Opening an insurance company as a business. Sample business plan for an insurance company

Despite the fact that the insurance market is sufficiently developed, the current situation in this sector is such that opening a new insurance agency may be a profitable idea based on the needs of the target audience.

In the capital and other large cities, insurance services from jewelry companies are often sought. Insurance of financial risks arising during the joint construction of residential or non-residential facilities is in demand in megacities. You can always find your niche for opening an agency by conducting a thorough analysis of the insurance market for available services. To do this, taking into account all the features outlined below, they create a business plan for an insurance agency. One of the possible options is a franchise or branch of an already popular agency. Such a project could be a good starting point in the future for a new and independent agency.

Features of the insurance agency business plan project

The essence of the project is to create an agency for insurance of life and health, property and other valuables. The main goal of the business plan is to assess the prospects and economic efficiency of the project to create an insurance agency from scratch. The plan can be used as a commercial proposal when negotiating with a potential investor or when obtaining a commercial loan.

The project implementation is planned for 2 years.

During this period it is planned to achieve the following goals

— creation of a profitable enterprise;

— meeting the needs of the target audience in the field of life and property insurance for both individuals and legal entities;

- obtaining high profits.

The main financial aspects of a new business are as follows:

— the period within which the company will recoup all initial investments and reach the level of profitability – 2 years. Under favorable conditions - earlier;

— total cost of the project (the amount of the commercial loan that is planned to be issued at the beginning of the activity) – 1 million 200 thousand rubles;

— loan payments will begin from the first month of the enterprise’s activity. During the first two years, the total amount of payments will reach 82 thousand rubles;

— interest rate on the loan is 17.5%. In the future, this figure may be reduced;

— the total economic effect from the sale of services over the indicated period, under favorable conditions, will reach 84 million.

In general, starting a business in the insurance industry will be characterized by a low level of costs. But in order to avoid losses and have the opportunity to develop in the chosen direction, you need to think carefully about all areas of activity and draw up a clear plan for all upcoming stages.

Features and prospects of working as an insurance agent - in the video:

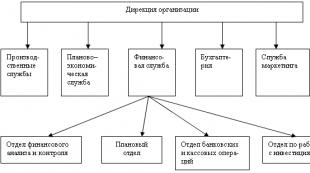

Features of the insurance company's activities

By offering life insurance and various types of property as its main services, the company immediately identifies an approximate circle of its clients. The target audience of the insurance company is very wide. First of all, these are private individuals who insure their lives in case of illness or death, accident or work injury. The second, more extensive and highly paid category is insurance of movable and immovable property of individuals, as well as organizations and enterprises.

Many insurance companies offer too many types of services at once. This may complicate entering the market, as it will require too much time and money, as well as attracting a large number of specialists. Therefore, it is worth starting with a limited list of services, with a main focus on serving individuals and providing a limited range of services to enterprises and organizations.

The operating principle and procedure of an insurance company largely depends on the type and scale of its activities. But in general, the general procedure includes the following responsibilities of the insurer:

— drawing up insurance programs of all types provided for in the strategy. At this stage, all financial aspects are calculated and a specific insurance proposal is developed;

— signing an agreement with a client - an individual or organization;

— receipt from the policyholder of the first insurance payment, of which 15% is received by the insurer as a commission and payment of expenses incurred, and the remaining amount goes to the insurance reserve. The insurance reserve, in turn, is divided into 2 parts: 70% for the accumulative reserve and 15% for the risk reserve. Both reserves are invested in instruments provided by law;

— upon the occurrence of an insured event, agency specialists review all submitted documentary evidence and make a decision on the advisability of making insurance payments, their amount and procedure.

The procedure for insurance and payments may differ slightly, but the principle is standard for all organizations. It is determined by relevant legislation. True, organizations can have different sales channels - both direct and brokerage channels are active in the market. At the same time, the share of the brokerage channel for sales of insurance services in the domestic market is still quite low and amounts to less than 4 percent. The Russian insurance system is characterized to a greater extent by the participation of non-insurance intermediaries - banks, travel agencies or car dealers. Vivid examples are MTPL and comprehensive insurance policies.

Internet insurance today also represents not only direct sales of insurance services. Over the past few years, the number of Internet agents performing intermediary functions has increased significantly.

