The founder and director are one person (“company of one”). What is the most profitable way to resolve the issue of the salary of the company’s founding general director? CEO, sole founder

The only founder and director in one person is a typical picture for a small business. Moreover, bringing a startup to profit often requires the manager to invest a year or even more of work and money into its development without receiving anything in return.

In such a situation, paying the director a salary is a luxury that not everyone can afford. The luxury of paying insurance premiums from your salary, maintaining personnel records and submitting a huge amount of “salary” reporting.

Meanwhile, in an already established business, you want something fundamentally different - social guarantees (sick leave, vacations), the formation of pension savings, a monthly salary. These are the benefits of an employment contract.

Is it necessary to conclude an employment contract and pay wages?, if your company has the only founder and director in one person? Unfortunately, there is no single official answer to this question. And if you came here for an exact “yes or no,” then I will immediately disappoint you.

Meanwhile, there are also advantages - using the situation in a way that is beneficial to you. And in both cases, guided by legal norms.

Employment contract with the sole founder

All official sources who are called upon to clarify controversial issues - Rostrud, the Ministry of Finance, extra-budgetary funds, the courts - like capricious young ladies, put forward opposing points of view. Moreover, with references to legislation. That does not prevent them from changing their position to the opposite one after some time.

By the way, letters from Rostrud and the Ministry of Finance are not normative legal acts; they contain only explanations and opinions and cannot have legal force.

Above, we have already briefly outlined the reasons why an employment contract with a single founder can be beneficial, we repeat:

- — the opportunity to receive monthly income from the business, regardless of whether there is profit;

- — social guarantees (payment of vacations and various benefits);

- — formation of pension insurance length of service for calculating pensions.

Examples of officials’ opinions against concluding an employment contract: letters of Rostrud dated 03/06/2013 No. 177-6-1, dated 12/28/2006 No. 2262-6-1, letter of the Ministry of Finance dated 02/19/2015 No. 03-11-06/2/7790, letter of the Ministry of Health and Social Development dated August 18, 2009 No. 22-2-3199. Here are their arguments:

- If the only founder and director are one person, then the employment contract will contain two identical signatures, he concludes with himself, which is impossible.

In paragraph 3 of Art. 182 of the Civil Code of the Russian Federation states that an agreement signed by the same person on both sides has no legal force. But the provisions of this article do not apply to labor relations; this is civil law.

- Article 273 of the Labor Code from Chapter 43 (labor relations with the manager) states that the provisions of this chapter do not apply to managers who are the only participants (founders) of their organizations.

As you can see, the statements are very controversial.

Is the director's employment contract with himself or with the company?

What arguments can you give in your favor if you are the only founder and director in one person and want to conclude an employment contract?

- The parties to the employment contract are different– director as an individual and organization as a legal entity. It is known that a legal entity has its own legal capacity and acts in legal relations on its own behalf, and not on behalf of its founders. Therefore, an employment contract between the director “with himself” is possible.

- Chapter 43 of the Labor Code, which officials refer to, describes the relationship with the manager, who is not the founder. The Labor Code itself does not prohibit concluding an employment contract with a single founder. And even in Article 11, among the persons to whom labor legislation does not apply, the founding director is not named.

Indirectly confirms the possibility of concluding an employment contract with the sole founder insurance legislation. So, for example, in paragraph 1 of Article 7 of Law No. 167-FZ of December 15, 2001 “On compulsory pension insurance in the Russian Federation” we will find that the insured persons are “those working under an employment contract, including heads of organizations who are the only participants (founders)".

Similar provisions are in laws No. 326-FZ of November 29, 2010 (health insurance) and No. 255-FZ of December 29, 2006 (social insurance).

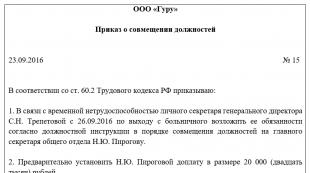

Order for director - sole founder

Labor relations with the general director are formalized in accordance with all the rules of labor legislation, with the conclusion of an employment contract. If there is only one founder, then the agreement can be concluded for an indefinite period.

The text of the agreement states that this employee “is assigned the duties of the general director on the basis of the decision of the founder (participant) No. ..... dated .....”.

Those. first you need to sign the decision of the sole participant of the company. The decision will say: “I assign the duties of the general director to myself.”

Based on the decision, an order is issued to the director - the sole founder, which says approximately the following: I, full name, begin to perform duties as the general director of LLC "..." from (date). Grounds: decision of the sole participant of the company No.... dated...

The requirement to issue an employment order is contained in Art. 68 Labor Code of the Russian Federation. The entry for employment is made according to the general rules established by the Rules for maintaining and storing work books (approved by Decree of the Government of the Russian Federation of April 16, 2003 N 225), as well as the Instructions for filling out work books, approved. Resolution of the Ministry of Labor of the Russian Federation dated October 10, 2003 No. 69.

The signed order for the performance of duties will be an order for employment. Based on the concluded employment contract and order, an entry is made in the work book.

Entry into the work book is done as follows:

- — in column 3: Appointed to the position of General Director

- — in column 4: order details

If you plan to enter into an employment contract not only with the director, but also to hire other employees, then.

Salary of the director - the sole founder

The employment contract will provide for the payment of wages to the director. Its size must be economically justified (Article 273 of the Tax Code - expenses are economically justified and documented).

Please note that the salary of the director - the sole founder may be paid only upon concluding an employment contract. If it is not there, then the tax authorities will not recognize it as an expense.

The explanation is simple - among the expenses that cannot be taken into account when calculating the tax base for profits, the Tax Code indicates any remuneration to managers, except under an employment contract (clause 21 of Article 270 of the Tax Code of the Russian Federation).

The director's salary is paid according to the same rules as other employees, there are no differences. Personal income tax is also withheld and insurance premiums are charged.

The only founder and director in one person without an employment contract

There is also the opposite situation, when the founder does not want to enter into an employment contract, but performs management functions. Since we have refuted the arguments of the Ministry of Finance and Rostrud, we will not refer to their conclusions and justifications. Let's go from the other side - from the position of civil legislation.

Article 53 of the Civil Code, art. 32, 33, 40 of the Law “On LLC” indicate that the director is the sole executive body of the company and carries out the current management of the LLC’s activities.

There is no connection here with the presence or absence of an employment contract and payment of wages. From the moment the sole founder, by his decision, assumes the functions of the sole executive body, he receives management powers.

Thus, the only founder who wants to manage his organization himself has the right to either conclude an employment contract or do without it.

SZV-M for founding director

All employers are required to submit a report to the Pension Fund of Russia in the form SZV-M. This must be done no later than the 15th day of the month following the reporting month. Until March 2018, according to the official position of the Pension Fund, SZV-M, there was no need to apply for a founding director with whom an employment contract was not concluded and who does not receive a salary. This was explained by the fact that such persons were not recognized as employees, and therefore as insured persons.

However, the Pension Fund of Russia has changed its position since March 2018. Now SZV-M for the founding director is submitted in any case, regardless:

- — the presence or absence of an employment contract concluded with him;

- - the presence or absence of wage payments to him;

- — the organization conducts business activities or stops them.

A SZV-STAZH report is also submitted to the founder.

Officials explain their demand by the fact that Article 16 of the Labor Code states that even without a concluded employment contract, in this case, an employment relationship arises with the employee due to his actual admission to employment.

On this topic you can read: letters of the Pension Fund of the Russian Federation No. LCH-08-24/5721 dated 03/29/18, 17-4/10/B-1846 dated 03/16/18.

