Favorable account for individual entrepreneurs. Where is it profitable to open a current account for an individual entrepreneur and how much does it cost? Details include

Hello, dear readers! I came up with the idea a long time ago to write a review article about where and in which bank to open a current account for individual entrepreneurs and LLCs and to collect in it all the interesting offers on banks providing such a service. Therefore, keep a list of the best, in my opinion, banks for opening a current account. I contacted bank representatives and received information from most.

Criteria for evaluation

I propose to evaluate the banks listed below according to the following criteria in order to determine where it is profitable, safe and convenient to open a current account:

- Cost of opening a current account.

- Maintenance cost (monthly).

- Account opening deadlines.

- Internet banking (availability and cost).

- Mobile bank (availability and cost).

- SMS notification (availability and cost);

- Operation day.

- Commission for non-cash payments legal. persons.

- Possibility of transferring physical persons to regular bank cards/accounts (commission).

- Cash withdrawal through ATMs (commission).

- Cash.

- Number of free plastic cards.

- Synchronization with online accounting “My Business” and “Elba”, etc.

- Interest on account balance.

If you have a suggestion to expand the list of criteria, write in the comments, we will try. I couldn’t fit all the banks into one table on the website, so let’s go through all the banks one by one.

List of banks

Important We did, i.e. have tariffs without a monthly subscription fee.

We will divide the list into classic “veteran” banks, and into more modern and technological ones.

The “veterans” include:

- Sberbank.

- Alfa Bank.

- Promsvyazbank.

- Loko-Bank.

Towards more modern and technologically advanced banks:

- Tinkoff.

- Modulbank.

- Tochka (based on Otkritie and Qiwi banks).

- DeloBank (based on SKB Bank).

If the first group of banks is known to everyone, then the second group is still little known, but I will tell you with full responsibility that I would recommend looking in the direction of the second group. Below we will compare and in conclusion we will draw conclusions on where to open a current account for individual entrepreneurs and LLCs is profitable, safe, convenient, etc.

Open a current account at Tinkoff Bank

- Cost of service (monthly) - the first 2 months are free, then at the "Simple" tariff - 490 rubles. per month, “Advanced” - 990 rub., “Professional” - 4990 rub. per month. If there were no account transactions in a month, then this month is free.

- Account opening time - you can use it in 5 minutes.

- Operating day - from 7:00 to 21:00 Moscow time.

- Commission for non-cash payments legal. persons - according to the “Simple” tariff, 3 payments are free, the rest - 49 rubles. per payment, according to the “Advanced” tariff, 10 payments are free, the rest - 29 rubles. per payment, according to the “Professional” tariff - 19 rubles per payment. Unlimited payments on the “Simple” tariff – 490 rubles, on the “Advanced” tariff – 990 rubles, on the “Professional” tariff – 1990 rubles. per month.

- Possibility of transferring physical to persons on regular bank cards/accounts (commission) - yes, on Tinkoff Bank cards without commission.

- Cash withdrawal through ATMs (commission):

— According to the “Simple” tariff: up to 400,000 rubles. — 1.5%, up to 1,000,000 rub. - 5%, from 1,000,000 - 15%. With each withdrawal, an additional 99 rubles are withdrawn.

— According to the “Advanced” tariff: up to 400,000 rubles. — 1%, up to 2,000,000 rub. - 5%, from 2,000,000 - 15%. With each withdrawal, an additional 79 rubles are withdrawn.

— According to the “Professional” tariff: up to 800,000 rubles. — 1%, up to 2,000,000 rub. — 5%, from 2,000,000 rub. - 15%. With each withdrawal, an additional 59 rubles are withdrawn. - Cash:

— At the “Simple” tariff: 0.15%, minimum 90 rubles.

— According to the “Advanced” tariff: up to 300,000 rub. free, from 300,000 rub. — 0.1%, minimum 79 rub. , 3 refills per month - 990 rubles, per year - 9900 rubles.

— According to the “Professional” tariff up to RUB 1,000,000. free, from 1,000,000 rub. — 0.1%, minimum 59 rub. 5 top-ups without commission - 1490 rub. per month, 14,900 rub. in a year. - The number of free plastic cards is 0 rubles, one corporate and salary cards or two corporate and salary cards, depending on the tariff.

- The interest on the account balance is up to 6%.

You can open an account at bank website.

A small conclusion on the bank's proposal. Oleg Tinkov is at his best as always. It has always been famous for the best service. One of the longest operating days, money is transferred instantly, cool mobile application and Internet banking, up to 6% per annum on account balance, opening without visiting the bank, the first 2 months are free, telephone support 24/7, you can withdraw cash almost at any ATM and much more.

Soon there will be such features as reminders about upcoming taxes, submitting reports to government agencies, checking partners and counterparties, currency payments and friendly currency control, templates for regular payments, etc.

Open a current account in Modulbank

- The cost of opening a current account is free.

- Cost of service (monthly) - first tariff - 0 rubles, second tariff - 490 rubles, third tariff - 4500 rubles. per month.

- Internet banking (availability and cost) - yes, free.

- Mobile bank (availability and cost) - yes, free.

- SMS notification (availability and cost) - yes, free.

- Operating day: 9.00 – 20.30.

- Commission for non-cash payments legal. persons - 90, 19 and 0 rub. (in order of tariffs listed).

- Possibility of transferring physical to persons on regular bank cards/accounts (commission) - yes. For individual entrepreneurs, depending on tariffs: 0.75% up to 300,00 rub., 19 rub. up to 500,000 rub., about rub. up to 1,000,000 rub. For LLC, depending on tariffs: 0.75% up to 100,000 rubles, 19 rubles. up to 200,000 rub., 0 rub. up to 300,000 rub.

- Cash withdrawal through ATMs (commission): from 0 to 20% depending on the withdrawal amount.

- Cash deposit: from 0 to 2.7%.

- The number of free plastic cards is 1 to 5, depending on the tariffs.

- Synchronization with online accounting “My Business” and “Elba”, etc. - There is.

bank website.

A small conclusion on the bank's proposal. The bank has a free tariff plan. Modulbank operates on the basis of the Regional Credit bank, which is more than 23 years old, with a convenient mobile application and Internet banking, cash withdrawal to any bank card with low commissions. And, as a representative of the bank said, all current accounts are insured for 1.4 million rubles, which makes us believe in its reliability. By the way, its founder is the former head of the business department at Sberbank, Yakov Novikov. I don’t see any downsides yet, just like Tinkoff Bank.

Open a current account at Tochka Bank

- The cost of opening a current account is free.

- Cost of service (monthly) - depending on the tariff, from about to 2500 rubles.

- Account opening time - you can use it in 5 minutes, and complete registration - 1 day.

- Internet banking (availability and cost) - yes, free.

- Mobile bank (availability and cost) - yes, free.

- SMS notification (availability and cost) - yes, free.

- Operating day - from 00.00 to 21.00 Moscow time.

- Commission for non-cash payments legal. for persons - on the free tariff - payments are free, on the other two 10 and 100 are free, in addition to the package - 60 and 15 rubles.

- Possibility of transferring physical to persons on regular bank cards/accounts (commission) - yes.

— Up to 200,000 or up to 500,000 rubles. free of charge depending on tariffs for individual entrepreneurs.

— Up to 100,000 or up to 300,000 rubles. free of charge depending on tariffs for LLC.

— With the free plan, translations are free for individual entrepreneurs and LLCs. - Cash withdrawal through ATMs (commission): free of charge on the free tariff, up to 50,000 rubles on the second tariff. - 1.5%, over - 3%, at the third tariff - up to 100,000 rubles. free, above - from 1.5 to 3% depending on the amount.

- Cash deposit: on a free tariff - up to RUR 300,000. 1%, over - 3%, on the second tariff any amounts - 0.2%, on the third - up to 1,000,000 free, over 0.2%.

- The number of free plastic cards is from 2 to 6 free depending on the tariff.

- There is no interest on the account balance. There is a tax cashback of 2%.

bank website.

A small conclusion on the bank’s proposal: Convenient mobile application, and Internet banking, the longest operating day, transfers within Tochka around the clock, transfers to individuals. persons without commissions, created on the basis of Otkritie Bank, which has been on the market for a long time.

