironically, I'm doing all the things I never wanted to do. Even though I didn't like school, I own an education company and teach people around the world because I love it. Although my inability to write English was the cause of two exam failures in my time, today I am best known as an author. My book, Rich Dad Poor Dad, spent more than seven years on the New York Times bestseller list and is the third best-selling book in the United States. Only “The Joy of Sex” and “The Road Less Traveled” stand above it. On top of that, the book “Rich Dad Poor Dad” and the series of board games I created, “Cash Flow,” are dedicated to the very accounting that I could not stand for so long.

But how does all this relate to the question “What is your purpose in life?”

The answer is contained in a simple but extremely profound thought by the Vietnamese Zen Buddhist master Thich Nhat Hanh: “The path is the goal in itself.” In other words, your purpose in life is to find your path in life. However, the concept of a path cannot be identified with your profession, title, amount of money received, successes and failures.

Finding your path means finding out what you were put on this earth to do. What is the purpose of your life? Why have you received this great gift called life? And what gift are you giving to life in return?

Looking back, I realize that the education I received did nothing to help me find my path in life. For four years I studied at the naval school to become a merchant navy officer. If I had chosen a career at Standard Oil and served on oil tankers until retirement, I would not have found my path. If I had stayed in the Marine Corps or transferred to civilian aviation, I would not have found my way either.

If I had stayed in the Navy or Air Force, I would never have become a world-famous best-selling author, been invited to appear on Oprah Winfrey's television program, co-authored a book with Donald Trump, or created an international educational company that trains entrepreneurs and entrepreneurs. investors around the world.

How to find your way

The Cash Flow Quadrant ranks high among all the books I've written because it helps people find their path in life. As you know, most people at the very beginning of their lives receive a standard instruction: “Go to school and get a good job.” But the education system teaches us to find jobs in the E or S quadrants. It does not teach us how to find our way in life.

There are people who from an early age know exactly what they will do in the future. They grow up confident that they will become doctors, lawyers, musicians, golfers or actors. We've all heard of child prodigies - children with exceptional abilities. However, it should be noted that these talents manifest themselves mainly in the professional field and do not necessarily determine a person’s life path.

So how do you still find your path in life?

My answer is: “If only I knew!” If I could wave a magic wand and use magic to show you your path, I would.

But since I don't have a magic wand and can't tell you what you need to do, I can only tell you what I did. I just trusted my intuition, my heart and my inner voice. For example, in 1973, after returning from the war, when my poor dad began to persuade me to study further, get a master's degree and work in the government, my brain went numb, my heart sank, and my inner voice said: “No way!”