Moreover, regional branches for reinsurance require inclusion in SZV-M not only of the founder in the singular, but also of all founders, if there are several of them.

Is the founding director included in the DAM?

In the Calculation of Insurance Premiums (RAV) form, section 3 includes personalized information on the amount of wages accrued to each employee.

Therefore, if an employment contract is concluded with the founding director and he is paid a salary, then clearly such an individual and payments to him must be reflected in section 3.

However, according to the latest position of officials (letter of the Ministry of Finance dated 06/18/18 No. 03-15-05/41578, letter of the Federal Tax Service No. GD-4-11/6190@ dated 04/02/2018) Section 3 of the DAM should also include information about the director - the sole founder, even if an employment contract has not been concluded with him and he does not receive wages. In this case, subsection 3.2 will have zero indicators.

Officials explain this by saying that despite the lack of payments, such a person does not cease to be insured. And it is insured because there is still an employment relationship, even without an employment contract.

In this article, we deliberately examined not only the problem of concluding or not concluding an employment contract, but also reporting. Because in the same situation the same organs say completely different things. Fantastic! There cannot be an employment contract in principle, but at the same time there is one. As well as the obligation to submit reports.

No matter how you do it, you will still be wrong! Therefore, there is only one conclusion - do what suits you best - by concluding or not concluding an employment contract. But in the reports the only founder and director must be one person.

If you don’t have time to spend time on accounting routine, if you have more important tasks in your business, then write on the page or in the online chat, we will be happy to help you. In the comments you can ask questions about the content of the article if you have any.

Is an employment contract necessary if the director and founder are the same person? If necessary, where can I find a sample contract?

Answer

No no need.

The letter of the Ministry of Health and Social Development of Russia dated August 18, 2009 No. 22-2-3199 indicates the impossibility of concluding an employment contract with the head of an organization in the case where the head of the organization is also its only founder (participant, shareholder).

It should be noted that the absence of an employment contract with the head of the organization - its sole founder (participant, shareholder) does not call into question the existence of an employment relationship between him and the organization. According to official explanations, labor relations that arise as a result of election to a position, appointment to a position or confirmation in a position are characterized as labor relations on the basis of an employment contract (). In particular, this means that the specified manager is subject to compulsory social insurance in case of temporary disability and in connection with maternity and has the right to pay for sick leave in the general manner, even in the absence of an employment contract concluded with him according to the general rules (clarifications approved). The legality of this position was confirmed by the court ().

In this case, indicate all working conditions, including salary, allowances, etc. in the manager’s hiring notice.

Ivan Shklovets,

Deputy Head of the Federal Service for Labor and Employment

Forms: Order (instruction) on hiring a director for the main job. The director is the sole founder of the organization

|

Unified form No. T-1

|

||||||||||||||||||||||||||||||||||||

Closed Joint Stock Company "Alfa"

EMPLOYMENT AGREEMENT No. 15-TD

Moscow 09/20/2013

Closed joint stock company "Alpha" represented by its sole founder

Kondratyev Alexander Sergeevich, acting on the basis of the decision of the sole founder (minutes dated September 15, 2009 No. 1), hereinafter referred to as “Employer”, with one

parties, and Kondratyev Alexander Sergeevich, hereinafter referred to as “Employee”, appointed

to the position of General Director of the Closed Joint Stock Company "Alpha", on the other hand

The parties have entered into this agreement as follows:

1. GENERAL PROVISIONS

1.1. This employment contract governs the relationship between the Employer and the Employee,

related to the latter’s performance of duties as the General Director of the Closed

joint stock company "Alpha", located at: 125008, Moscow,

st. Mikhalkovskaya, 20.

1.2. The Employer provides the Employee with a job as a General Director

Closed joint stock company "Alpha".

1.3. This employment contract comes into force on the day the Employee is admitted to work,

determined by clause 1.4 of the agreement.

1.4. The employee begins to perform the job duties provided for herein.

employment contract, from the date of issuance of the order to take office.

1.5. The employee is given a probationary period of three months in order to

checking the Employee’s compliance with the assigned work.

2. RIGHTS AND OBLIGATIONS OF AN EMPLOYEE

2.1. The employee independently decides all issues of the organization’s activities in accordance with

legislation of the Russian Federation, the charter of ZAO Alfa, this employment contract, with the exception of

issues referred by the legislation of the Russian Federation to the jurisdiction of other bodies.

2.2. The employee has the right:

2.2.1. Act without a power of attorney on behalf of the organization.

2.2.2. Issue powers of attorney, including to heads of branches and representative offices

organizations, and perform other legally significant actions.

2.2.3. Open (close) the organization’s accounts with credit institutions.

2.2.4. Carry out the hiring of other employees of the organization in accordance with the established procedure,

conclude, amend and terminate employment contracts with them.

2.2.5. Distribute responsibilities among deputies, and, if necessary, delegate to them

your rights.

2.2.6. In accordance with the established procedure, approve the structure and staffing of the organization,

issue local regulations mandatory for all employees of the organization,

approve regulations on structural divisions, branches and representative offices

organizations.

2.2.7. Approve regulatory and technical instructions, labor protection and fire safety instructions

security.

2.2.8. Involve other employees of the organization in disciplinary and material

liability in accordance with the current legislation of the Russian Federation.

2.2.9. Resolve other issues related to the legislation of the Russian Federation, the organization’s charter and

this employment contract falls within the competence of the Employee.

2.2.10. For timely and full payment of wages in accordance with your

Qualification, complexity of work, quantity and quality of work performed.

2.2.11. To provide annual paid leave.

2.2.12. For advanced training in the manner established by labor legislation and

regulatory legal acts of the Employer.

The employee has other rights provided for by the labor legislation of the Russian Federation, this

employment contract and job description.

2.3. The employee is obliged:

2.3.1. When performing official duties, be guided by the legislation of the Russian Federation,

regulatory legal acts of the Employer, the organization’s charter and this labor

agreement.

2.3.2. Ensure the organization of administrative, economic, financial and other

activities of the organization.

2.3.3. Plan the activities of the organization.

2.3.4. Ensure targeted and efficient use of the organization's funds.

2.3.5. Ensure timely and high-quality implementation of all contracts and obligations

organizations.

2.3.6. Provide working conditions for other employees of the organization that are appropriate

labor protection requirements and social guarantees in accordance with the legislation of the Russian Federation.

2.3.7. Ensure compliance with the legislation of the Russian Federation in the implementation of financial and

business transactions, including timely payment in full of all

taxes, fees established by the legislation of the Russian Federation, and reporting on work

organizations in the manner and within the time limits established by the legislation of the Russian Federation.

2.3.8. Ensure timely payment of wages, benefits and other payments to others

employees of the organization.

2.3.9. Do not disclose information constituting state or official secrets that has become

known to him in connection with the performance of his official duties.

2.3.10. Submit draft annual and quarterly activity plans to the Employer

organizations and reports on their implementation.

2.3.11. Ensure that all planned performance indicators of the organization are met.

2.3.12. Comply with the labor regulations in force in the organization.

2.3.13. Inform the Employer in a timely manner about the start of activity checks

organizations by control and law enforcement agencies and their results, as well as cases

bringing organization employees to criminal liability.

2.3.14. Upon termination of this employment contract, transfer the affairs of the organization

the newly appointed head of the organization.

2.3.15. In case of change of personal data, submit the relevant documents

To the employer.

2.3.16. Perform other duties provided for by the legislation of the Russian Federation and the charter

organizations.