Current account in Expert Bank

- The cost of opening a current account is free.

- Cost of service (monthly) - depending on the tariff, from about to 3990 rubles.

- Account opening time - you can use it in 5 minutes, and complete registration - 1 day.

- Internet banking (availability and cost) - yes, free.

- Mobile bank (availability and cost) - yes, free.

- SMS notification (availability and cost) - yes, free.

- Operating day - from 09.00 to 17.00 Moscow time.

- Commission for non-cash payments legal. persons: 0, 18 and 78 rub. depending on the tariff.

- Possibility of transferring physical to persons on regular bank cards/accounts (commission) - no information.

- Cash withdrawal through ATMs (commission): free withdrawal is not provided for the free tariff. On paid ones - up to 100,000 and 700,000 rubles. for free. The maximum withdrawal amount is $15,000.

- Cash deposit: 0.1%, free at the maximum rate.

- The interest on the account balance is up to 5%.

You can open a current account at bank website.

A small conclusion on the bank's proposal. Expert Bank is the largest in the Omsk region and has branches in several cities of Russia. There is a free tariff, online account reservation, the bank does not limit the volume of payments, offers a modern Internet bank and increased limits on cash withdrawals from corporate cards. When making an advance payment for service, you can get a 10% discount.

Current account in Promsvyazbank

- The cost of opening a current account is 0 rubles.

- Maintenance cost (monthly) - from 0 to 2,290 rubles. depending on the tariff.

- Account opening time - 1 day, reservation 10 minutes in advance on the official website when submitting an online application.

- Internet banking (availability and cost) - yes, free.

- Mobile bank (availability and cost) - yes, free.

- SMS notification (availability and cost) - yes, from 0 to 199 rubles. depending on the tariff.

- Operating day - from 9.00 to 21.00.

- Commission for non-cash payments legal. persons - from 3 to 200 pcs. free, over the limit - from 19 to 110 rubles. depending on the tariff.

- Possibility of transferring physical to persons on regular bank cards/accounts (commission) - yes, from 0.1 to 10% depending on the amount. An additional charge ranges from 18 to 350 rubles. depending on the tariff.

- Cash withdrawal through ATMs (commission) - 1.2% on average;

- Number of free plastic cards - all cards are paid. You can produce any quantity costing from 200 to 990 rubles. per month per card.

- Synchronization with online accounting “My Business” and “Elba”, etc. - yes! And what’s more, when you open an account, you get 3 months of accounting as a gift.

You can read the terms and open an account at official website of Promsvyazbank.

A small conclusion on the bank's proposal. Promsvyazbank is a systemically important bank in the Russian Federation, which indicates its reliability. Moreover, in recent years the bank has become more modern and is constantly developing. Definitely, he deserves you to open a current account with him!

- The cost of opening a current account is free.

- Cost of service (monthly) - from 0 to 8,000 depending on the tariff.

- Terms for opening an account - the account will be ready in 5 minutes, complete registration - 1 day.

- Internet banking (availability and cost) - yes, included in the price.

- Mobile bank (availability and cost) - yes, included in the price.

- SMS notification (availability and cost) - yes, at the maximum tariff - free, at the rest - 60 rubles. for each card.

- Operating day - from 09.00 to 18.00 Moscow time.

- Commission for non-cash payments legal. persons: free - 3, 5, 10, 50 and 100 pcs. depending on the tariff. Over the limit - from 16 to 100 rubles.

- Possibility of transferring physical to persons on regular bank cards/accounts (commission) - yes. For LLC - 0.5%. At the maximum tariff RUB 300,000. free, then 1.5%. For individual entrepreneurs - 150,000 rubles. free, then 1%. At the maximum tariff - 300,000 rubles. free, then 1.5%.

- Cash withdrawal through ATMs (commission): at a free rate of 3%, at a maximum rate - 500,000 rubles. free, then 1.4%. At other tariffs - 1.4%.

- Cash deposit: on a free tariff - from 0.15 to 0.36% depending on the tariff and amount. You can deposit from 50,000 to 500,000 rubles for free. With the free plan, you can deposit cash only with a commission.

- The number of free plastic cards is up to 5. Free service only in the first year. From the second - 2,500 per year.

- Synchronization with online accounting “My Business”, “Elba”, etc. is available.

- The interest on the account balance is up to 3%.

You can open a current account at bank website.

A small conclusion on the bank's proposal. Not long ago, Sberbank developed a new line of tariffs, and now entrepreneurs have access to a free package of services. The bank holds promotions for new clients, so you can get 1 or 3 months of service as a gift. Each tariff provides free payments, and if you open a savings account, interest will be charged on the account balance.

Open a current account with Alfa Bank

- 0 rub. opening an account and connecting to Internet banking.

- 0 rub. Internet banking and mobile banking for account management.

- 0 rub. issuing a business card for depositing and withdrawing cash at any ATM.

- 0 rub. tax and budget payments.

- Maintenance cost (monthly) - from 490 rubles. up to 9,900 per month.

- Commission for non-cash payments legal. individuals - from 3 payments to 30 payments free of charge. At the maximum tariff, all payments are 0 rubles. Over the limit - from 16 to 50 rubles. depending on the tariff.

- Possibility of transferring physical to persons on regular bank cards/accounts (commission) - yes. From 100,000 to 500,000 rub. free depending on the tariff. Over the limit - from 1 to 10% depending on the tariff.

- Cash withdrawal through ATMs (commission) - from 50 to 500,000 rubles. free depending on the tariff, over the limit - from 1 to 10%.

- There is synchronization with online accounting “My Business” and “Elba”, etc.

- There is no interest on the account balance, but you can get cashback on taxes of up to 3%.

Additional bonuses:

- 3,000 rub. for advertising on Google.

- 9,000 rub. for advertising in Yandex.

- up to 50,000 rub. for promotion on social networks.

- Access to all working tools “Bitrix24”, “My Business”, “Contour” for six months free of charge.

- Certificate for recruitment in HeadHunter.

You can open a current account at bank website.

A small conclusion on the bank's proposal. Just like in Sberbank, you can choose for reliability. But the tariffs are less favorable than in Sberbank: there is no free tariff, a small number of free payments and high commissions for physical transfers. persons. Among the advantages of the bank: cashback on taxes, gift certificates for partner services and convenient online banking.

Current account in LOCKO-Bank

- The cost of opening a current account is free.

- Maintenance cost (monthly) - 0, 990, 4,990 rubles. depending on the tariff.

- Terms for opening an account - reservation within a minute, full registration - within 24 hours.

- Internet banking (availability and cost) - yes, free.

- Mobile bank (availability and cost) - yes, free.

- SMS notification (availability and cost) - yes, from 150 to 250 rubles. per month, at the maximum tariff - free.

- Operating day - from 9.00 to 19.00.

- Commission for non-cash payments legal. persons - 19, 29 and 59 rubles. depending on the tariff.

- Possibility of transferring physical persons to ordinary bank cards/accounts (commission) - yes, for individual entrepreneurs up to 150,000 rubles. to your account for free, in other cases for individual entrepreneurs and LLCs with a commission from 2 to 10% depending on the amount.

- Cash deposit - from 0.07 to 0.3% depending on the amount and tariff. At the maximum tariff there is a free deposit.

- There is synchronization with online accounting “My Business” and “Elba”, etc.

- There is no interest on the account balance.

You can submit an application and open an account at official website of Loko-Bank.

A small conclusion on the bank's proposal. Loko-Bank offers a free tariff, functional mobile and Internet banking. There is fast online account reservation. But in terms of the cost of SMS information and payments, the bank loses to its competitors.

Current account at Eastern Bank

- The cost of opening a current account is free.

- Maintenance cost (monthly) - from 490 to 9,990 rubles. depending on the tariff.

- Account opening time: reservation within 5 minutes, full registration within 24 hours.

- Internet banking (availability and cost) - yes, free.

- Mobile bank (availability and cost) - yes, free.

- SMS notification (availability and cost) - yes, free. Extended version - 250 rub. for the first issue, 100 rubles. - for the next 2.

- Operating day - from 9.00 to 23.00.