Registration

The insurance company can be immediately registered as an LLC. There are other types of legal entities. But a limited liability company will be the most convenient and profitable for a start-up organization. When drawing up the charter for the LLC being opened, you need to list in detail the planned services of the agency, not forgetting about additional and auxiliary offers. When filling out the documents, you must provide all activity codes of the new company. For this purpose, a specialized OKVED classifier is used. In it, one or more suitable activity codes are selected. Regardless of what additional activities may be, they must be related to insurance and must be separately indicated when drawing up the application. For example, this could be damage assessment, which has a direct connection with insurance.

A mandatory condition for creating an LLC is the contribution of the authorized capital. Its size largely depends on the services provided by the campaign. The higher the value of the services (for example, life insurance of the client), the larger the authorized capital. But the minimum amount is 10 thousand rubles.

Other documents required when opening a legal entity are the charter, the decision to create an LLC (or another form), the decision to appoint a manager and, if there are several founders, the minutes of the founders’ meeting.

License. Certificate

The agency can act on the basis of a special permit - a license for the services provided. All legal requirements regarding types and forms of insurance, as well as licensing and certification, are contained in the specialized federal law “On the organization of insurance business in the Russian Federation” ().

You must first pass the certification required by law. This process is quite complex, it takes place under the guidance and control of the Ministry of Finance and requires a long time - usually certification takes up to a month. To complete it you will need a package of documents, including:

- Insurance rules.

- Documentation for opening a campaign.

- Tariff calculations.

The specifics of the campaign are such that each new type of insurance requires the preparation of new documents. In addition, the head of the company must confirm his qualifications in this field. The success of the undertaking will depend on the work experience of the manager himself and the number of positive reviews about his activities.

The result of the preparatory work will be the inclusion of the enterprise in the relevant state register after receiving a license. The entire licensing process will take up to six months, so you need to take care of this in a timely manner.

Regulatory documents that must be studied before starting work:

Stages of creating a business

The basic sequence of actions for opening an insurance agency is as follows:

— development of a strategy for the future company;

— drawing up a marketing and financial plan;

— renting or purchasing office space, equipping it and preparing it for opening;

A more detailed insurance agency plan includes the following steps:

| Stages | Execution conditions | Deadlines |

| Start of the project | 1 – 2 year | |

| 1 month project | First 30 banking days | |

| Receiving credit funds | Availability of a mandatory package of documents | 1 month |

| Entry into the state register, registration with administrative and tax authorities | Concluded investment agreement | From 1 to 30 calendar days |

| Selecting a location, preparing documentation | Preliminary work | 1 month |

| Purchase of equipment | Conclusion of an investment agreement | Up to 30 calendar days |

| Equipment installation | Receiving investment funds | Up to 30 calendar days |

| Hiring employees | Production activities | Up to 30 calendar days |

| Training | The end of the stage of organizing the production process | Up to 1 month |

| Advertising | Within 1 month | Up to 1 year |

| End of the project | 12 – 24 months |

Premises and equipment

The main condition for the selected office space is good access to it and the availability of convenient parking for clients’ personal vehicles. There should be good transport links nearby - a metro station and public transport stops for clients who do not have their own car. At the entrance, a noticeable sign is required that will orient visitors and serve as an advertisement.

The room may be small, but spacious enough to accommodate several employees and the opportunity to meet with clients. Maximum area - 150 sq. m, but maybe less. The design of the office as the face of the agency is very important. This issue needs to be given a lot of attention: there should be no bright, emphasized decorative details here. Clients are more attracted to a strictly business-like appearance, which speaks of the company’s reliability.

Purchasing office equipment will be an important stage in opening a company. At the first stage you need to purchase:

— desks and chairs for employees in the quantity necessary to provide furniture for the entire team;

— chairs, armchairs or sofas for waiting by clients;

— computers with high-quality software for all specialists;

— other office equipment – printers, scanners, copy machines;

- connection to telephone and Internet.

To create a comfortable atmosphere, the workplaces of specialists should be demarcated. You can equip several separate small offices. If this is not possible, the room is zoned using screens.

Staff

At the time of opening the agency, there should be no more than 10-20 employees on staff. A larger staff will be too expensive to maintain on a monthly basis. In addition, a start-up insurance agency is unlikely to be able to count on a large number of clients. The team will include:

- manager,

- accountant,

- lawyer,

- insurance agents.