The employee is obliged to perform other duties provided for by labor legislation

RF, this employment contract and job description.

3. RIGHTS AND OBLIGATIONS OF AN EMPLOYER

3.1. The employer has the right:

3.1.1. Require the Employee to conscientiously perform his duties hereunder

employment contract and other obligations provided for by the legislation of the Russian Federation and the charter

organizations.

3.1.2. Adopt local acts directly related to work activities

Employee, including labor regulations, labor protection requirements and

ensuring occupational safety, decisions on sending the Employee on business trips.

3.1.3. Bring the Employee to disciplinary and financial liability in the manner

established by the Labor Code of the Russian Federation and other federal laws.

3.1.4. Encourage the Employee for conscientious, effective work.

The employer has other rights provided for by the labor legislation of the Russian Federation, this

employment contract.

3.2. The employer is obliged:

3.2.1. Provide the Employee with the work stipulated by this employment contract.

3.2.2. Ensure the safety and working conditions of the Employee that comply with regulatory standards

labor protection requirements.

3.2.3. Provide the Employee with equipment, tools, technical documentation and

other means necessary for the performance of his labor duties.

3.2.4. Pay the full amount of wages due to the employee in

deadlines.

3.2.5. Process and ensure the protection of the Employee’s personal data in

in accordance with the legislation of the Russian Federation.

3.2.6. Introduce the Employee, against signature, to the adopted local regulations,

directly related to his work activity.

3.2.7. Notify the Employee of changes in the terms and conditions of this Agreement determined by the parties.

employment contract, as well as the reasons that necessitated such changes, in

in writing no later than two months, unless otherwise provided by the Labor Code

The employer performs other duties provided for by labor legislation and

other regulatory legal acts containing labor law norms, collective

contract, agreements, local regulations and this employment contract.

4. WAGES AND SOCIAL GUARANTEES

4.1. For the performance of labor duties provided for in this employment contract,

The employee is given a salary of 90,000 (Ninety thousand) rubles. per month.

If the average salary of employees of the organization’s main personnel for

calendar year has increased, then the Employee’s official salary, by decision of the Employer, may

increase in the average salary of the organization's core personnel. Size

increase in the Employee's salary is determined by the Employer.

4.2. Compensation payments are made to the Employee in accordance with

legislation of the Russian Federation.

4.3. Based on the organization’s performance indicators and incentive conditions,

established by the Employer, the Employee is paid bonuses (quarterly, annual)

in the amount determined by the Employer, at the expense of funds provided for wages

employees of the organization.

4.4. Payment of wages to the Employee is made within the time limits and in the manner established

collective agreement, labor regulations, other local regulations

acts of the Employer.

4.5. Wages are paid to the Employee simultaneously with the payment of wages to everyone

other employees of the organization.

4.6. The Employee is subject to benefits, guarantees and compensation established

legislation of the Russian Federation and local regulations of the Employer.

5. WORKING AND REST TIME

5.1. The employee is assigned a five-day working week with a duration of 40 (forty)

hours. Weekends are Saturday and Sunday.

5.2. The employee is granted annual basic paid leave of

28 calendar days.

5.3. Annual basic paid leave is provided within the terms agreed with

Employer.

6. SOCIAL INSURANCE

6.1. The employee is subject to compulsory social insurance in connection with labor

activities. Types and conditions of compulsory social insurance for communications workers

labor activities are carried out by the Employer in accordance with the legislation of the Russian Federation.

7. OTHER CONDITIONS OF THE EMPLOYMENT CONTRACT

7.1. The employee undertakes during the validity period of this employment contract and after it

cessation of not disclosing legally protected trade secrets for five years,

became known to the Employee in connection with the performance of his job duties.

With a list of information constituting a legally protected trade secret, Employee

must be familiarized with signature.

7.2. In case of violation of the procedure for use and unlawful disclosure of information,

specified in clause 7.1 of this employment contract, the relevant guilty party

contract is obliged to compensate the other party for the damage caused.

8. RESPONSIBILITY OF THE PARTIES TO AN EMPLOYMENT CONTRACT

8.1. The Employer and the Employee are responsible for non-fulfillment or improper

fulfillment of assumed duties and obligations established by this labor contract

agreement, local regulations of the Employer, legislation of the Russian Federation.

8.2. For committing a disciplinary offense, that is, failure to comply or improper

performance by the Employee, through his fault, of the labor duties assigned to him, to the Employee

disciplinary sanctions may be applied as provided for in Article 192 of the Labor Code

Code of the Russian Federation.

8.3. The Employer and the Employee may be subject to financial and other types of legal

liability in cases and in the manner provided for by labor legislation and other

federal laws.

9. VALIDITY OF THE EMPLOYMENT CONTRACT

9.1. This employment contract is concluded for a period of five years.

10. CHANGE AND TERMINATION OF THE EMPLOYMENT CONTRACT

10.1. Each party to this employment contract has the right to put before the other party

the question of its addition or other changes to the employment contract, which by agreement

the parties are formalized by an additional agreement, which is an integral part

employment contract.

10.2. Changes and additions may be made to this employment contract by agreement

parties also in the following cases:

a) when the legislation of the Russian Federation changes in terms of rights, obligations and interests

parties, as well as when local regulations of the Employer change;

b) in other cases provided for by the Labor Code of the Russian Federation.

10.3. If the Employer changes the terms of this employment contract (except

labor function) for reasons related to changes in organizational or technological

working conditions, the Employer is obliged to notify the Employee about this in writing no later than

than two months before their change (Article 74 of the Labor Code of the Russian Federation).

About the upcoming dismissal due to the liquidation of the organization, downsizing or

staff of the organization's employees, the Employer is obliged to warn the Employee personally and under

signature at least two months before dismissal.

10.4. This employment contract is terminated only on the grounds established

Labor Code of the Russian Federation and other federal laws.

Upon termination of an employment contract, the Employee is provided with guarantees and compensation,

provided for by Chapter 27 of the Labor Code of the Russian Federation, as well as other norms of the Labor Code

Russian Federation and other federal laws.

11. FINAL PROVISIONS

11.1. Labor disputes and disagreements between the parties regarding compliance with the terms of this

employment contract are resolved by agreement of the parties, and in case of failure to reach an agreement

are considered by the labor dispute commission and (or) the court in the manner established

legislation of the Russian Federation.

11.2. To the extent not provided for in this employment contract, the parties are guided by

legislation of the Russian Federation.

11.3. This employment contract has been concluded in two copies, each having the same

legal force. One copy is kept by the Employer in the Employee’s personal file, the second is kept by

Employee.

12. ADDRESSES, DETAILS AND SIGNATURES OF THE PARTIES

The most important changes this spring!

- Five bad habits of HR managers. Find out what your sin is

-

Inspectors from GIT and Roskomnadzor told us what documents should now under no circumstances be required of newcomers when applying for employment. Surely you have some papers from this list. We have compiled a complete list and selected a safe replacement for each prohibited document. -

If you pay vacation pay a day late, the company will be fined 50,000 rubles. Reduce the notice period for layoffs by at least a day - the court will reinstate the employee at work. We have studied judicial practice and prepared safe recommendations for you.

The editors of the magazine "Personnel Business" found out which habits of personnel officers take a lot of time, but are almost useless. And some of them may even cause bewilderment to the GIT inspector.