- Commission for non-cash payments legal. individuals - 5 and 20 payments free of charge, above the norm - from 16 rubles. There are plans with free payments.

- Possibility of transferring physical to persons on regular bank cards/accounts (commission) - yes, up to 150,000 rubles. free, up to 500,000 rub. — 0.5%, over 500,000 rub. - 1%.

- Cash withdrawal through ATMs (commission) - no information.

- Depositing cash is free.

- Number of free plastic cards - no information.

- There is synchronization with online accounting “My Business” and “Elba”, etc.

- There is no interest on the account balance.

You can find out detailed tariffs and open an account at official website of Vostochny Bank.

A small conclusion on the bank's proposal. Vostochny Bank offers free account reservation, full-fledged Internet banking and extended operating hours. You can transfer money to a personal card without commission, and the cost of payment is one of the lowest among banks.

Current account in DeloBank

DeloBank is a service from the well-known SKB Bank, which has been successfully operating in the banking services market for a long time.

- The cost of opening a current account is free.

- Cost of service (monthly) - depending on the tariff, from about to 7590 rubles.

- Account opening time - you can use it in 10 minutes, and complete registration - 1 day.

- Internet banking (availability and cost) - yes, free.

- Mobile bank (availability and cost) - yes, free.

- SMS notification (availability and cost) - yes, free.

- Operating day - from 09.00 to 21.00 Moscow time.

- Commission for non-cash payments legal. persons: on the free tariff, all payments are 87 rubles, on the rest there are 10, 100 and an unlimited number of free payments depending on the tariff, payments over the limit - 25 rubles.

- Possibility of transferring physical to persons on regular bank cards/accounts (commission) - up to RUR 50,999.99. free, then with a commission, above - from 1 to 10% depending on the amount.

- Cash withdrawal through ATMs (commission): 2% at SKB Bank and partner ATMs, 3% at other ATMs.

- Cash deposit: up to 50,000, 200,000 rub. free depending on the tariff, at the maximum tariff unlimited amounts are free, over the limit - from 0.1 to 0.3% depending on the tariff.

- The number of free plastic cards is 1.

- Synchronization with online accounting “My Business”, “Elba”, etc. is available.

- The interest on the account balance is up to 5%.

You can open a current account at bank website.

A small conclusion on the bank's proposal. DeloBank is a new online branch of SKB Bank with a convenient personal account. There is a free tariff, interest on the balance, you can deposit cash and transfer money to individual accounts for free. persons Depending on the connected tariff, you can get 1 or 2 months of service as a gift. And if you pay in advance, DeloBank will provide a discount from 5 to 20%.

Conclusion

If you are just starting out or have a micro-business with a small turnover, then the following are ideal for you:

- Modulbank(free plan).

- Dot(cool service).

- Tinkoff Bank(free 2 months and cheap tariff 490 RUR).

- (there is a free plan).

- (there is a free plan).

If you really like to choose, you can open accounts in both and compare for yourself which is better. It's free anyway ;)

If your turnover is higher (from 1 million rubles per month), then you can use the first 4 (Tinkoff, Modulbank, Expert Bank and Tochka), and you can also consider:

- Promsvyazbank.

- Alfa Bank.

- Sberbank.

- Oriental.

Conclusion

In conclusion, I want to say that the choice is yours. Personally, I believe that the future belongs to technology companies. If you have your own evaluation criteria, write in the comments, you can also suggest other banks for review, but only if they are really better in terms of conditions than those listed in the article. I would also like to ask you to write reviews about the banks where you have current accounts, what you like, what you don’t like, etc.

I hope that the article helped you in choosing a bank to open a current account for an individual entrepreneur or LLC.

Which bank to open a current account for an individual entrepreneur or LLC - some of the best banks for cash settlement services for small businesses in Russia

You can open a current account for an individual entrepreneur or LLC in any Russian bank, the only difference is in the tariffs, conditions, quality of work and reliability of the banks themselves. Next, we selected several of the most popular banks for opening a bank account among entrepreneurs; these banks are among the TOP most reliable banks in Russia.

Important! The cost of cash settlement services (CSS) in banks may differ from the cost presented on the official websites of banks, depending on the region and due to temporary promotions. You can get up-to-date information on cash settlement services by clicking on the link in the description of each bank.

What are the best banks to open a current account?

List of banks where you can open a current account and not worry about reliability.

Sberbank is the largest, but also the most expensive bank in providing settlement and cash services for individual entrepreneurs and LLCs. The cost of maintaining a current account with Sberbank differs for each region, but you can now open a current account for an individual entrepreneur or LLC with Sberbank for free.

Sberbank also launched free RKO tariff for 1 year, which includes monthly 3 free interbank payments and an unlimited number of domestic ones. The cost of interbank banking over the limit is 100 rubles per payment.

The remaining tariffs of Sberbank cash settlement services are as follows:

- "Good season" for 490 rubles includes 5 free payments, both interbank and domestic, then 49 rubles per payment;

- "Good profit" for 990 rubles per month includes 10 of the same payments, then 49 rubles per payment;

- "Active settlements" for 2,490 rubles per month includes 50 payments, then 16 rubles per payment;

- "Active settlements" for 8,600 rubles per month includes an unlimited number of free domestic payments and 100 interbank payments, then 100 rubles per payment.

Novice entrepreneurs previously ignored it due to the high cost of banking services at Sberbank, but thanks to the free tariff, this bank has become interesting to novice businessmen.

Alfa-Bank is currently running a promotion: a 25% discount on cash settlement services. You pay for 9 months of cash settlement services at once, the bank gives you another 3 months of service, thereby making the current account cheaper for you by 25%. To take advantage of the promotion, submit now.

According to the study “Business Banking Feers Rank 2016” from Markswebb Rank & Report analysts, it is among the TOP 3 most profitable banks for cash settlement services for small businesses.

You can open a current account with UBRD for free, the cost of servicing the account starts from 500 rubles per month, however, there are also free trial options for up to 6 months, but they are provided as part of the purchase of a service package.

The cost of an online interbank payment at UBRD is 25 rubles, intrabank payments are free; using a paper copy of the payment document – 70 rubles, intrabank using “paper” – 20 rubles.

The cost of acquiring (a terminal for paying with Visa, MasterCard and other bank cards) at UBRD ranges from 1.6% to 2.5% of the payment amount, the percentage depends on the turnover and type of terminal.

The main advantage of cash settlement services at Tinkoff Bank is accrual of interest on the balance on the current account - up to 6% per annum, and free interbank for individual entrepreneurs and LLCs(on the “Advanced” tariff). It is worth noting the increased working hours of the bank for making payments - the bank carries out interbank payments daily from 1 am to 20 pm, and he has very few competitors in this.

Opening a bank account for an individual entrepreneur or LLC at Tinkoff Bank is free and does not require a visit to the bank, and the cost of service depends on the tariff, of which there are two:

490 rubles per month for the “Simple” tariff. In this case, an interbank transfer will cost 49 rubles, and the interest on the balance will be 6% per annum.

It is important to note this tariff for young individual entrepreneurs, since the bank does not charge a fee for servicing a current account if there is no turnover for the month, and the first 6 months of service are free in any case.

990 rubles per month for the “Advanced” tariff. The cost of interbank banking will be only 29 rubles per transfer or 990 rubles per month for an unlimited number of transfers - taking into account monthly services, this 1,980 rubles per month, and no payments for interbank online transfers.

The interest on the account balance is 8% per annum.

Promotion! The first 2 months of cash settlement services at Tinkoff Bank on this tariff are free for everyone.

According to Markswebb Rank & Report, Modulbank is one of the top three banks for cash settlement services for small businesses, one of the most popular banks among entrepreneurs, a competitor to Tinkoff and Tochka banks.

Individual entrepreneurs and LLCs can open a current account with Modulbank using one of three tariffs:

"Strat" - RKO with free service, but the cost of an online interbank payment is 90 rubles.

"Optimal" – 490 rubles per month, the cost of interbank transfer is only 19 rubles per transfer. In addition, the entrepreneur will receive 3% per annum to the current account balance.

"Unlimited" - 4,900 rubles per month for RKO and free interbank. Interest is accrued on the current account balance in the amount of 5% per annum.