The main responsibility of insurance agents is to independently find clients to provide them with insurance services. Otherwise, you will have to wait a long time for the company to develop. According to the preliminary plan, in the first 2 years, as the company develops, it will be necessary to increase the team to 100 - 150 full-time and freelance agents.

As business opportunities expand, the number of employees and insurance agents will also grow. And for the business to develop, there must be insurance agents on staff who can convince and sell insurance services. The more services are sold, the better the insurance agency will do. The company's profit will depend on this.

In order to accurately recruit a professional staff, you need to familiarize yourself with a large number of applicants and select only the most professional and experienced. In order to retain new employees, you need to create the most favorable working conditions, interest agents with a positive bonus, possible career advancement, and a good percentage of the services they sell. You can also go by training beginners using special training. It is advisable to use these two types of work with agents simultaneously. Be sure to hire several experienced insurance specialists who do not require training.

The dress code of employees is one of the optional, but important conditions. The strict appearance emphasizes the authority of the company and the professionalism of its specialists.

Marketing. Basic strategies for attracting clients

A marketing campaign should begin with studying the state of the market, current trends and dynamics. Crisis phenomena, which periodically influence the general state of the economy, are important in the functioning of the insurance market. Thus, in 2008–2009 and 2013–2014, the insurance market significantly reduced its activity, which is natural due to the international and domestic crisis. At the present time, the echoes of the last crisis are still being felt by most insurance agencies, especially small market participants. To cope with this problem and retain customers, it is necessary to offer more favorable conditions, comprehensive insurance packages, and necessarily improve the quality of services.

Statistics show that despite some negative trends, the insurance market is still growing and expanding. A particularly popular area is life insurance: every year this service is in increasing demand. If we analyze the insurance situation in the country as a whole, we can conclude that as a result of the crisis, the total number of companies on the market has decreased. At the same time, only strong and competitive participants remained in this segment.

The driving force of an insurance agency forward is the advertising of each individual insurance service, since the work of an insurance agency is the sale of insurance services.

With each specific insurance service, they need to go to the target audience of customers, sometimes mixing them. A profitable solution would be a “two in one” offer - a discount when insuring two objects at the same time.

With a small starting capital and the impossibility of providing a wide range of insurance services at once, you can focus on one type of service. It is important that this direction is not yet widespread enough on the market or is completely new. In the absence of competition, you can achieve high results in business development. And as the business develops in the future, add new insurance services.

According to statistics, the following advertising methods work best:

— Internet: creation and promotion of a website, posting information about insurance services on thematic websites, using banner and contextual advertising;

— Media, especially the use of thematic publications. This will allow you to reach the target audience as much as possible;

A good method would be to offer services directly to potential clients - organizations and enterprises - in the form of online newsletters with information about current service packages. Customer reviews are one of the best promotion methods in this area. This is due to the high cost of insurance services and the low level of consumer confidence in little-known and untested companies.

How to open your own insurance business in a short time - in the video:

Finance

First, you need to count on a minimum capital of 20 million rubles. Having such an amount will allow you to confidently start a business and not be afraid of a temporary lack of profit.

When opening an insurance campaign, you must count on the following main expense items:

| Expense item | Expenses per month | Expenses for the year | One-time costs | Total expenses for the year |

| Rent (purchase) of premises (from 40 sq.m.) | 30000 | 360000 | 60000 | 420000 |

| Purchase of equipment, including computers and office supplies | 106000 | 106000 | ||

| Buying a car | 430000 | 430000 | ||

| Website creation, hosting, scripts | 120000 | 120000 | ||

| Advertising expenses | 45000 | 540 thousand | 540 thousand | |

| Salary | 332000 | 3.9 million | 3.9 million | |

| Taxes | 99800 | 1198000 | 1198000 | |

| Additional expenses | 71560 | 71560 | ||

| Total | 407 thousand | 4.9 million | 788 thousand | 5.7 million |

Thus, the financial result regarding investments during the first year of the company’s operation is as follows: to open and develop an insurance company during the designated period, you need to have an amount of up to 6 million rubles available. This condition is relevant for a small organization of several insurance agents. If a larger organization is initially opened, this amount can double. However, this project provides for a gradual expansion of the company's scale.