1. Whether or not to conclude an employment contract with the sole participant manager.

2. Is it necessary to pay a salary to such a manager and how to take it into account in tax expenses.

3. Are insurance premiums calculated on the salary of the head of the LLC.

The situation when the owner of a business, the only participant in an LLC, is also its manager is not uncommon. As a rule, there are two main reasons for this: saving on wages for a hired manager and not having to delegate managerial powers to anyone else. In addition, the Law “On Limited Liability Companies” allows for the election of the sole executive body of the company from among its participants. Thus, nothing prevents the owner of the LLC from entrusting management to himself... in theory. However, in practice, this is associated with many questions, the main one of which is: how to formalize the relationship between the manager and the LLC he owns? This raises other questions: is it necessary to pay wages to the manager? If necessary, do contributions need to be calculated and can they be taken into account in tax expenses? We will look into all these subtleties further in the article.

Registration of relations with the head - the only participant of the LLC

The election of the sole executive body of the LLC (director, general director, president, etc.) is formalized decision of the sole participant of the company(Articles 39, 40 of the Law of 02/08/1998 No. 14-FZ). The wording of such a decision could be as follows: “Appoint director of LLC ... (full name)”, signature, date.

Based on the decision, it is issued order on behalf of the head of the LLC on taking office approximately as follows: “I, ... (full name), assume the powers of director of the LLC from ... (date) on the basis of the decision of the sole participant No. ... dated...”, signature, date.

The execution of the above documents, the participant’s decision and the manager’s order, corresponds to usual practice and does not raise doubts. But then the most important question remains to be resolved: is the relationship between the manager and the LLC, of which he is the only participant, an employment relationship and is it necessary to conclude an employment contract? The opinions of regulatory authorities on this issue are divided and, unfortunately, there is still no single solution.

- Position 1. An employment contract is not concluded, the relationship is not an employment relationship.

Representatives of Rostrud adhere to this point of view (letter of Rostrud dated March 6, 2013 No. 177-6-1, dated December 28, 2006 No. 2262-6-1, letter of the Ministry of Health and Social Development of Russia dated August 18, 2009 No. 22-2-3199). In addition, representatives of the Ministry of Finance also consider it impossible to conclude an employment contract with the manager, who is the sole founder of the LLC.

So, what are the main arguments put forward by officials of Rostrud and the Ministry of Finance in defense of their position:

- Article 273 of the Labor Code of the Russian Federation directly states that the provisions of Chapter 43 of the Labor Code of the Russian Federation “Peculiarities of labor regulation of the head of an organization and members of the collegial executive body of the organization” do not apply to the head of the organization, who is the only participant. From here the officials conclude that the impossibility of applying labor legislation as a whole to the relationship between the organization and its leader, the only participant.

- Article 56 of the Labor Code of the Russian Federation states that the parties to an employment contract are the employee and the employer, that is, an employment contract is always a bilateral agreement. If the contract is signed on behalf of the employee and the employer by the same person, then such an employment contract is invalid, since one of the parties is missing. Due to this concluding an employment contract with a manager who is the only participant is not allowed. In this case, the sole participant assumes the powers of the manager by his decision, which is the basis for his implementation of managerial activities.

According to this position, it turns out that the head of the organization enters not into labor, but into civil legal relations with the organization. Thus, he is not entitled to any guarantees provided for by the Labor Code of the Russian Federation (annual paid leave, compensation, etc.), including wages, and, accordingly, deductions to extra-budgetary funds from it (including to the Pension Fund of Russia ). It is, of course, difficult to agree with this, because there is an infringement of the rights of such leaders. For example, if an LLC has not one, but several participants, then concluding an employment contract with one of them is allowed (since there are two parties: an employee and another participant on behalf of the employer).

- Position 2. An employment contract is concluded and the relationship is recognized as an employment relationship.

This approach is advocated by representatives of the FSS (Letter of the FSS of the Russian Federation dated December 21, 2009 No. 02-09/07-2598P), as well as judicial practice (Appeal ruling of the Chelyabinsk Regional Court dated November 27, 2014 in case No. 11-12571/2014, Resolution of the Thirteenth Arbitration Court Court of Appeal dated June 22, 2015 No. 13AP-9651/2015 in case No. A21-9807/2014). In this case, the argument most often boils down to the following:

- The head of the sole participant of an LLC is indeed not covered by Chapter. 43 of the Labor Code of the Russian Federation, since it does not need the guarantees provided to hired managers. At the same time, among persons who are not covered by labor legislation in general, specified in Part 8 of Art. 11 of the Labor Code of the Russian Federation, the director and sole participant of the company is not named. Consequently, it falls under the general rules of the Labor Code of the Russian Federation, and relations with him are labor relations.

- In accordance with Law No. 14-FZ “On Limited Liability Companies”, the head of the LLC (sole executive body) is elected by the decision of the sole participant (Articles 39, 40 of the Federal Law of 02/08/1998 No. 14-FZ). And election to office, in turn, is one of the grounds for the emergence of labor relations and the conclusion of an employment contract(paragraph 2, part 2, article 16 of the Labor Code of the Russian Federation). In this case, the agreement with the elected manager is signed by an authorized person on behalf of the LLC (paragraph 2, article 40 of the Federal Law of 02/08/1998 No. 14-FZ). Thus, the parties to the employment contract will be: the employing organization represented by the sole participant, on the one hand, and the employee elected to the position of manager, on the other hand. That is, the employment contract is not concluded by the manager, the only participant, “with himself”: the contract is concluded between a legal entity and an individual. This means that the requirement of Art. 56 of the Labor Code of the Russian Federation on the mandatory presence of two parties to an employment contract (employee and employer) has been fulfilled.

The fact that the manager, the only participant, does not enter into an employment contract with himself, but that there are, as expected, two parties to the contract (the employee is an individual and the employer is a legal entity), is reflected in the standard preamble to the employment contract, for example:

"Limited Liability Company "Lux" (LLC "Lux"), hereinafter referred to as the "Employer", represented by the sole participant of LLC "Lux" Ivan Ivanovich Ivanov, acting on the basis of the Charter and the decision of the sole participant dated 01.11.2015 No. 1, with on the one hand, and Ivan Ivanovich Ivanov, hereinafter referred to as “Employee,” on the other hand, have entered into this employment agreement as follows: The Employee is hired as a director...”

So, we have found out that the legality of concluding an employment contract with a manager who is the only participant can be proven (including in court). A Why should managers themselves enter into an employment contract?? Why is it not recommended to simply agree with the first position and “not register as an LLC”? Here are the main reasons:

- According to the Labor Code of the Russian Federation, an employment contract with an employee must be concluded within three days from the date of actual admission to work (Part 2 of Article 67 of the Labor Code of the Russian Federation). And actual access to work is, in fact, determined by the decision of the sole participant to elect a leader and the order to take office. For evading the execution of an employment contract, administrative liability is provided under Art. 5.27 of the Code of Administrative Offenses of the Russian Federation, which entails a fine on officials in the amount of ten thousand to twenty thousand rubles; for legal entities - from fifty thousand to one hundred thousand rubles.

- The presence of an employment contract is the basis for accepting for tax accounting the expenses for remuneration of the director, the sole participant of the LLC.

- The presence of labor relations and an employment contract with the manager, the only participant, is a necessary condition for recognition of the manager as an insured person for compulsory pension, social and medical insurance.

In order to “secure” the labor nature of the manager’s relationship with the LLC, of which he is the only participant, it is recommended, in addition to concluding an employment contract:

- issue an order for employment,

- make an entry in the work book,

- approve the staffing schedule.

Payroll for the manager

Above, we examined the arguments in favor of the labor nature of the relationship and the conclusion of an employment contract with the director, the sole participant of the LLC. Continuing the logic of reasoning, we inevitably come to the conclusion: the manager who is the only participant needs to pay wages.