Intrabank payments are free on all tariffs.

Let us add that the cost of a trading terminal for accepting payments by bank cards is from 24,500 rubles, the commission on the payment will be 1.9%.

Otkritie is one of the leading banks in terms of reliability. The cost of settlement services in a given bank varies depending on the region, for example in St. Petersburg it will be 1,100 rubles per month.

When you open a current account with Otkritie Bank, you will receive 3 months free service and 3 months of free access to the Rostender system.

Also, your products and services will be available on openplatforma.ru, which will allow you to expand your customer base.

Lokobank (CB LOCKO-Bank) - a bank from the TOP-100 banks in Russia offers opening a current account using an INN. By submitting an online application with your TIN, the bank will open your account in just a minute. You can then provide the bank with the necessary documents at a convenient time, and the manager will come to you himself.

Important! For clients who open an account, an acquiring terminal is given as a gift.

LOCKO-Bank has 3 tariffs:

"Start" for 0 rubles per month and interbank payment for 59 rubles.

"Optima" for 990 rubles per month, interbank costs 29 rubles.

“Unlimited” for 4,990 rubles per month, payments to another bank – 19 rubles.

When paying for settlement services for 3 or more months, the bank gives a discount from 5 to 25 percent.

Opening a current account with Somcombank is free, service is provided at a wide range of tariffs:

“Starter” - 650 rubles per month, the cost of one interbank payment is 25 rubles (5 payments are free), cash withdrawal without commission - up to 100,000 rubles per month, over - 2%.

“Remote” – 1,150 rubles per month, the cost of one interbank payment – 18 rubles, cash withdrawal without commission – up to 100,000 rubles per month, over – 2%.

“Personal” – 1,850 rubles per month, interbank – 15 rubles, cash withdrawal without commission – up to 100,000 rubles per month, over – 2%.

“Profitable” - a tariff for 3,000 rubles per month with an accrual of 7% on the balance, interbank - 15 rubles per payment, cash withdrawal without commission - up to 100,000 rubles per month, above - 2%.

Bank package rates:

“Starter-Package” – 2,450 rubles per month, which includes 20 prepaid online payments. Electronic interbank over the limit costs 25 rubles per payment, the commission for cash withdrawal is from 2%, while 100,000 rubles per month can be withdrawn without commission.

“Remote-Package” – 3,600 rubles per month, which includes 50 prepaid online payments. Electronic interbank payment over the limit costs 18 rubles, the commission for cash issuance is from 2%, while 200,000 rubles per month can be withdrawn without commission.

“Remote-Package” – 4,650 rubles per month ( 80 prepaid interbank online payments, then 15 rubles per payment). The commission for cash withdrawal starts from 2.5%, while 300,000 rubles per month can be withdrawn without commission.

The operating day at Sovcombank begins at 01-00 and ends at 19-00.

And he has the right to make only cash payments, observing the established limit of 100 thousand rubles. However, by working in this way, you deprive customers and clients of the opportunity to pay by card or online, and you deprive yourself of the convenience of managing your money. There is an abundance of offers in the financial market, and we decided to figure out which bank is better to open a current account for individual entrepreneurs in 2019.

Criteria for choosing a bank for individual entrepreneurs

What should be the best bank to open an individual entrepreneur account? Reliable, easy to use and inexpensive to maintain. But that is not all. A typical entrepreneur's business is a retail outlet where most customers pay in cash. At the same time, payments with suppliers are carried out, as a rule, by bank transfer. Accordingly, the commission percentage when depositing cash into the account should be profitable.

Another important issue for an entrepreneur is the ability to transfer money for personal needs without extra costs. A good way to avoid paying commissions for cash withdrawals is to apply for a card in your name as an individual. If such a card is opened in the same banking institution where the individual entrepreneur’s account is, then no transfer fee is charged. The main thing is that the owner of the card is the entrepreneur himself, and not his spouse, for example.

In our opinion, the best bank for individual entrepreneurs must meet the following necessary criteria:

- Enter . Since 2014, entrepreneurs have been equated to ordinary individuals. This means that if a bank’s license is revoked, they are guaranteed a refund, but not more than 1,400,000 rubles. In this sense, an individual entrepreneur is in a better position than an LLC, because such a guarantee does not apply to organizations.

- Offer different tariff packages of services and special loan products. It is important for small businesses to be able to choose only the services they need, so as not to incur unnecessary costs. Many banks offer inexpensive tariff plans, within which a limited number of payments are made; restrictions may also apply to the amount of turnover per month or year.

- Allow you to carry out transactions on your current account from any device connected to the Internet. When it comes to convenience, the online payment feature is the main criterion when choosing the best bank for small businesses.

Less significant, but also important signs of the best bank include the cost of opening a current account, the speed of transactions, the presence of many branches and branches in different cities.

To select a current account, try our bank tariff calculator:

Are you planning to open your own business? Don't forget to reserve your current account. To select a current account, try our bank tariff calculator:

The calculator will select the most advantageous bank offer for settlement and cash services for your business. Enter the volume of transactions you plan to make per month, and the calculator will show the tariffs of banks with suitable conditions.

Our rating of the best banks for individual entrepreneurs in 2019

International and Russian rating agencies compile ratings based on financial indicators: assets, profit, creditworthiness. Of course, a good bank should not only offer clients favorable conditions, but also take care of its financial stability. When compiling our rating, we took into account the opinion of professional experts, customer reviews and the criteria discussed above for choosing the best bank for individual entrepreneurs.

From the top 30 banks according to the banki.ru portal (the rating is compiled using public reporting on the Central Bank website), we selected five institutions in which we recommend opening an individual entrepreneur account in 2019.

Tinkoff Bank. It takes first place in the Business Banking Fees Rank 2017 in terms of the cost of servicing Individual Entrepreneurs and first place in terms of the cost of servicing B2B services. Second place in the independent national rating of banks on banki.ru for quality of services. Ideal for beginning entrepreneurs and for all those who are not ready to spend heavily on banking services.

Tinkoff Bank ready to offer to users of our website as part of the loyalty program 7 months free service for new individual entrepreneurs (registration less than six months ago).

Alfa Bank. Main areas: full range of settlement services, corporate and investment business, leasing and factoring, trade finance. Our users, having opened an account here, receive additional bonuses: a promo code for advertising in Yandex.Direct, a free month of Beeline communications, a gift certificate for recruiting from HeadHunter.

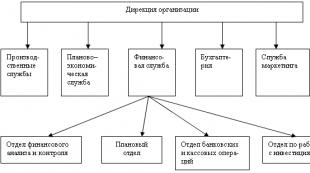

![]()

Bank opening. The bank has been operating in the financial market since 1993 and is included in the list of systemically important credit institutions in Russia. Serves 2.7 million individuals and about 190 thousand legal entities. Present in 61 regions of the Russian Federation, has 442 offices. Supports beginners and experienced participants in foreign economic activity, accompanies and finances foreign trade contracts on favorable terms.

Sberbank. The largest credit institution in Russia, with a reputation as the most reliable bank. In recent years, it has been actively working to improve its service, which has allowed it to receive the title of the bank with the best customer support of 2015 according to banki.ru.

![]()

VTB. A bank with state participation, which enjoys special trust from individuals. According to all significant indicators, it is consistently included in the TOP 5 banks in Russia. For small businesses participating in government procurement, the bank provides guarantees to secure obligations under contracts.

Comparison of RKO tariffs

The more transactions are carried out on the account, the higher the cost of servicing. Let's see what expenses an individual entrepreneur will have when maintaining an account in the top five banks.

Bank and | Alpha | Tinkoff Bank | Sberbank | VTB "Start" | Opening |

|---|---|---|---|---|---|

Opening an account | Card certification 450 rub. | Card certification 200 rub. | |||

Service per month | 0* | 0 | 1000 rub. | 0 | |

Cost of electronic payment | 3 payments free, then 49 rubles. | up to 3 payments free, then 100r | up to 5 payments are free, then 100 rubles. | up to 3 payments free, then 79 rub. | |

Transfer for personal needs of individual entrepreneurs | Up to 150,000 rub. per month free of charge, then 1%, not less than 100 rubles. | Up to 400,000 rub. free per month, then 1.5%, but not less than 99 rubles. | Up to 150,000 rub. free per month, then 1% | 1% of the amount up to RUB 600,000, then from 3% | |

Refill | 0.3%, minimum 290 rub. |

(*) If an entrepreneur opens an account with Tinkoff Bank as part of the loyalty program.