The financial year begins in January. The deadline for tax payments will begin from the beginning of the year. The list of taxes for LLCs under the standard taxation system will be as follows:

The income part of the business plan should begin with drawing up an approximate pricing policy for the future agency. This indicator is determined taking into account the cost of the organization and the current pricing policy in the industry. Average tariffs for insurance services in the country today are as follows:

By dividing the entire 2-year period of opening and developing a business into 2 main stages - investment and operation, you can draw up the following service provision plan:

| Period | Type of service | Volume of production and sales for 1 month. (PC.) | price, rub. | Sales revenue, rub. |

| 1 – 12 month of investment | Life and health insurance | 20 people | From 120 thousand | From 2.4 million |

| 1 – 12 month of investment | Other insurance | 100 objects | From 17 thousand | 1 million 680 thousand |

| Life and health insurance | 50 people | From 134.4 thousand | From 6.7 million | |

| 13 – 24 months of operation | Other insurance | 200 objects | From 18.5 thousand | From 3.7 million |

If in the future the current market trends continue, that is, an increase in the volume of services provided in the amount of 10–22% per year, then the annual growth in the volume of sales of the company’s services will reach more than 58 million rubles per year.

To overcome difficulties at entering the market and smoothly pass the entry barrier, it is imperative to attract highly qualified specialists and use high-quality equipment. A competent marketing strategy and a well-thought-out advertising campaign are required. To find the best specialists, you need to allocate approximately 1 month to search for personnel, selecting the best using the interview method.

Risks

When planning the income of an enterprise, be sure to take into account all possible risks.

The main ones

— high level of competition in the insurance industry;

— lack of proper trust among potential clients, especially private individuals;

— high level of competition in the industry for positions of top managers and specialists in other areas;

— high level of capitalization of investments.

The conclusion about opening an insurance agency as a type of business may be as follows. First of all, such an enterprise is potentially highly promising and profitable, characterized by high profitability and constantly increasing demand among potential clients. All these advantages take place with proper organization of the company’s work and a timely advertising campaign. The weaknesses of this industry include high competition, continued distrust among the target audience and a lack of specificity in the legislative framework. In the future, the prospects for the insurance business will depend on the general economic situation in the country, the quality of legislative regulation of this issue, as well as competent business planning by each entrepreneur.

The main features of opening an insurance agency are in the video:

MS Word Volume: 34 pages

Business plan

Reviews (36)

A professional will help you pay attention to the obstacles and benefits of this popular trend. Life, property, and health insurance is a serious matter, and competition in this industry is great. You should consider in advance how exactly your company will be able to attract potential customers. Any insurance organization must clearly calculate in advance the benefits and the ability to provide its clients with insurance payments on time.

The proposed document is also suitable for organizing an insurance broker; it will help you navigate the modern legislative framework, as well as articles of the law that are focused on insurance. Also, special attention should be paid to attracting customers, that is, a clearly thought-out marketing position. Selection of personnel is also of no small importance, because the number of concluded contracts also depends on the ability of a professional to achieve a positive result in communication with a potential client.

Having studied the information on organizing an insurance agency, you can be convinced that sometimes it is profitable to establish a branch of an insurance company in order to become a subsidiary of an already popular and well-known insurance company with a well-known brand. This initiative is promising, especially if you use various property, life, and business insurance schemes, that is, you provide clients with the opportunity to choose the most acceptable options for an insurance contract.

Competition in the insurance business is one of the highest in the services market. But, despite this depressing fact, an entrepreneur who decides to build an insurance business has every chance of success. The main thing is to choose the right niche for your activity and competently approach the opening of your own insurance company. The introduction of new insurance services in this industry, such as insurance of financial risks during shared construction, insurance of title to real estate, allows newcomers to this business to count on a successful outcome.

The main difficulty for those who are planning to open an insurance company from scratch is the presence of a solid authorized capital, the minimum amount of which is 20 million rubles. If you expect to provide life insurance services, then this amount should be even higher. It should also be taken into account that when registering a legal entity, the charter is allowed to indicate only one type of activity - insurance itself (or several of its types).

Profits in an insurance company depend on how efficiently your insurance agents work. Entrepreneurs planning to open an insurance business should remember that an insurance agent is the core of your company. And there should be a lot of such people in your insurance company. During the first year of work, you need to recruit at least a hundred smart employees, preferably experienced and qualified specialists. It is clear that professionals are not lying around on the street, and you will have to either lure them away from competing companies or look for them through advertisements. The last option is to recruit inexperienced employees and actively train them.