The employer’s obligation to pay employees wages in full and on time is enshrined in Art. 22 Labor Code of the Russian Federation. At the same time, the Labor Code does not provide for any exceptions for the manager who is the only participant in the company.

It should also be noted that labor legislation does not establish minimum working hours. That is, theoretically it can be one hour a week. The main thing is that such working hours must be stipulated in the employment contract. In an effort to “save” on a manager’s salary, the main thing is not to overdo it: the minimum wage accrued to the manager must be no less than the salary calculated based on the proportion of time worked (Part 3 of Article 133 of the Labor Code of the Russian Federation).

Insurance contributions from the manager's salary

The head of the organization, who is its sole participant, as well as other persons working under employment contracts, recognized as insured:

- on compulsory pension insurance (clause 1, article 7 of Law dated December 15, 2001 No. 167-FZ)

- for compulsory social insurance in case of temporary disability and connection with maternity (clause 1, part 1, article 2 of Law dated December 29, 2006 No. 255-FZ)

- on compulsory health insurance (clause 1 of article 10 of the Law of November 29, 2010 No. 326-FZ).

Accordingly, for the manager’s salary Insurance contributions to the Social Insurance Fund, Pension Fund, Compulsory Medical Insurance Fund are calculated in accordance with the general procedure(Part 1 of Article 7 of the Law of July 24, 2009 No. 212-FZ).

From all of the above, it follows that the manager who is the only participant has the right to receive compulsory social insurance benefits at the expense of the Social Insurance Fund (for temporary disability, pregnancy and childbirth, etc.). This is confirmed by explanations from the FSS and court decisions (letter of the FSS of the Russian Federation dated December 21, 2009 No. 02-09/07-2598P, Determination of the Supreme Arbitration Court of the Russian Federation dated September 23, 2009 No. VAS-11691/09, Resolution of the Federal Antimonopoly Service of the West Siberian District dated November 9, 2010 to case No. A45-6721/2010, Resolution of the Federal Antimonopoly Service of the Far Eastern District dated October 19, 2010 No. F03-6886/2010 in case No. A73-2821/2010, Resolution of the Federal Antimonopoly Service of the West Siberian District dated October 7, 2010 in case No. A45-8040/2010) .

Manager's salary in tax expenses

Labor costs are taken into account for the purposes of calculating income tax (Article 255 of the Tax Code of the Russian Federation) and under the simplified tax system (clause 6, paragraph 1, Article 346.16 of the Tax Code of the Russian Federation). However, the Tax Code of the Russian Federation contains a reservation: for tax purposes, expenses “for any types of remuneration provided to management or employees in addition to remunerations paid on the basis of employment agreements (contracts)” are not taken into account (clause 21 of Article 270 of the Tax Code of the Russian Federation).

As stated at the beginning of the article, the Ministry of Finance takes the position that concluding an employment contract for a manager who is the only participant is impossible. Due to this The Ministry of Finance considers it unacceptable to include the salary of such a manager in tax expenses. At least, such clarifications were given by the department in relation to the simplified tax system and unified agricultural tax (Letters of the Ministry of Finance of Russia dated 02/19/2015 No. 03-11-06/2/7790, dated 10/17/2014 No. 03-11-11/52558). But given the logic of the reasoning of representatives of the Ministry of Finance, most likely there will be a similar opinion regarding expenses on the general system.

But we also considered the second point of view, according to which an employment contract with the manager, the only participant, should be concluded. This position has weighty arguments and, importantly, it is supported by the courts. Therefore, if payments to the manager are provided for in the employment contract, then there is every reason to include them in tax expenses. At the same time, it would be useful to stock up on documents confirming the reality of costs and their economic justification, such as staffing tables, time sheets, pay slips, cash receipts, etc.

The regulatory and judicial authorities currently do not have a single answer to the question “whether to conclude an employment contract with the manager who is the sole participant of the LLC or not.” In this case, what should the leaders themselves do if they find themselves in a similar situation? Of course, you need to make your own decision based on logic and common sense. And whatever decision is made, you need to be able to defend and justify it if necessary.

It is safer, after all, to conclude an employment contract and all other documents confirming the employment nature of the relationship (employment order, staffing table, draw up a work book, keep a time sheet, etc.). Accordingly, the manager must assign and pay wages, charge insurance premiums from them and withhold personal income tax. Regarding the inclusion of wages as tax expenses, there are two options:

- option one is “safe”: pay the minimum possible wage and not include it in expenses, since this is the position of the Ministry of Finance;

- option two is “risky”: include the manager’s salary as expenses for tax purposes, but you must be prepared to defend such a right in court.

What point of view do you adhere to on the issue of formalizing relations with the director who is the sole participant of the LLC? And why?

Do you find the article useful and interesting? share with colleagues on social networks!

There are still questions - ask them in the comments to the article!

Yandex_partner_id = 143121; yandex_site_bg_color = "FFFFFF"; yandex_stat_id = 2; yandex_ad_format = "direct"; yandex_font_size = 1; yandex_direct_type = "vertical"; yandex_direct_border_type = "block"; yandex_direct_limit = 2; yandex_direct_title_font_size = 3; yandex_direct_links_underline = false; yandex_direct_border_color = "CCCCCC"; yandex_direct_title_color = "000080"; yandex_direct_url_color = "000000"; yandex_direct_text_color = "000000"; yandex_direct_hover_color = "000000"; yandex_direct_favicon = true; yandex_no_sitelinks = true; document.write(" ");

Normative base

- Labor Code of the Russian Federation

- Tax Code of the Russian Federation

- Code of Administrative Offenses of the Russian Federation

- Federal Law of 02/08/1998 No. 14-FZ “On Limited Liability Companies”

- Federal Law of December 15, 2001 No. 167-FZ “On Compulsory Pension Insurance in the Russian Federation”

- Federal Law of December 29, 2006 No. 255-FZ “On compulsory social insurance in case of temporary disability and connection with maternity”

- Federal Law of November 29, 2010 No. 326-FZ “On Compulsory Health Insurance in the Russian Federation”

- Federal Law of July 24, 2009 No. 212-FZ “On insurance contributions to the Pension Fund of the Russian Federation, the Social Insurance Fund of the Russian Federation, the Federal Compulsory Medical Insurance Fund”

- Letter of the Ministry of Labor of Russia dated 05.05.2014 No. 17-3/OOG-330

- Letters of Rostrud dated 03/06/2013 No. 177-6-1, dated 12/28/2006 No. 2262-6-1,

- Letter of the Ministry of Health and Social Development of Russia dated August 18, 2009 No. 22-2-3199

- Letter of the Federal Social Insurance Fund of the Russian Federation dated December 21, 2009 No. 02-09/07-2598P

- Letters of the Ministry of Finance of Russia dated February 19, 2015 No. 03-11-06/2/7790, dated October 17, 2014 No. 03-11-11/52558

Find out how to read the official texts of these documents in the section

In a situation where the only participant (founder) performs the functions of the sole executive body (director, general director), we as directors are often asked 2 questions:

If an employment contract is concluded, is it possible to take into account the director’s salary as an expense for income tax purposes?

Does a business owner need to enter into an employment contract to perform the functions of director of an organization?

The legislation does not provide a clear answer to the question of how to formalize the relationship between an organization and its leading member (founder). Rostrud insists that there cannot be an employment contract with the director - the only participant. The Russian Ministry of Finance indicates that you cannot pay your own salary, but if there is an agreement between the legal entity and the manager, then the expenses can be taken into account. The courts clearly say that an employment contract must be concluded.