Updated: 2019-3-26

Oleg Lazhechnikov

90Since I once registered an individual entrepreneur (), I also have to use a separate bank account for business activities. I have already written general information, and in this post I would like to post a small comparison of tariffs of various banks, including those recommended in the comments.

We will mainly talk about Moscow banks, but they are often represented in the regions, and their tariffs will be lower.

Due to the unstable economic situation in the country and the revocation of licenses from banks, there is an opinion that it is better to choose top and large banks, so that later you do not have to pull money out of small ones through the DIA (individual entrepreneurs’ accounts are insured up to 1.4 million rubles). But I wouldn’t say that it’s difficult, it’s just that the money will be “frozen” for some time. Alternatively, you can simply not keep large amounts in the individual entrepreneur’s account and withdraw them immediately.

And, for that matter, to really not worry at all, you need to open an account with Alfabank/Sberbank, nothing will happen to them. So see for yourself. The larger and more reliable the bank, the higher your service costs will be. But if you have a big business, then all these commissions against the background of the company’s turnover will be peanuts.

Tinkoff

After the Module worsened the tariffs (the first 2 months are free) it began to look more attractive, and besides, it is still a much larger bank.

Opening an account, connecting to Internet banking, sending a representative to your office/apartment is free. A very long operating day, from 1 am to 8 pm, inside the bank around the clock. This is convenient for me; sometimes I do translations in the evening. Intra-bank transfers to individual and company accounts are free.

I have "Simple" tariff— 490 rub/month. SMS notification on the account - 99 rubles/month, if there is an operation 4% on the balance. The first 3 external payments to the accounts of individual entrepreneurs and companies are free, then 49 rubles each. But there is an ambush with payments to individuals - 1.5% of the amount (plus 99 rubles) within 400 thousand rubles, for larger amounts the commission is higher. But if we are talking about transfers to yourself, then you can transfer up to 150 thousand rubles/month to your Tinkoff Black debit card for free, and 250 thousand rubles/month to a credit card. Or a total of 400 thousand rubles per month. IMHO quite enough.

Tariff "Advanced"— 1990 rub/month. SMS notification on the account - 99 rubles/month, if there is an operation 6% on the balance. The first 10 external payments to the accounts of individual entrepreneurs and companies are free, then 29 rubles each. Payments to individuals - 1% of the amount (plus 79 rubles) within 400 thousand rubles, for larger amounts the commission is higher. But if we are talking about transfers to yourself, then you can transfer up to 300 thousand rubles/month to your Tinkoff Black debit card for free, and 400 thousand rubles/month to a credit card. Or a total of 700 thousand rubles per month.

Tariff "Professional"— 4990 rub/month.

Cash withdrawal from the card is 1.5% up to 400 thousand rubles/month in the Simple tariff and 1% up to 400 thousand rubles/month in the Advanced tariff. Card with a separate account and free service.

Thus, if you do not want to make Tinkoff bank cards for yourself, or you have physicists on your payroll, then you need to look for something else. For example, with good tariffs. And the tariffs are easier to understand.

Currency transfers

Maintaining foreign currency accounts is free. You can transfer currency to an individual’s account within Tinkoff to avoid commissions on transfers to other banks. But the limits on transfers and commissions will be the same as for ruble transfers, as stated above.

For the “Simple” tariff. Currency control - 0.2% of the amount (minimum 490 rubles). External transfer 0.2% of the transfer amount, minimum 49 cu.

For the "Advanced" tariff. Currency control - 0.15% of the amount (minimum 290 rubles). External transfer 0.15% of the transfer amount, minimum 29 cu.

Modulbank

Tariff "Start"— 0 rub/month, payment for legal entities 90 rub, payment for individuals 0.75% (but not less than 90 rub) within 300 thousand rubles (hereinafter 1%). Suitable for those who have almost no operations at all, I do not consider it at all.

Tariff "Optimal"— 690 rubles/month, but if you pay for the year at once, it will be 4650 rubles (388 rubles/month) instead of 8280 rubles. They give 3% on the balance, payment for legal entities and individual entrepreneurs - 19 rubles, payment for individuals - 19 rubles within 500 thousand rubles / month (hereinafter 1%). I have this tariff, IMHO it is the most successful. By the way, you can pay 9,990 rubles one-time and then use it as much as you like until the first tariff change. He'll finish in 2 years.

Is there some more tariff "Unlimited" for 4900 rubles per month.

They provide a free card for withdrawing and depositing cash. She has her own separate account. There are limits and withdrawal fees depending on the tariff and withdrawal amount. Depositing at certain ATMs is free. But I don’t use a card, I’m used to withdrawing it to an individual’s account in another bank.

Currency transfers

Servicing a foreign currency account is free. Transaction passport for Optimal and Unlimited tariffs is free. For currency control they charge 300 rubles for a payment within 500 thousand rubles (in equivalent) and 1000 rubles if from 500 thousand rubles to 1 million.

Currency transfer to an individual to another bank 30 dollars, 30 euros or 150 yuan (yes, there are accounts in yuan), up to 500 thousand/1 million rubles per month (Optimal/Unlimited). If more, then 1%. Something like that. Considering that they do not serve physicists and the currency will have to be transferred to another bank anyway. In this regard, it is more convenient when an individual has an account with the same bank, because intrabank payments are usually free. But if you don’t need currency, you can convert it into rubles inside the Module; their currency exchange rate is: exchange rate +/- 1%.

I have also written more than once that the Module has a minus in terms of foreign currency payments, that their intermediary bank takes $15 from some payments. In theory, this should depend on how exactly the non-resident counterparty sends them, shifting the entire commission to the recipient or paying part of it on its side. But previously there was no commission for the same payments (I received it in another bank), they only appeared in the Module.

Commissions for foreign exchange transactions

Tochka bank

Tariff “All the best at once”— 2,500 rubles/month (the first 3 months are 500 rubles each), includes 100 payments in favor of individual entrepreneurs and legal entities, free transfers to an individual’s account up to 500,000 rubles (hereinafter 0.5%). Cash withdrawals up to RUB 100,000 are free. They give 2% cashback on taxes.

Opening a foreign currency account is free, maintaining it is also free. Currency control 0.15% of the transfer amount, but not less than 350 rubles. There is a paid tariff, there is a slightly lower percentage. Outgoing currency payment is 25 cu for the “All the best at once” tariff and 30 cu for the rest.

Alfa Bank

The bank is from the TOP 10, that is, one of the most.

Free: opening ruble and foreign currency accounts, connecting to Internet banking, mobile application, issuing a bank card and transfers to legal entities and individual entrepreneurs within Alfabank, SMS alerts. If there are no transactions in the current month on the “One percent” and “To start” tariffs, then no service fee is charged. A representative can come to your office or home.

Long operating day, like Tinkoff: from 1:00 a.m. to 7:50 p.m., inside the bank around the clock.

Tariff "One percent". Everything is free, including SMS alerts. Pay only 1% on all receipts. Tochka has exactly the same tariff. Great for small IPs with low speeds. No income - don't pay anything. Opening a foreign currency account is not available.

Tariff "To start". Account maintenance is 490 rubles/month, or free if there are no transactions. 3 external payments for individual entrepreneurs and legal entities free of charge, then 50 rubles. Internal and external transfers to individual accounts are free up to 100 thousand rubles, 1% up to 500 thousand and 1.5% up to 2 million.

Tariff "Electronic". Account maintenance 1440 rub/month. When you pay for 9 months, you immediately get another 3 months as a gift. Certification of a card with a sample signature - 590 rubles. External payments to individual entrepreneurs and legal entities cost 16 rubles. Internal and external transfers to individual accounts are free up to 150 thousand rubles, 1% up to 300 thousand, 1.5% up to 1 million, and then the commission increases as the amount increases.