There can be any options for the insurance business - you can open your own insurance store or car insurance company, the main thing is that the level of service in your company is high. But in order for your potential clients to know about this, you need to promote the company. For example, if you decide to open your own car insurance, then you need to promote the services among the appropriate audience - at car markets, car showrooms, and in places where cars are registered. Accordingly, to find clients who want to issue a financial guarantee, that is, buy a liability insurance policy, you need to look in completely different places.

Organization of work with clients in an insurance company is also of no small importance. In order to avoid serious litigation later, it is necessary to develop a competent agency agreement when working for an insurance company. If you want to avoid annoying mistakes and open your own insurance company, a company that will function effectively in the insurance market, be sure to use a professional insurance company business plan. Relying on it, you will be able to understand many of the intricacies of conducting such a difficult business.

Reviews for an insurance company business plan (36)

1 2 3 4 5

Insurance company business plan

NataliaI needed a business plan for an insurance company to prepare individual assignments for undergraduate students studying in the field of Insurance. Students in the discipline "Fundamentals of Small Business Operations" must acquire the skills of drawing up a business plan. From the downloaded example, I used the given proportions to form the income and expenditure parts of the financial plan, as well as set tariffs and the size of the insurance fund. Students will develop their own version of a business plan for different regions. I will definitely provide links to the sources used. Perhaps in real life they will ask for a service - preparing a business plan in BiPlan. Thank you that I had an example close enough to real conditions, which is what is required for practice-oriented training.

Natalia, thank you for your detailed review! We are glad that our work helps future entrepreneurs master the science of planning. This is very important for starting your own business. And thank you for working so closely with students, this is very important!

Insurance company business plan

OlgaStanding on your feet in the face of fierce competition is not an easy task. Your business plan helped me understand how to act in such a situation, due to which I can beat my competitor and stand out from other companies. I am very grateful to you for all the advice.

Olga, thank you for your gratitude. Indeed, there is fierce competition in the insurance business, but it is more than possible to work successfully in this market. We hope that our advice will bring tangible results. I wish you success.

Insurance company business plan

VyacheslavAn old idea is starting to come true. Your business plan helped me understand some issues. I hope that I was able to perform all the calculations correctly; I tried to rely on the advice of your specialists. Let's see how events develop further.

Vyacheslav, we are glad that we were able to support you. Now a lot depends on you and your diligence, we are confident that you will succeed and realize your idea. Good luck to you.

In stock Insurance company business plan 5 12

The idea of starting an insurance business requires a careful approach if you want to earn real income. First of all, keep in mind that the business plan of an insurance company should be based on the fact that it is necessary to conduct a full market analysis of existing insurance services in advance.

Important points in organizing an insurance company:

- - the authorized capital of the establishment of a legal entity must be at least 120 million rubles;

- - only a citizen of the Russian Federation who meets certain requirements can manage a company;

- - insurance activities are permitted only after obtaining a license; in order to obtain permits for a type of activity, insurance rules developed for a specific company will be required;

- - to obtain permission to carry out activities, it is necessary to have a central office of the company.

Decide what type of insurance you will engage in; the amount of authorized capital will depend on this. For life insurance, a capital of 240 million rubles will be required, and for reinsurance, at least 480 million.

Main organizational stages.

The Russian market is already crowded with insurance companies. A detailed study of the market will make it possible to find a less filled niche. It would be wiser to choose one of the types of insurance, or services that are just gaining popularity among consumers.

As an idea, you can use, for example, a lightning strike during a thunderstorm or a meteorite fall.

When you have chosen the type of insurance you will engage in, you should decide on the scale of your company’s work: city, region, entire country. The formation of the staffing table will depend on this.

There is another way to determine the scope of activity. Choose a specialization, for example, in water transport.

Without attracting third-party investments, you will not be able to implement your business plan. It is for this reason that such a document should be as detailed and understandable as possible for future co-founders.

Be prepared that registering a legal entity is a fairly lengthy process. You will also need a license from the Ministry of Finance, which can take from four to twelve months to obtain.

The most important.

In the insurance business, an important factor is the stable and justified motivation of the organizers and their like-minded people to achieve a specific level of sales.

Probably, more important than the authorized capital, there will be competently selected personnel capable of self-motivation and seeing a real perspective before failure. Even in the first stages, pay attention to the psychological aspect.

Your investors should be prepared in advance for a long-term placement of their capital and not a quick return on it.

For reference.