As we see, there is no consensus on this issue: some (theorists) are of the opinion that in such a situation an employment contract cannot be concluded, others (practitioners) believe that an employment contract in this case is an urgent necessity.

What should an organization do in such a situation: should it draw up an employment contract with the director or not? Is it worth it to include the manager’s salary as expenses or not? Let's analyze it.

Theorists(for example, Y.P. Orlovsky in the Commentary to the Labor Code of the Russian Federation) argue that:

employment contracts are not concluded with managers who are the only participants in organizations, since labor legislation does not apply to them;

a participant (the sole founder of the organization) cannot conclude an employment contract with himself,

and justify their position with the following arguments:

such a prohibition is directly provided for by Part 2 of Article 273 of the Labor Code of the Russian Federation (hereinafter referred to as the Labor Code);

if such an employment contract is concluded, then the norms of Chapter 43 of the Labor Code cannot be applied to it, which means that such a person can work in the company as anyone, but not as a manager, because legal regulation of the work of the head of an organization can only be implemented through the application of the norms of Chapter 43 of the Labor Code;

the nature of the employment relationship is hired (self-employed) work. In the situation described above, the lack of independence of labor is lost, since he exercises employer powers in relation to himself.

Currently, this point of view is shared by Rostrud (Letter dated March 6, 2013 No. 177-6-1) and the Ministry of Finance of Russia (Letter dated October 17, 2014 No. 03-11-11/52558), i.e. in fact, officials deny the very possibility of labor relations.

The same point of view was previously held by the Ministry of Health and Social Development of Russia, justifying it by the fact that the basis of Part 2 of Article 273 of the Labor Code is the impossibility of concluding an employment contract with oneself, since the organization simply does not have other participants (members, founders). The only participant in the company in this situation must, by his decision, assume the functions of the sole executive body - director, general director, president, etc. Management activities in this case, in our opinion, are carried out without concluding any contract, including an employment contract (Letter of the Ministry of Health and Social Development of the Russian Federation dated August 18, 2009 No. 22-2-3199). But later the Ministry of Health and Social Development of Russia changed its point of view to the opposite (Letter of the Ministry of Health and Social Development of the Russian Federation dated 06/08/2010 No. 428n), justifying it by the fact that only in this way can the manager be provided with social and labor guarantees.

Note: this position of officials can be beneficial at the initial stage of launching a business project, because when the activity does not yet generate any income, then there is no need for extra expenses (in the absence of an employment contract, salaries are not paid, insurance premiums are not charged).

Practices based on the fact that:

laws don't prohibit the sole participant (founder, member, owner of property) of the organization becomes its leader (i.e., manages this organization, including performing the functions of its sole executive body). Thus, from Article 88 of the Civil Code and Articles 2, 7, 11 of the Federal Law “On Limited Liability Companies” (hereinafter referred to as the LLC Law) it follows that an LLC can be founded by one person or may consist of one person. And from Article 39 of the Law on LLCs, it follows that the highest management body in an LLC is the general meeting of its participants; if there is only one participant, he makes the decisions of the only participant. The sole founder of the company decides who will manage the organization. The law does not prohibit the founder of the company, as the sole executive body, from assigning these responsibilities to himself (Article 40 of the LLC Law);

the sole founder holding the position of manager personally performs a labor function for the organization to manage its current activities, he works in the interests of the legal entity, he is provided with a workplace and other working conditions are provided;

labor legislation applies to such managers, and in labor relations with the organization they manage, they are employees.

This point of view is also shared by judicial practice. The courts believe that such managers (along with any other employees) have the right to receive social benefits (for temporary disability, pregnancy and childbirth, etc.) from the Social Insurance Fund. For example:

in the Ruling of the Supreme Court of the Russian Federation dated February 28, 2014 No. 41-KG13-37, it is noted that if the relationship between an organization and its leader, who is the sole participant (founder) of this organization and the owner of its property, is formalized by an employment contract, the said leader is subject to general provisions Labor Code of the Russian Federation.

The Supreme Arbitration Court of the Russian Federation dated 06/05/2009 No. VAS-6362/09 in case No. A51-6093/2008,20-161 in the Determination substantiated this position with the following arguments:

in accordance with Article 273 of the Labor Code, the provisions of Chapter 43 on the specifics of regulating the labor of the head of an organization and members of the collegial executive body of organizations apply to heads of organizations regardless of their organizational and legal forms and forms of ownership, except in cases where the head of the organization is the only participant (founder) , a member of the organization, the owner of its property. Stated position does not mean that these persons are not subject to the Labor Code of the Russian Federation. Otherwise it would violate their labor rights;

Article 16 of the Labor Code stipulates that labor relations that arise as a result of election and appointment to a position are characterized as labor relations on the basis of an employment contract;

By virtue of Article 39 of the LLC Law, the appointment of a person to the position of director is formalized by the decision of the sole founder of the company, therefore, labor relations with the director as an employee are formalized not by an employment contract, but by the decision of the sole participant.

Accordingly, such an employee, who has a labor relationship with the company, has the right to compulsory social insurance provided for by the Labor Code of the Russian Federation and the Federal Law “On the Fundamentals of Compulsory Social Insurance”.

The FAS of the West Siberian District in the Resolution of the FAS of the West Siberian District dated November 18, 2009 in case No. A45-11064/2009 indicated: “According to Article 6 of the Federal Law of July 16, 1999 No. 165-FZ “On the Basics of Compulsory Social Insurance” ( hereinafter referred to as Law No. 165-FZ), the subjects of compulsory social insurance are policyholders (employers) and citizens of the Russian Federation working under employment contracts.

Article 9 of Law No. 165-FZ establishes that relations under compulsory social insurance arise for all types of compulsory social insurance from the moment an employment contract is concluded with an employee;

in accordance with Articles 11, 16 of the Labor Code of the Russian Federation, labor relations that arise as a result of the election or appointment of a director of a company are characterized as labor relations on the basis of an employment contract. A person appointed to the position of director of a company is its employee, and the relationship between the company and the director as an employee is regulated by labor law.

According to Article 7 of the Federal Law of February 8, 1998 No. 14-FZ “On Limited Liability Companies” (hereinafter referred to as Law No. 14-FZ), a company can be founded by one person, who becomes its sole founder. The same person can also make a decision to appoint a director if for this purpose a general meeting of the company’s participants is impossible, since only one person who acted as a founder when creating the company is its participant.

From the foregoing it follows that a limited liability company may include one participant, who has the right to perform the functions of the head of a limited liability company, i.e. be his employee.

The provisions of the Labor Code of the Russian Federation do not contain norms prohibiting the application of the general provisions of the Code to labor relations when there is a coincidence of an employee and an employer in one person, although the application of the provisions of Chapter 43 of the Labor Code of the Russian Federation to such legal relations is excluded. Consequently, the employee has the right to maternity leave with the payment of benefits under state social insurance in the amount established by law, while the argument of the Social Insurance Fund that... there is no status of a person insured under compulsory social insurance was rightfully rejected by the court as insolvent

This point of view is indirectly confirmed by the state. organs. Thus, the Pension Fund of the Russian Federation in its Letter dated 05/06/2016 No. 08-22/6356 “On reporting” indicated the following:

In accordance with paragraph 2.2 of Article 11 of the Federal Law of 04/01/1996 N 27-FZ “On individual (personalized) accounting in the compulsory pension insurance system” (which entered into force on 04/01/2016), the policyholder provides monthly information about each insured person working for him . Reporting is presented in the form SZV-M, approved by Resolution of the Board of the Pension Fund of the Russian Federation dated 01.02.2016 N 83p.