There are also several more expensive plans. There is a fairly wide range of tariffs, but there are too many conditions, it’s difficult to understand right away.

To withdraw cash, they give you a free Alfa-Cash card (In, Ultra, FIFA) linked to your main current account. Annual service is free for the Alfa-Cash In card (only for cash deposits) and 299 rubles/month for the Ultra card. Cash withdrawal at the “One percent” tariff up to 1.5 million is free. Cash withdrawal up to 100 thousand rubles/month - 1.25% on the “To start” tariff (min. 129 rubles) and 1.5% on the “Electronic” tariff (min. 200 rubles). The larger the withdrawal amount, the higher the commission. Depositing cash into a current account is 1% for the “One Percent” tariff, free for “Na Start” and 0.23% for “Electronic.

For currency control they want 600 rubles for each payment within 400 thousand rubles (in equivalent), then 0.15%. Monthly servicing of a foreign currency account is free on the “To start” tariff and 1,440 rubles/month on the “Electronic” tariff. Within Alfbank, all currency transfers are free for the “At Start” tariff. For the “Electronic” tariff, internal transfers are free only to the accounts of individual entrepreneurs and legal entities, and payments to individuals within the bank or to other banks are 1% (min. 900 rubles). Both tariffs charge 0.25% for external transfers (minimum 57 dollars or 43 euros, maximum 228 dollars or 174 euros).

Raiffeisen

The minimum “Start” package costs 990 rubles/month, there is a discount for paying annually. The package includes free account opening and maintenance. Payments for 25 rubles, transfers to individuals within 100,000 rubles without commission, then 1%. They issue a free card for your account, servicing the “Business 24/7 Basic” card costs 90 rubles/month. SMS notification - 199 rubles/month.

Without package: opening a ruble/currency account 1,700 rubles, maintaining a ruble/currency account 950 rubles/$25 per month. Transfer to an individual in Raiffeisen without commission, transfer to an individual in another bank 0.1%, but minimum $40.

Sberbank

Opening an account costs 2,400 rubles, but if your revenue is up to 1.8 million per year and you want a loan, then 700 rubles. Internet banking connection RUB 960. These were all one-time expenses, let's move on to monthly ones. Account maintenance is 700 rubles/month, fee for using Sberbank Business Online is 650 rubles/month, payment fee is 30 rubles.

Opening a foreign currency account 2400 rubles, maintaining a foreign currency account 600 rubles/month. Currency control 0.15% of the amount, minimum 10 cu.

These were the general tariffs for cash and service services. But there are also service packages. For example, “Minimum” 1500 rubles/month - ruble account + Internet bank + 5 payments. It is not difficult to calculate that everything will be approximately the same without the package. If you pay for several months, there will be a small discount.

Promsvyazbank

USB key costs 1,500 rubles, only with it you can use the PSB On-Line Internet bank. The minimum tariff “Business Light” is 1050 rubles/month, opening an account is 590 rubles, payment is 45 rubles. The “My Business” tariff is 1250 rubles/month, it immediately includes bank services, a payment card of 45 rubles, opening an account is free. They give a discount if you pay for several months. Currency control 0.15%, but not less than 750 rubles. SMS notification 199 rub/month.

Why did they come up with this problem with a USB key... For me, it’s immediately impossible to use, carry a flash drive around different countries, God forbid you lose it.

Vanguard

Opening an account 1000 rubles (if the application is through the website), maintaining a ruble account 900 rubles/month, maintaining a foreign currency account 500 rubles/month, payment 25 rubles or $30 for bucks, currency control 0.075% (min 400 rubles).

In Avangard, one thing worth knowing is that the money received does not need to be withdrawn to your personal account on the same day, otherwise there will be a commission. You just have to make it a rule to make a delay of at least one day before withdrawal.

UBRD

Free account opening, Internet banking and manager visit. The minimum Economy tariff is 500 rubles/month, the payment fee is 25 rubles, but to activate the package you need to pay another 750 rubles one-time. Tariff “Online” - 800 rubles/month, payment plan 25 rubles, connection is free. The difference between these tariffs is that “Online” payments are made around the clock.

Personal experience

Agree, I wouldn’t be able to compare these two banks if I didn’t use Tinkoff too, it wouldn’t be fair :)

I now have 2 current accounts (Module and Tinkoff). So far I’m using two, but I’m going to switch to Tinkoff, since I have individual cards there. I'll try to compare the most basic points.

- Tinkoff is a larger bank and is ahead in terms of financial indicators. It is included in the people's TOP, but Modulbank is not included.

- Tinkoff has accounts for individuals, and for those who have bank cards like , it will be very convenient for them to receive money on them instantly and without commissions. Modulbank does not work with individuals; it will only have an individual entrepreneur account.

- Tinkoff has a tariff of 490 rubles/month. Modulbank has a free tariff, but there is a commission for transfers of 0.75% to individuals, so it would be more correct to compare with the Optimal tariff 388-690 rubles/month. So the same goes for the service. Tinkoff charges another 99 rubles/month for SMS, while Modul has them for free. But SMS is, in principle, an optional function.

- Tinkoff began opening foreign currency accounts in January 2017, but I didn’t open them, I can’t say anything. Currency control at Tinkoff is 0.2% of the amount (minimum 490 rubles), at Modulbank it is fixed 300 rubles for transactions up to 500 thousand and 1000 rubles for transactions 500 thousand - 1 million rubles. But the Module has such a problem - for some reason, a commission of 15 euros is taken from some payments along the way, for example, with Google Adsense. For a similar payment to another bank, there is no commission.

- Currency transfers from an individual entrepreneur's account to an individual's account will be free within Tinkoff Bank. In the Module, you will have to pay at least 30 euros for each currency transfer to your card in another bank.

- Both banks have remote support and you can find out any question via chat, as well as perform some actions.

My review of Tinkoff Business

To be honest, I initially wanted to go to , since I have been using their debit cards for many years. But they refused me without explanation. I assume there were some technical problems, because all this was at the very beginning, when they only offered services to legal entities and individual entrepreneurs. Then I opened an account with Modulbank (more about it below), but six months later I once again applied to open an account with Tinkoff, and they gave the go-ahead! So keep in mind that if you want to go to Tinkoff, but were turned down, you can try again after a few more months.

I have a small individual entrepreneur and not many operations per month, so I didn’t want to pay decent amounts for services every month; it’s somehow stupid to overpay for it. Actually, for this reason I did not consider top banks, there are no inexpensive tariffs there.

Tinkoff has a simple online bank that is intuitive. I don’t remember ever having any problems with him. Everything works perfectly! Lately I’ve been using their mobile app more and more often, you can do the same thing there. Somehow it even became more convenient from the phone. Tech support responds in chat with a slight delay, but always to the point. I’m really pleased with it and with a clear conscience I can recommend it to all my friends and subscribers.

Signature verification, online banking, and account opening were free, and a representative arrived at my home 3 days after I left the application. We filled out the paperwork in about 10 minutes and he left. It's great, of course, when you don't have to travel, as is often the case with other banks.

I can’t say anything about foreign currency accounts; I still have foreign currency accounts in Modulbank. Perhaps later I will completely switch to Tinkoff Business, but for now I’m too lazy to do all this, I use two banks.

My review of Modulbank

To be honest, when I opened an account with Modulbank, I didn’t expect anything special. You could say I opened it out of desperation (see review about Tinkoff). However, the bank turned out to be very convenient.

So far I’m happy with everything, no problems have arisen, not a single problem at all. The procedure for opening an account took about 30 minutes, although I had to go to their office in Moscow City (nowadays they come to their home or office). I didn’t pay anything for opening an account, certifying signatures, or connecting to Internet banking.

The Module has a fairly convenient and intuitive Internet bank, where you can always ask a question in an online chat. Sometimes they answer right away, sometimes you need to wait 10-20 minutes. At night they often reply that a specialist will answer during business hours the next day. But I corresponded a lot with the currency control, they only work during the day. I like that everything is very simple, and there is no such fuss about security as there was in the defunct Interactive Bank. There, I remember, you are tortured to confirm the operation with various codes and passwords, but here it’s just a text message and that’s it.