The number of insurance agencies in Russia has decreased by twenty percent. According to data as of the end of January this year in the unified state. The register of insurance entities included 459 insurance agencies, 14 of which are reinsurance agencies.

Moreover, 10 mutual storage societies are listed in the unified state register. The leader in this type of business was the Rosgosstrakh company (registered: Malakhovka village, Lyuberetsky district, Moscow region), which occupies more than 12% of the entire share of the Russian insurance market; last year's receipts in the form of insurance premiums to this company amounted to 97,431,792 ruble

A business plan for opening an insurance company that you decide to open should begin with identifying a special segment, type of activity in the already existing market for the relevant services. It is most profitable to identify an unoccupied niche in the market or a segment in which there is an increased and unsatisfied demand... for alcohol.

The Russian insurance market is characterized by a high level of employment, which complicates the search for new free niches for the activities of young companies. And yet, focusing on innovative insurance products, it is still possible to find effective business solutions.

Business plan

We present to you a free, ready-made example of an insurance company business plan that will help you start your own business providing insurance services.

This example contains all the calculations and tables for a specific city, so in your case all the numbers will, of course, be different.

How to open an insurance company

So, how to open an insurance company? Let's consider information that will help you in starting this business.

Registration

The insurance business is carried out by legal entities (LLC, CJSC, etc.), whose charter clearly defines the types of insurance services that they will engage in. In addition, the minimum authorized capital of the company is 20 million rubles, which varies upward depending on the services provided (especially increases when planning life insurance).

Company license and certification

In order for an insurance company to be included in the Unified State Register of Insurance Organizations, that is, licensed, it is necessary to undergo a certification procedure, which can last from six months to a year. An important point here is confirmation of the qualifications of the management of the insurance company: education and work experience of the general director, his business reputation. You will also need well-written constituent documentation and clearly formulated insurance rules for each type of planned insurance activity.

Investments and opening costs

The primary costs of opening an insurance company, which will be spent on purchasing or renting, as well as equipment for the company’s office, salaries and advertising, depending on regional characteristics, will range from half a million to a million dollars.

Room

The requirements for an insurance company office are quite standard: convenient location, parking for employees and clients, sufficient space (depending on the specifics of the work), its design and dress code for employees. The design of the office determines the client’s first impression of the insurance company, so it should be in a business style and emphasize the solidity and reliability of the company.

Working staff

The composition of an insurance company's employees is usually divided into two groups: office workers - management, legal services, accounting, and insurance agents - the “gold reserve” of each insurance company. Forming a staff of insurance agents, on whom the flow of clients of an insurance company depends, is a key personnel task. This can be solved either by attracting experienced employees, who will need to be provided with preferential conditions, or by training newcomers. Typically, insurance companies seek to combine these two paths by building a talent pool of experienced and entry-level employees.

Basic strategies for attracting clients

In the insurance business, it is important to develop targeted advertising strategies, that is, for each type of insurance, find the most effective types of advertising, placement locations, etc. For example, for home insurance, it is profitable to look for clients in areas of new buildings, cottage communities, and on real estate websites.

Low prices for services at the beginning of work is an effective advertising move.

Prospects for this business

The efficiency of the insurance business depends on the gradual expansion of the list of services provided, which occurs due to the development of the insurance company. Normal payback period: 3-5 years. If the profit corresponds to 10% of the total amount of insurance premiums, such a business can be considered successful.

Russian insurance services are well developed. And this must be taken into account when drawing up a business plan for an insurance company, since most people are accustomed to using the services of trusted agencies with a long history. A young company at the initial stage of its formation may encounter great difficulties. In order to minimize many problems, it is necessary first of all to identify a special market segment - an insurance niche that is not yet occupied in the city and surrounding areas, and that also satisfies the growing consumer demand. A business plan for an insurance company from scratch is drawn up according to a standard structure.

Summary

Ideal Business Support is a full service agency for the insurance industry. Ideal offers a wide range of support services designed for insurance agents. An ideal will specialize in a few offerings, but can do almost everything. While the market for support services is competitive, most companies are generalists. The ideal will stand out by concentrating on the insurance niche.

The purpose of an insurance company business plan is to provide the best business support services to the client. We exist to attract and serve customers. When we adhere to this maxim, everything else will fall into place. Our services will exceed our clients' expectations.