When implementing this norm, working citizens are understood to mean the persons specified in Article 7 of the Federal Law of December 15, 2001 N 167-FZ "On Compulsory Pension Insurance in the Russian Federation", which includes those working under an employment contract, including heads of organizations who are the only participants (founders), members of organizations.

the absence of the fact of accrual of payments and other remuneration in favor of the above-mentioned persons for the reporting period is not a basis for failure to submit reports in respect of these persons in the SZV-M form.

Thus, these persons are subject to the compulsory pension insurance regime and upon payment of insurance premiums they acquire pension rights.

Accordingly, these insurers must submit monthly information to the Pension Fund of the Russian Federation about each insured person working for it.

Is it possible to include a director's salary as an expense for income tax purposes?

Discussions about whether it is necessary to conclude an employment contract with the sole founder of the organization or whether one should do as officials advise (assign the functions of a manager without concluding any contract to oneself (the person who is the sole founder)) would not be so relevant if not one but. The fact is that, according to tax law, expenses for paying wages can be taken into account for tax purposes only if:

labor relations (Article 255 of the Tax Code of the Russian Federation);

civil law relations (clause 21 of article 255 of the Tax Code of the Russian Federation).

By virtue of paragraph 21 of Art. 270 of the Tax Code of the Russian Federation, when determining the tax base, expenses for any types of remuneration provided to management or employees, in addition to remunerations paid on the basis of employment contracts, are not taken into account. Therefore, even if a civil contract has been concluded with the head of an organization, accounting for the costs of paying him remuneration is associated with tax risks.

Since June 28, 2017, a company’s debts can be recovered from its controlling persons, for example, from the CEO or founders. This rule applies even if the company is excluded from the Unified State Register of Legal Entities.

!Important update!

After entering information about the termination of the legal entity’s activities into the Unified State Register of Legal Entities its founder has no right to receive the remaining property until settlements with creditors are completed.

Document:“Review of judicial practice in the application of legislation on legal entities (Chapter 4 of the Civil Code of the Russian Federation)” (approved by the Presidium of the Arbitration Court of the North Caucasus District on 07/06/2018)

Let’s look at it in detail from the Founder’s and Lender’s side:

!Important update!

The Supreme Court of the Russian Federation indicated that if the head of a company created a situation where the Federal Tax Service could not collect the debt, which led to the initiation of bankruptcy proceedings, then he does not have the right to evade responsibility.

!Important update!

Judicial practice has opened to collect tax arrears from the general director.

Having studied this information, you will probably have questions and doubts about the future economic security of the General Director (Director), since the issue is very serious and until the time for the inevitable collection of debts at the expense of your property is lost, take advantage of our written consultation - we will study your situation in detail, We will answer all your questions and justify the reality of your concerns, and offer solutions.

Application for written consultation: [email protected]

Any counterparty at some point may stop fulfilling its obligations. The first reaction to this is attempts to come to an agreement. Then the lawyer sends a complaint, which often remains unanswered. As a result, it turns out that the counterparty has already been liquidated or the company does not have funds in its accounts. The lawyer is forced to challenge the liquidation and try to collect debts from the controlling persons (Article 10 of the Federal Law of October 26, 2002 No. 127-FZ). Until recently, controlling persons could only be brought to justice in bankruptcy cases, but due to the liquidation of the debtor, the courts dismissed the case.

At the end of 2016, Federal Law No. 488-FZ dated December 28, 2016 “On Amendments to Certain Legislative Acts of the Russian Federation” was adopted. The amendments come into force on June 28, 2017. They simplified debt disputes with controlling persons.

Let's take a closer look.

When choosing a legal form (individual entrepreneur or LLC), the main argument in favor of registering a company is often the limited liability of a legal entity. In this, Russia differs from other countries where a company is created for the sake of partnership, and not because of avoiding financial risks. About 70% of Russian commercial organizations are created by a single founder, who, in most cases, manages the business himself.

Many companies do not really function, not even earning enough for the director’s salary and not differing in profitability from a freelancer who provides services in his free time from hired work. However, legal entities in Russia are registered as often as individual entrepreneurs.

First, let’s find out where the confidence comes from that it is financially safe to conduct business in the form of an LLC? Article 56 of the Civil Code of the Russian Federation states that the founder (participant) is not liable for the obligations of the organization, and the organization is not liable for its debts.

That is why, to the question: “What responsibility does the founder of an LLC bear?” the majority answers - only within the limits of the share in the authorized capital.

Indeed, if the company is solvent and pays on time to the state, employees and partners, then the owner cannot be attracted to pay the company’s bills. The created organization acts in civil circulation as an independent entity and is itself responsible for its own obligations. As a result, a false impression is created of a complete lack of responsibility of the LLC owner to creditors and the budget.

However, the limited liability of a company is valid only as long as the legal entity itself exists. But if an LLC is declared bankrupt, then the participants may be subject to additional or subsidiary liability. True, it is necessary to prove that it was the actions of the participants that led to the financial disaster of the company, but creditors who want to get their money back will make every effort to do this.

Article 3 of Law No. 14-FZ dated 02/08/1998: “In the event of insolvency (bankruptcy) of a company due to the fault of its participants, these persons, if the company’s property is insufficient, may be assigned subsidiary liability for its obligations.”

Subsidiary liability is not limited to the size of the authorized capital, but is equal to the amount of debt to creditors. That is, if a bankrupt company owes a million, then it will be recovered from the founder of the LLC in full, despite the fact that he contributed only 10,000 rubles to the authorized capital.

Thus, the concept of limited liability within the authorized capital is relevant only to the organization. And the participant can be held to unlimited subsidiary liability, which in a financial sense makes him equal to an individual entrepreneur.

The liability of the LLC director for debts arises if there are such signs of guilty actions or inaction:

Indicative in this sense is the ruling of the Arbitration Court of the Jewish Autonomous Region dated July 22, 2014 in case No. A16-1209/2013, in which 4.5 million rubles were recovered from the founding director. Having a company that had been involved in heat and water supply for many years, he entered a new company with the same name in a competition for the right to lease utility infrastructure facilities. As a result, the previous legal entity was left without the ability to provide services, and therefore did not repay the amount of the previously received loan. The court recognized that the insolvency was caused by the actions of the owner and ordered the loan to be repaid from personal funds.

Prosecution procedure

At what point does the founder become responsible for the activities of the LLC? As we said above, this is only possible in the process of bankruptcy of a legal entity. If an organization simply ceases to exist, having honestly paid all creditors during the liquidation process, then there can be no claims against the owner.

Protecting the interests of the budget and other creditors is the law of October 26, 2002 No. 127-FZ “On Insolvency (Bankruptcy)”, the provisions of which are also in force in 2017. It details the procedure for carrying out bankruptcy and bringing to responsibility the managers and owners of the company, as well as persons controlling the debtor.

The latter refers to persons who, although not formally owners, had the opportunity to instruct the manager or participants of the company to act in a certain way. For example, one of the most impressive amounts in the case of bringing to subsidiary liability (6.4 billion rubles) was recovered from the controlling debtor of a person who was not part of the company and did not formally manage it (Resolution of the 17th Arbitration Court of Appeal in the case No. A60-1260/2009).

What conclusions can be drawn from all that has been said:

The liability of a participant is not limited to the size of the share in the authorized capital, but can be unlimited and repaid from personal property. There is little point in establishing an LLC just to avoid financial risks.