All foreign currency receipts are also very easy to process. I simply upload screenshots to the online chat, for example, from my Google Adsense personal account (only for the very first time you still need to send an offer). And then I don’t need to fill out a bunch of fields in the certificate of currency transaction, I don’t need to create an order for a transfer from a transit account to a regular one, all this is done automatically, I just need to enter the password from SMS. Again, I remember how it used to be in other banks, when I made a mistake (there are a lot of fields), they call and ask me to redo everything again. By the way, in Modulbank foreign currency accounts (dollar, euro, yuan) are opened without visiting the office, also through online chat.

Banks for those who use My Business

I won’t tell you about the tariffs; users of the service can go to this page themselves and find out everything. I wouldn’t consider all banks, but I’ve already made my choice - Tinkoff/Modulbank (I have 2 accounts).

P.S. I update the post whenever possible, but tariffs can change quite quickly, so be sure to check everything on the banks’ website, and write me comments so that I can also correct it myself.

Life hack 1 - how to buy good insurance

It’s incredibly difficult to choose insurance now, so I’m compiling a rating to help all travelers. To do this, I constantly monitor forums, study insurance contracts and use insurance myself.

Life hack 2 - how to find a hotel 20% cheaper

Thanks for reading

4,78

out of 5 (ratings: 69)

Comments (90 )

- If you are a new entrepreneur, look for a bank that offers a starter tariff plan. This is a minimum package of services, often servicing it costs 0 rubles.

- The bank must have a wide network of branches and ATMs so that you can go to the office or use an ATM to replenish or cash out your account at any time. In addition, you can consider banks that serve clients remotely.

- The service organization must offer a multifunctional Internet bank created specifically for small business clients. As a result, the entrepreneur will be able to conduct operations remotely, from anywhere.

- Variety of tariff plans. A business may expand, its needs may change, and you should be able to switch to a different tariff. To open a current account, it is advisable to choose a bank that offers at least 3 tariff options: starting, medium and for high turnover.

- Price of service and operations performed. It is clear that the service should not only be profitable, but also convenient. Therefore, first determine the needs of your business, and then look for a bank that will satisfy them at the lowest price.

- Offer additional products. It’s good if the chosen bank provides comprehensive services to entrepreneurs, that is, it is not limited to cash settlement services. The client may need to participate in a salary project, connect to acquiring, credit and deposit products - it is better to receive all these services from the servicing bank: it is both profitable and convenient.

- The bank must issue cards for businesses. These are debit payment instruments linked to the individual entrepreneur's current account. As a result, the client will be able to use the ATM to withdraw funds and replenish the account. These cards can be used for standard transactions in stores and on the Internet, and they can be used to pay abroad.

- The bank shouldn't have any problems. It participates in the deposit insurance system; global and national rating agencies assign it a good rating and call it stable.

- online booking service for account details in 5 minutes;

- To open a current account it is not necessary to go to the office; Sberbank provides the service of connecting to cash settlement services, including remotely;

- If an individual entrepreneur was registered more than six months ago, Sberbank does not charge a service fee for the first 2 months. The exception is the TP “Great Opportunities;

- bonuses from partners: Yandex, Vk, hh, myTarget;

- a business debit card is paid, its maintenance per year is 2,500 rubles;

- additional services: management of salary projects, insurance, loans, deposits, accounting, bank guarantees, acquiring, leasing, factoring, foreign trade activities, collection.

- if you pay a service fee for a year at once, 3 months of using the services will be free;

- the maximum favorable tariff plan “1%” for beginning entrepreneurs, the client pays only 1% for funds received into the account;

- the best online bank for business with the ability to conduct online accounting and integration with online accounting services;

- possibility of issuing a virtual card for business with free service;

- free issue and maintenance of a business card only at the “1%” tariff; for all others, issue will cost 199 rubles, monthly maintenance – 299 rubles;

- most tariffs include free cash withdrawal and account replenishment;

- additional services: loans, deposits, acquiring, management of salary projects, foreign trade activities, bank guarantees, service for issuing loans from private investors, cash desks.

- on all tariff plans, payments to the budget are made free of charge;

- there is a service - free assistance in registering a business;

- the SMS notification service is activated and provided free of charge;

- you can make a payment outside of business hours;

- additional services for business: lending, deposits, acquiring, salary projects, bank guarantees, foreign trade activities.

- Under the “Business Light” and “24/7” tariffs, the first three months are free of service fees. Another three months can be free if the client pays for the service for a year at once;

- a wide range of business cards, including Customs cards;

- 24/7 payments within Promsvyazbank.

- if you compare where it is more profitable to open an account for a new individual entrepreneur, you should consider the “First Step” tariff; the client incurs virtually no costs;

- free transfers to individuals at any tariff;

- issuing a business card is free, the fee for its maintenance is charged only from the 7th month - 149 rubles;

- reserve bank account details online in 2 minutes;

- additional services: loans (including with government support), bank guarantees, deposits, acquiring, salary accounts, bank guarantees, currency transactions, foreign trade activities, educational platform, etc.

- there is a connection fee for the “Test Drive” and “Premium” TPs, but three months of using the bank’s services will be free, and for subsequent months a low fee will be charged;

- provision of bonuses from UBRD partners: 1C, Promo Expert, hh, My Warehouse, etc.;

- range of standard additional services: acquiring, loans, deposits;

- additional services for business: consulting, remote business registration, provision of accounting and legal services, insurance, electronic document management, business meetings, etc.

- accrual on account balance 4-6% per annum;

- for the first two months there is no fee for servicing the “Simple” and “Advanced” tariff plans;

- on the “Simple” TP, no monthly fee is charged if the total monthly spending on the client’s corporate cards exceeds 50,000 rubles;

- for the “Advanced” TP there is no monthly fee if the total monthly spending on corporate cards exceeds 200,000 rubles;

- IP service is only remote, there are no offices;

- gifts from partners: Yandex, Google, Vk, myTarget;

- provision of a personal manager;

- instant account booking and remote opening;

- additional services: acquiring, online accounting, foreign trade activities, salary projects, bank guarantees, credit services, customer lending, call center, website builder, etc.

- Online service only, no offices;

- According to the “Optimal” tariff, there is no service fee if the individual entrepreneur immediately pays 9,900 rubles. When paying for services for 6 months, a 15% discount is provided, for a year - 20%;

- According to the “Unlimited” tariff, there is no service fee if the client immediately pays 99,000 rubles. When paying for services for six months - a 15% discount, for a year - 20%;

- accrual of up to 3-7% per annum on the client’s balance (except for the starting tariff);

- book an account online in 5 minutes;

- additional services: loans, deposit products, salary projects, acquiring, accounting services, foreign trade activities, cash desks.

- on the “All the best at once” TP, the first 3 months of using the services cost 500 rubles;

- remote service only;

- online banking integrates with any online accounting services;

- additional services: accounting services, acquiring, foreign trade activities, servicing payroll projects;

- discounts from numerous partners.

Anton

Anton

Igor

Andrey

Alexei

Eldar

Olga

Stanislav

Stanislav

Benjamin

Clemenso

Tatiana

Paul

ar86

Zhenya

Tolik

Anatoly

January 14, 2019 Individual entrepreneur taxes

There are dozens of financial organizations on the market offering settlement services to individual entrepreneurs, but not every service will be truly profitable and convenient. So that you can choose the best bank for small businesses, we analyzed the market and selected 9 optimal offers. These are organizations with favorable rates that are maximally focused on business needs.

Main criteria when choosing a servicing bank

By law, an entrepreneur is not obliged to conduct business, but a modern business cannot exist safely without banking support. Connecting to RKO significantly expands the list of possible partners. will be able to connect to acquiring - accept payments from cards, make financial transactions remotely, participate in tenders and much more. In addition, in the absence of an account, non-cash transactions in amount cannot exceed 100,000 rubles established by law.

When choosing where to open a current account for an individual entrepreneur, it is important to pay attention to the following points:

Below are banks for individual entrepreneurs that meet all these parameters. Maintaining an account in each of them will be profitable and convenient.