Ideal has two strong competitive advantages. The first is knowledge of the insurance industry. The owner's experience in the industry is invaluable. This experience will allow you to better serve your customers by leveraging information about customer needs and preferences. Additionally, the value of networks based on previous insurance relationships will give the company a big head start in the competition. By establishing relationships with many people in the industry, you can leverage these professional connections.

The idea is projected to reach profitability by month 11 and generate $44,000 in profit by three years.

By drawing up a step-by-step business plan for an insurance company, good information was obtained about the market and the general attributes of the most valuable and loyal customers. This information will be used to better understand who is being served, their specific needs and how Ideal can better communicate with them.

The customer profile consists of the following geographical, demographic and behavioral factors:

| Market analysis | |||||||

| 2017 | 2018 | 2019 | 2020 | 2021 | |||

| Potential clients | height | ||||||

| Exclusive agents | 7% | 78 | 83 | 89 | 95 | 102 | 6,94% |

| Insurance brokers | 8% | 123 | 133 | 144 | 156 | 168 | 8,11% |

| Other | 0% | 0 | 0 | 0 | 0 | 0 | 0,00% |

| Total | 7,66% | 201 | 216 | 233 | 251 | 270 | 7,66% |

Services

An insurance company business plan example provides the market with a range of support services for insurance agents. Ideal strives to deliver the following benefits that are important to its customers.

- Industry knowledge: Agents don't have time to train service staff on all the complexities of the insurance industry. Therefore, it is of great importance if the help desk has industrial understanding.

- Convenience: Services must be available when agents need them. In addition, it is difficult to accurately predict when such a need will arise.

- Customer service. To build a sustainable business, clients must be 100% satisfied with Ideal's services. This business philosophy will be ingrained in the minds of all employees.

Market Trends

The market trend for insurance agents (as well as other service providers) is to outsource non-essential activities, allowing the business to focus on its core competencies. This allows the insurance company's business to focus more precisely on its business model.

Reasons for this trend:

- Reduced overhead costs.

- Reduced training costs for non-existent employees.

Market growth

During the last two years, the insurance support services industry was worth $498 million. From 2015 to 2017, the industry growth rate was 5.6%. Over the next three years, the industry is expected to have no problem maintaining this excellent growth.

Another growth factor has been the gradual acceptance of insurance as a smart risk management strategy. With recent unexpected events such as natural disasters and terrorism, the insurance industry is likely to continue to grow as people and companies hedge their risks with insurance.

A sample business plan for an insurance company that needs support can be divided into two segments:

- Exclusive agents: these are agents for only one type of insurance, for example, state farm. The insurance agent will sell all types of coverage that State Farm offers, but only State Farm insurance. While the choices here are limited, the advantage of an exclusive agent is that they usually have a very strong relationship with that company, which is good if there are any claims issues.

- Insurance brokers: these agents do not have an exclusive contract with any one insurance company. They may offer insurance from multiple companies. The benefit of this setup is that they can offer a broader range of service offerings than an agent who only sells one brand of insurance.

Marketing company

The sole purpose of the business plan is to position the insurance company as the most efficient support service that commands the majority of the market share. The marketing strategy will focus primarily on creating customer awareness of the services offered, then developing the customer base and finally working to build customer loyalty and referrals.

- The company will use a variety of sources, such as the yellow pages and a trade magazine.

- The second way to communicate is through networking based on industry relationships.

- The third way is to participate in a regional exhibition, which attracts most local agents and brokers.

- The final communication method is a direct mail campaign targeting local insurance agents and brokers. The email campaign will provide all potential customers with information about Ideal's offerings.

Marketing approach

The marketing mix of an insurance company's business plan consists of approaches to pricing, distribution, advertising and promotion, and customer service.

- Pricing: Pricing scheme will be competitive with other support service providers.

- Spreading: Services will be offered at the client's place of business or in the office, whichever the client prefers.

- Advertising and promotion: a multi-level marketing campaign will be used to ensure visibility and equity.

- Customer service: managers will be held accountable for achieving these ambitious goals.

Advantages and disadvantages

An insurance company's business plan also reflects the strengths and weaknesses within the firm and describes the opportunities and threats facing Ideal.

Advantages of opening an insurance company:

- In-depth industry knowledge.

- An effective, comprehensive training program for employees.

- Extensive industry network connections.

Disadvantages of opening an insurance agency:

- Limited marketing budget to ensure visibility.

- Inability to scale quickly to large increases in demand.