If the company is run by a hired manager, provide for an internal reporting procedure that allows you to have a complete picture of the state of affairs in the business.

Accounting statements must be under strict control; loss or distortion of documents is a particular risk factor indicating deliberate bankruptcy.

Creditors have the right to demand collection of debts from the owner himself if the legal entity is in the process of bankruptcy and is not able to meet its obligations.

It is more difficult to attract the owner of an enterprise to pay business debts than an individual entrepreneur, but since 2009 the number of such cases has been in the thousands.

Creditors must prove the connection between the financial insolvency of the company and the actions or inaction of the participant, but in some situations there is a presumption of his guilt, i.e. no proof required.

Withdrawal of assets from a company on the eve of bankruptcy is a significant risk of criminal prosecution.

It is better to initiate the bankruptcy procedure without delaying it.

Collection of LLC debts from the director 2017

In 2017, cases of collection of company debts from equity holders became more frequent.

The opportunity to collect from the owner a debt that exceeds the property of the LLC and its authorized capital arises, as we have already noted, during the bankruptcy of the company.

In this situation, the concept of subsidiary liability comes into force, namely additional obligations of the manager, who is responsible for the debts of the debtor organization in the legally established manner.

The possibility of repaying the obligations of an LLC at the expense of the shareholder’s personal funds is provided for by the Law “On Insolvency (Bankruptcy)” dated October 26, 2002 N 127-FZ.

According to amendments to the Law dated 06/05/2009, creditors can hold the founder of the company, as well as senior officials of the organization (manager, chief accountant, manager and others) financially liable.

This is possible if one of the following circumstances occurred during the bankruptcy of the LLC:

the founder made a decision regarding the activities of the company, the implementation of which brought losses to counterparties and creditors;

the founder approved the decision, the implementation of which influenced the bankruptcy of the organization;

the founder (director, accountant) did not ensure the appropriate maintenance and safety of tax reporting and accounting documentation;

The management of the company (founder, director) did not submit an application to the arbitration court to recognize its own financial insolvency, provided that all relevant circumstances were present.

If one of the above conditions occurs, the creditor or any other interested party has the right to demand repayment of the LLC’s debts at the expense of the founder’s personal funds.

To do this, it is necessary to file a statement of claim with the court, to which all available documentary evidence of the owner’s guilt must be attached.

If the application is sent as part of a bankruptcy case, then it is considered by the arbitration court.

If the LLC is officially declared bankrupt, and the plaintiff is a creditor, then the decision to collect the debt is considered by a court of general jurisdiction. In the latter case, the defendant is directly the founder as an individual.

Upon execution of the court proceedings, a decision is made whether the founder’s actions were committed culpably or not. If guilt is proven, the court obliges the defendant to satisfy the material demands of creditors and counterparties at the expense of personal funds, or, if they are insufficient, with their own property.

Criminal liability of the CEO and founder in 2017

The legislation provides for criminal liability of the founder (founders) for unlawful actions in relation to the activities of the Limited Liability Company.

In financial and legal practice in 2016, evidence of unlawful actions of the founder was the most common case in which the owner received criminal punishment.

Such actions may include:

- concealment of the company's property and falsification of information about its value;

- illegal disposal of the organization's property;

- illegal repayment of material claims of creditors;

- financially inadequate satisfaction of property claims from debtors.

The owner faces imprisonment if his fault causes losses to society in the amount of more than 250 thousand rubles.

Article 179 of the Criminal Code of the Russian Federation provides for bringing the founder to criminal punishment if his actions contained coercion to conclude a transaction (or refusal), which subsequently directly or indirectly affected the organization’s losses.

Do not forget about generally accepted legal norms, violation of which entails criminal punishment not only for the shareholder, but also for senior officials of the organization. Thus, criminal liability arises if the founder initiated or committed actions that led to:

- evasion of payment by an enterprise of national taxes and fees;

- abuse during the issue of the organization’s own securities;

- illegal transfer of funds in foreign currency and, as a result, evasion of customs duties.

Bringing a shareholder to criminal liability is carried out within the framework of lawsuit proceedings. The initiator of the application may be creditors and counterparties.

If the applicant for compensation of losses is the company itself, then its interests in court are represented by a manager who has passed the competitive selection procedure. If a company is officially declared bankrupt, a bankruptcy creditor acts on its behalf.

Manager and founder rolled into one

The subsidiary liability of the founder and director of an LLC for the obligations of a legal entity has its own characteristics. In a situation where an organization is managed by a hired general director, some share of the financial risks passes to him. According to Article 44 of the Law “On LLC”, the manager is responsible to society for losses caused by his guilty actions or inaction.

The liability of the LLC director for debts arises if there are such signs of guilty actions or inaction:

- making a transaction to the detriment of the interests of the enterprise he manages, based on personal interest;

- concealment of information about the details of the transaction or failure to obtain the approval of participants when such a need exists;

- failure to take measures to obtain information relevant to the transaction (for example, the integrity of the counterparty was not verified or information about the licensing of the contractor’s activities was not clarified, if the nature of the work requires this);

- making decisions about a transaction without taking into account information known to him;

- forgery, loss, theft of company documents, etc.

In such situations, the participant has the right to file a claim against the manager for compensation for damage caused. If the director proves that in the process of work he was limited by the orders or requirements of the owner, as a result of which the business became unprofitable, then responsibility will be removed from him.

But what if the owner is the manager of the company? In this case, it will not be possible to refer to an unscrupulous hired manager. The presence of outstanding debts obliges the sole executive body to take all measures to repay them, even if the owner is the only one, and at first glance, does not infringe on anyone’s interests with his actions.

The manager must submit an application to recognize the legal entity as a debtor, but if he does not do this, then employees, contractors, and tax authorities have the right to begin bankruptcy proceedings. In this case, the party filing the claim appoints the selected arbitration manager, and this is of particular importance in attracting the owner to the obligations of the LLC.

In addition, in order to increase the bankruptcy estate, the plaintiff has the right to challenge transactions made within a year before the application for declaring the debtor bankrupt was accepted. In cases where the transaction was completed at prices below market prices, the period for challenging is increased to three years.

During the insolvency process, the director, business owner, and beneficiary are involved in the proceedings. If the court recognizes the connection between the actions of these persons and insolvency, then a penalty in the amount of the plaintiff’s claims is imposed on personal property.

Intentional bankruptcy and judicial practice

In modern Russia, deliberate bankruptcy, as well as fictitious bankruptcy, is one of the most common ways of evading debt obligations. Insolvency, or bankruptcy, in domestic legislation is understood as “the inability of a debtor, recognized by an arbitration court, to fully satisfy the claims of creditors for monetary obligations and (or) to fulfill the obligation to make mandatory payments.”

Methods of committing deliberate bankruptcy include: concluding transactions on conditions that are obviously unfavorable for the debtor, alienation of the debtor’s property, which is not accompanied by adequate monetary or material compensation. If bankruptcy is intentional in nature, then circumstances arise that allow it to be qualified as intentional bankruptcy, which is an illegal act in accordance with the legislation of the Russian Federation. Researchers note the high social danger of deliberate bankruptcy. Many cases of deliberate bankruptcy do not lead to criminal liability of the persons who are its initiators and organizers and do not entail any consequences, which significantly increases the social danger of this act. The existence of numerous shell companies, the spread of corruption and fraudulent schemes is a serious problem of modern Russian business, and it is to solve this problem that the legislator has assigned various types of liability for deliberate bankruptcy.