The best banks for cash settlement services

This is a rating of banks for individual entrepreneurs; it includes organizations offering the best products for small businesses. Their services are in demand; most individual entrepreneurs in the country are served by them. The rating includes both conventional banks with stationary offices and innovative ones that offer clients completely remote services.

Sberbank

Since most entrepreneurs primarily consider Sberbank, we will initially analyze its programs. The bank is truly ready to offer individual entrepreneurs high-quality, convenient and profitable services. 5 tariff plans have been developed for entrepreneurs.

Features of service at Sberbank:

Sberbank tariffs

| Rate | Payments to legal entities per month. | Citizens | Replenishment per month | Cash withdrawal per month |

| Easy start, no fees | 3 free, after 100 rub. | up to 150,000 rub. no commission | 0,15% | 3% |

| Good season, 490 rub. | 5 free, after 49 rub. | up to 150,000 rub. no commission | up to 50,000 rub. for free | 3% |

| Good income, 990 rubles. | 10 free, after 49 rub. | up to 150,000 rub. no commission | up to 100,000 rub. for free | 3% |

| Active payments, 2490 rub. | 50 free, after 16 rub. | up to 150,000 rub. no commission | up to 100,000 rub. for free | 3% |

| Great opportunities, 8600 rub. | 100 free, after 100 rub. external | up to 300,000 rub. no commission | up to 500,000 rub. for free | up to 500,000 rub. for free |

Alfa Bank

This bank is also often considered by entrepreneurs to connect to cash settlement services. When choosing where to open a current account for an individual entrepreneur, be sure to study its offers. An important advantage of Alfa Bank is its modern approach to work, innovative technologies; its Internet banking for business is recognized as the best in Russia.

Features of service at Alfa Bank:

Alfa Bank tariffs

| Rate | Payments to legal entities per month. | Citizens | Replenishment per month | Cash withdrawal per month |

| 1%, no fee | no fee | no fee | 1% | no fee |

| Electronic, 1400 rub. / 1080 rub. when paid annually | 16 rub. every | free up to 150,000 rub. | 0,23% | from 1.5% |

| Success, 2300 rub./1725 rub. when paid annually | 10 free, after 25 rub. | free up to 150,000 rub. | no fee | up to 50,000 rub. for free |

| Foreign trade activity, 3200 rubles/2400 rubles when paid annually | in rubles - 30 rubles, foreign currency - 0.25% | free up to 150,000 rub. | 0,28% | from 1.5% |

| Everything you need. 9900 rub./7425 rub. when paid annually | no fee | free up to RUB 500,000 | no fee | free up to RUB 500,000 |

VTB

Another large, stable and reliable bank for servicing entrepreneurs. VTB is a more conservative organization and offers classic services to small businesses.

Features of service at VTB:

VTB tariffs

Promsvyazbank

The bank works with any form and scale of business, and has developed a special starting tariff for beginning entrepreneurs. Promsvyazbank clients receive all the necessary financial services in one place.

Features of servicing individual entrepreneurs at Promsvyazbank:

Promsvyazbank tariffs

| Rate | Payments to legal entities per month. | Citizens | Replenishment per month | Cash withdrawal per month |

| Start, no fee. | 3 free, after 99 rub. | free up to 150,000 rub. | free up to RUB 30,000. | no fee |

| Business Light, 1050 rub. | free up to 75,000 rub. | from 0.15% | from 0.5% | |

| Business 24/7., 1600 rub. | 18-19 rub. | from 0.1% | from 0.25% | from 0.5% |

| My business, 1800 rubles. | 45 rub. for the first 5, then 110 rubles. | free up to 75,000 rub. | from 0.15% | from 0.5% |

| Business Check, 2290 rub. | 30 free, after 40 rub. | free up to RUB 75,000. | from 0.1% | from 0.5% |

Opening

Another large financial structure that actively works with business. The bank's offer for entrepreneurs includes 5 tariff plans and a full range of all possible financial products and business services. You can open an account both in rubles and in foreign currency.

Features of service at Otkritie Bank:

Otkritie Bank tariffs

| Rate | Payments to legal entities per month. | Citizens | Replenishment per month | Cash withdrawal per month |

| First step, 0 rub. | 3 free, after 100 rub. | up to 150,000 rub. for free | 0,15% | 0,99% |

| Fast growth, 490 rub. | 7 free, then 100 rub. | up to 150,000 rub. for free | 0,15% | 0,99% |

| Your own business, 1290 rub./860 rub. when paying for 3 months. | 15 free, then 25 rub. | up to 150,000 rub. for free | 0,15% | 0,99% |

| Whole world, 1990 rub./1327 rub. when paying for 3 months. | 15 free, then 25 rub. | up to 150,000 rub. for free | 0,15% | 0,99% |

| Open opportunities, 7990 RUR/5327 RUR. when paying for 3 months. | for free | up to 500,000 rub. for free | 0,15% | 0,99% |

UBRD

The bank adheres to modern trends, develops convenient service packages and online services. In addition to standard financial services, clients are offered a large list of additional ones. The UBRD tariff plan “Everything is simple” ranks first in terms of profitability among tariffs for small individual entrepreneurs. Internet bank Light was recognized as the best service for small businesses in 2018 - the rating was compiled by the Markswebb agency.

Features of servicing individual entrepreneurs at UBRD:

UBRD tariffs

| Rate | Any electronic payments | Replenishment per month | Cash withdrawal per month |

| It's simple, 0 rub. | 79 rub. | 0,05% | from 1.1% |

| Economy, 600 rub. | 10 free, then 25 rub. | 0,05% | from 1.1% |

| Online, 750 rub. | 25 rub. | 0,05% | from 1.1% |

| Test drive, 500 rubles, connection - 4200 rubles. | no fee | 0,05% | from 1.1% |

| Premium, 700 rubles, connection - 7000 rubles. | no fee | 0,05% | from 1.1% |

Tinkoff

Let's consider the best banks in the country that operate completely remotely. Many entrepreneurs pay attention to Tinkoff Bank. It has been working in the market for a long time and, despite its remote activities, is one of the ten best banks in Russia in many sectors of financial activity. Clients are offered a high-quality, long-developed and “tested” algorithm for remote collaboration using numerous services.

Features of service at Tinkoff:

Tinkoff tariffs

ModulBank

We can say that this is the best bank for opening an account for individual entrepreneurs, operating entirely via the Internet. He cooperates only with companies and entrepreneurs, all attention is paid to them. Despite remote service, clients receive all the necessary financial services and settlement services.

Features of service in ModulBank:

Tariffs of ModulBank

Dot

Created on the basis of Otkritie Bank. It is a bank only for business representatives. Account registration at Tochka and its maintenance are always remote. Tochka applies a modern approach to work; this organization’s Internet bank is recognized as one of the most effective on the market.

Features of service at Tochka:

Tariffs Points

Conclusion

To compare where it is more profitable to open a current account for an individual entrepreneur, you can use the following table, which shows the main conditions of the presented banks:

| Rate | Service | Starting tariff | Cash | Cashing out |

| Sberbank | 0-8600 rub. | 0 rub. | 0.15% or free | 3%, free on the “Great Opportunities” tariff plan |

| Alfa Bank | 0-7425/9900 rub. | 0 rub., 1% fee only for receipt of funds | from 0 rub. | from 0 rub. |

| VTB | 1000-3000 rub. | 1000 rub. | from 0 rub. | from 0.5% |

| Promsvyazbank | 0-2290 rub. | 0 rub. | from 0.1% | from 0.5% |

| Opening | 0-7990/5327 rub. | 0 rub., | 0,15% | 0,99% |

| UBRD | 0-750 rub. | 0 rub., | 0.05%, min. 100 rub. | from 1.1% |

| Tinkoff | 0-1990 rub. | 490 rub. | from 0.2% | from 1% |

| ModulBank | 0-4990 rub. | 0 rub. | from 0 rub. | from rub. |

| Dot | 0-4990 rub. | 0 rub. | from 0 rub. | from 0 rub. |

These are the best banks for individual entrepreneurs for profitable opening of a current account. In each of them you can get high-quality and safe service, each has additional services and services for business. All listed organizations accept applications to connect to RKO online. For individual entrepreneurs, a minimum package of documentation is provided for opening an account.