- The brand is missing.

Possibilities:

- Participation in a growing industry.

- Work in an industry that is required by almost all Russians.

Ability to spread overhead costs as customer base increases.

Competitive advantages

The insurance company's business plan will position itself as the most experienced insurance support service. This positioning will be achieved by leveraging its competitive advantage.

Competitiveness is a specific deep industry knowledge of insurance. Although this specific knowledge will hinder a large market, it makes a small part of the market very attractive.

This in-depth industry knowledge is based on the firm's principal experience as an independent insurance agent. The owner will take all this intellectual capital and turn it into training program so that it becomes organizational knowledge.

The competition consists of many different service companies offering a wide range of services. However, none of them are intended for the insurance industry. While companies providing services in different industries offer adequate service, there is an advantage to hiring a company that services the industry and is much more knowledgeable about your specific needs.

Agent buying models simulate long-term relationships. If customers are satisfied, they tend to stay with the same service provider. There is usually a transition period for new clients where both parties spend time getting to know each other and their different needs. If it can be done once sooner, then it is more cost effective than moving from provider to provider.

Registration

Before you open a company providing insurance services, you must register a legal entity (LLC or CJSC). The size of the authorized capital of the new organization depends on what types of insurance the company’s activities will cover. If the company's services include life insurance for clients, then the authorized capital should be larger. To carry out insurance activities, you must obtain the appropriate certificate. We also recommend that you familiarize yourself with the relevant OKVED codes. The process of obtaining a certificate takes from 6 to 12 months.

Room

The business plan must provide a description of the premises in which the insurance company's office will be located. The premises must have a convenient location. The office building should be adjacent to a parking lot, the area of which can accommodate not only the cars of company employees, but also clients. The area of the premises is determined based on the number of insurance services provided.

The insurance company's office should be brought into proper shape. It is advisable to use the services of designers when decorating the interior. The room should be in a discreet business style. We must also not forget about the dress code of employees. This helps to form a positive impression of the company.

Financial plan

It is necessary to determine:

- fixed assets;

- intangible assets;

- primary costs;

- costs of paying for third party services;

- labor costs and taxes;

- total estimated costs for the year;

- profit for the year.

- You also need to create a short balance sheet.

This section will present the financial calculations of the insurance company's business plan as they relate to marketing activities. An insurance company's expenses and revenues focus on break-even analysis, sales forecasts, expenses, and how they relate to marketing strategy.

Break-even analysis

An insurance agency's break-even analysis shows that it would require $15,609 in monthly revenue to reach the break-even point.

Sales forecast

First month will be used to create an office. This includes choosing a site, purchasing furniture, and setting up a computer network.

First week of second month will be used for intensive training of two support staff. During the last three weeks of the month there will be sales activity. From now on, sales will increase steadily.

Fifth month– the last two support staff will be hired. They will also be trained during the first week of the month and then loaded.

| Sales forecast | |||

| 2017 | 2018 | 2019 | |

| Sales | |||

| Exclusive agents | $ 51049 | $ 112548 | $ 121458 |

| Insurance brokers | $ 59812 | $ 125745 | $ 134745 |

| Total sale | $ 110861 | $ 238293 | $ 256203 |

| Direct sales cost | 2003 | 2004 | 2005 |

| Exclusive agents | $ 7657 | $ 16882 | $ 18219 |

| Insurance brokers | $ 8972 | $ 18862 | $ 20212 |

| Interim direct cost of sales | $ 16629 | $ 35744 | $ 38430 |

Cost forecast

Marketing expenses should be budgeted to be high during the first quarter; a function of the desire to create visibility for a start-up company. After the first quarter, expenses will fluctuate depending on what marketing activities occur during each month.

| Marketing budget | |||

| 2017 | 2018 | 2019 | |

| ads | $ 2920 | $ 4000 | $ 5000 |

| Trade shows | $ 2 700 | $ 3000 | $ 3500 |

| Other | $ 2 025 | $ 2250 | $ 2500 |

| ---- | ---- | ---- | |

| General sales and marketing expenses | $ 7645 | $ 9250 | $ 11 000 |

| Sales percentage | 6,90% | 3,88% | 4,29% |

Risks

- Somewhat risky due to the regulatory nature of the insurance industry.

- Future competition from franchise support.

As computer technology continues to become more and more efficient and useful, it may reduce the need for support staff services.